By Pam Martens and Russ Martens: April 10, 2024 ~

As the financial crisis of 2008 was ravaging century-old financial institutions on Wall Street and collapsing the U.S. economy, the central bank of the United States, the Federal Reserve, launched an effort to restore market liquidity by becoming the buyer of the toxic sludge flooding Wall Street in the form of Mortgage-Backed Securities (MBS).

On November 25, 2008, in delicately-parsed language, the Fed announced it planned to buy $500 billion of MBS that was backed by government-sponsored enterprises (GSEs) Fannie Mae, Freddie Mac, and Ginnie Mae. That was the first of what would become Quantitative Easing (QE) to infinity at the Fed. The Fed’s MBS holdings have grown from the planned $500 billion to $2.4 trillion as of last Wednesday.

Just as it did with the bulk of its $29 trillion bailout programs to Wall Street during and after the 2008 financial crisis, the Fed farmed out its MBS buying program to the New York Fed, which, in turn, farmed out one critical leg of the program to the very Wall Street mega bank that had corrupted a significant part of the MBS market: JPMorgan Chase.

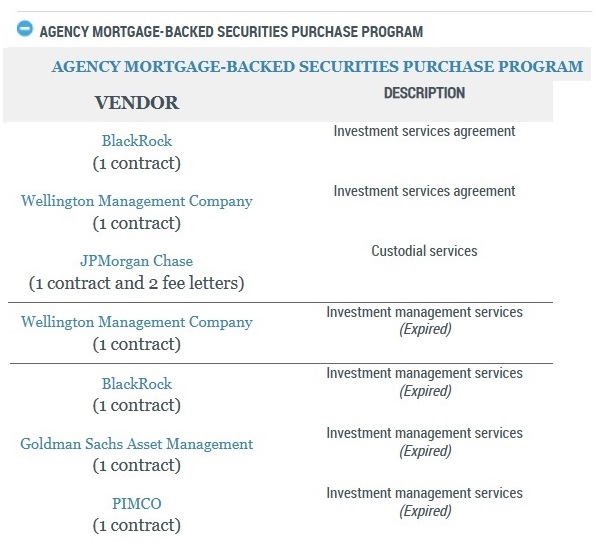

A little more than a month after the Fed’s MBS announcement, on December 31, 2008, the New York Fed signed a contract with JPMorgan Chase to be the sole custodian of the securities it bought under the MBS program. That contract with JPMorgan Chase was amended on April 1, 2010; April 26, 2011; April 17, 2014 and again on January 30, 2017. (As of this morning, the original contract and its amendments are available at the New York Fed’s website. Should those documents disappear, we have archived the same documents on our website here.)

Wall Street On Parade wrote about JPMorgan Chase being the sole custodian of the Fed’s MBS program in 2014 and again in 2020. In both years, the New York Fed confirmed that JPMorgan Chase remained the sole custodian of its MBS securities. But something strange happened this week when we sought our routine confirmation from the New York Fed.

On Monday, we emailed the communications department at the New York Fed and asked if JPMorgan Chase was still holding the MBS portfolio for the New York Fed.

The New York Fed has a vendor department, which, ostensibly, vets its vendors and keeps track of its vendor contracts. It should have taken less than five minutes to phone that department and verify if the MBS custodian contract with JPMorgan Chase was still in effect.

Instead, we received an email on Monday saying a response to our question would be forthcoming on Tuesday. When 5:00 p.m. Tuesday rolled around with no response, we emailed the New York Fed again for an answer, asking the following:

“Per below, can you confirm that JPMorgan Chase remains the sole custodian of the Agency Mortgage-Backed Securities held by the Fed?

“The FRBNY still has the Vendor Agreement indicated as current on its website so this shouldn’t be a problem to confirm. I’m just checking with you folks out of an abundance of caution to verify my facts.”

This time, the response from the New York Fed was Kafkaesque. We were told we could not put quotes around the information from the New York Fed or name the person giving us the information. And, the information that was provided to us was off topic. We were told that beginning in 2010 the New York Fed began to use internal staff to make its own purchases of MBS.

We shot back with yet another email:

“I’m asking strictly about the Custodian. Does that remain JPMorgan Chase?”

We were told via email that the New York Fed had nothing else to say on the matter.

We then took the screenshot below at the New York Fed’s website showing expired vendor contracts versus those not marked as “expired.” It would appear from this that the contract making JPMorgan Chase the sole custodian of the Fed’s $2.4 trillion in MBS debt securities is still in effect.

Why would the New York Fed confirm the same question in 2014 and 2020 but be so bizarrely cagey about confirming this information in 2024?

Could it be that the crime factory at JPMorgan Chase has simply gotten too embarrassing for the New York Fed to acknowledge its association with it?

The New York Fed failed to find a new custodian for the $1.49 trillion of MBS that JPMorgan Chase was holding for the Fed on January 7, 2014 when the Justice Department charged the bank with two criminal felony counts for its role in the Bernard Madoff Ponzi scheme. The bank admitted to the charges; paid $1.7 billion into a Madoff victims fund; and was given a 3-year Deferred Prosecution Agreement and put on probation for the same period.

The New York Fed also failed to replace JPMorgan as custodian when it was holding $1.7 trillion of the Fed’s MBS on May 20, 2015 and was charged with its third criminal felony count in less than a year and a half. On that occasion, JPMorgan Chase admitted to one criminal count brought by the Justice Department for its role with other banks in rigging the foreign exchange market. The bank paid a fine of $550 million and was put on probation again.

JPMorgan Chase admitted to its fourth and fifth felony counts on September 29, 2020 and, once again, the New York Fed saw no reason to remove its $2 trillion in mortgage securities out of the reach of the criminally-inclined bank. The 2020 felony counts, once again brought by the Justice Department, involved “tens of thousands of episodes of unlawful trading in the markets for precious metals futures contracts” and “thousands of episodes of unlawful trading in the markets for U.S. Treasury futures contracts and in the secondary (cash) market for U.S. Treasury notes and bonds,” according to the Justice Department. The bank agreed to pay $920 million in fines and restitution to various regulators. It was given another Deferred Prosecution Agreement and put on probation for the third time.

Apparently, rigging the sovereign debt market of the United States is not a disqualifying event to serve as a vendor at the New York Fed – raising the question as to what on earth would be a disqualifier.

Not only did the Federal Reserve and the New York Fed look the other way at five criminal felony counts in deciding to retain JPMorgan Chase as a custodian of its securities, but it looked the other way as JPMorgan Chase was repeatedly charged with fraud involving the very same securities it was holding for the Fed.

On November 15, 2013, JPMorgan Chase announced that it had agreed to pay $4.5 billion to settle claims by private investors that it had defrauded them in mortgage-backed securities.

On November 19, 2013, JPMorgan agreed to pay $13 billion to settle claims by the Department of Justice, the FDIC, the Federal Housing Finance Agency, and various State Attorneys General over its fraudulent practices involving mortgage-backed securities. Associate Attorney General Tony West said this at the time:

“Through this $13 billion resolution, we are demanding accountability and requiring remediation from those who helped create a financial storm that devastated millions of Americans. The conduct JPMorgan has acknowledged — packaging risky home loans into securities, then selling them without disclosing their low quality to investors — contributed to the wreckage of the financial crisis. By requiring JPMorgan both to pay the largest FIRREA penalty in history and provide needed consumer relief to areas hardest hit by the financial crisis, we rectify some of that harm today.”

Then, on February 4, 2014, JPMorgan admitted to a civil fraud action brought by the U.S. government for “submitting false certifications” to various government agencies to get its toxic mortgages insured by those agencies and “failing to self-report to HUD-FHA hundreds of loans that it had identified as fraudulent or otherwise deficient, and to submitting loan data to HUD-FHA that lacked integrity.” The bank was fined another $614 million in that matter.

To summarize: JPMorgan Chase played an integral role in bringing on the financial crisis of 2008 which forced the Fed to launch a bond-buying program to resuscitate the U.S. economy. JPMorgan Chase then benefitted by getting paid fees in the tens of millions of dollars to hold those bonds for the Fed. The bank then continued to engage in serial criminal activity; being put on probation; getting off probation and engaging in more criminal activity: All while the New York Fed entrusted it with trillions of dollars of Fed securities sitting inside its house of crime.

Making this situation even more absurd (if that’s possible), the 2017 amendment that the New York Fed signed with JPMorgan Chase effectively gutted crucial conflicts of interest protections. One section reads as follows:

“Bank [JPMorgan Chase] or any of its divisions, branches or Affiliates may be in possession of information tending to show that the Instructions received may not be in the best interest of Customer [Federal Reserve Bank of New York]. Bank [JPMorgan Chase] is under no duty to disclose any such information.”

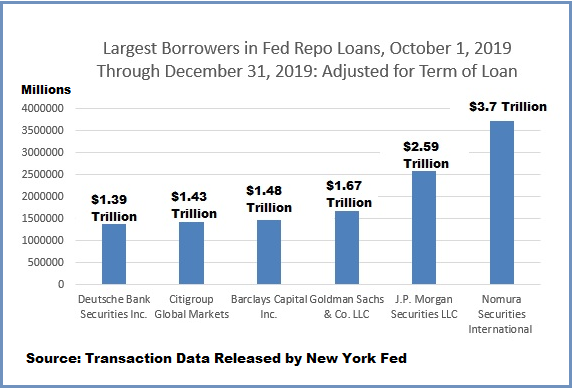

In the fourth quarter of 2019, when JPMorgan Chase was custodian of $1.4 trillion of MBS for the Fed, it was also getting a massive bailout from the New York Fed via repo loans. As the chart below shows, JPMorgan Chase was the second largest recipient of these repo loans, receiving $2.59 trillion on a cumulative, term-adjusted basis, for a financial crisis that has yet to be credibly explained.

Congress has threatened in the past to investigate the cozy ties between Wall Street and the New York Fed. The American people must demand that this happens sooner rather than later.