By Pam Martens and Russ Martens: March 28, 2023 ~

Senator Sherrod Brown (D-OH), the Chair of the Senate Banking Committee, will convene a hearing this morning at 10 a.m. to take testimony from federal bank regulators on why the second and third largest bank failures in U.S. history occurred within two days of each other this month. (A number of other regional banks have seen their share prices plunge this month.)

The two banks that failed and were taken over by the Federal Deposit Insurance Corporation (FDIC) were Silicon Valley Bank (SVB) and Signature Bank. Both had experienced bank runs in March and both had extreme exposure to uninsured deposits. One of the witnesses at today’s hearing, Martin Gruenberg, Chair of the Federal Deposit Insurance Corporation (FDIC), explains as follows in his written testimony for today’s hearing:

“A common thread between the failure of SVB and the failure of Signature Bank was the banks’ heavy reliance on uninsured deposits. As of December 31, 2022, Signature Bank reported that approximately 90 percent of its deposits were uninsured, and SVB reported that 88 percent of its deposits were uninsured. The significant proportion of uninsured deposit balances exacerbated deposit run vulnerabilities and made both banks susceptible to contagion effects from the quickly evolving financial developments. One clear takeaway from recent events is that heavy reliance on uninsured deposits creates liquidity risks that are extremely difficult to manage, particularly in today’s environment where money can flow out of institutions with incredible speed in response to news amplified through social media channels.”

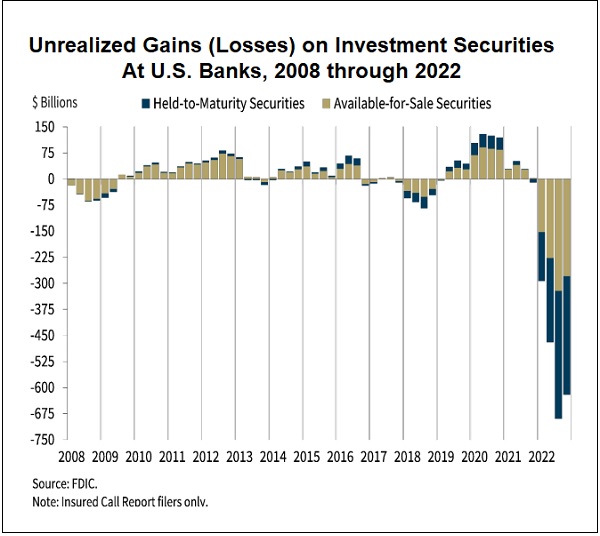

Gruenberg has included a chart in his written testimony that is nothing short of stunning. (See chart above.) It shows that the unrealized losses on investment securities at federally-insured U.S. banks during the 2008 financial crisis were less than $75 billion while at the end of the fourth quarter of 2022 they were over $600 billion.

You are no doubt asking yourself how 2008 could have been the worst financial crisis since the Great Depression if banks had less than $75 billion in unrealized losses on their investment securities. That’s because the mega banks on Wall Street were highly interconnected, understood how highly-leveraged each one was, and backed away from extending credit as the panic started to spread. The official report from the Financial Crisis Inquiry Commission (FCIC) reveals the following about the leadup to the 2008 crash:

“…as of 2007, the five major investment banks—Bear Stearns, Goldman Sachs, Lehman Brothers, Merrill Lynch, and Morgan Stanley—were operating with extraordinarily thin capital. By one measure, their leverage ratios were as high as 40 to 1, meaning for every $40 in assets, there was only $1 in capital to cover losses. Less than a 3% drop in asset values could wipe out a firm.”

Also, the chart above does not capture the losses and contagion the Wall Street banks themselves created in the broader financial system through their bundling and selling of hundreds of billions of dollars of toxic subprime mortgage debt and derivatives. The FCIC reports explains as follows:

“Most home loans entered the pipeline soon after borrowers signed the documents and picked up their keys. Loans were put into packages and sold off in bulk to securitization firms—including investment banks such as Merrill Lynch, Bear Stearns, and Lehman Brothers, and commercial banks and thrifts such as Citibank, Wells Fargo, and Washington Mutual. The firms would package the loans into residential mortgage–backed securities that would mostly be stamped with triple-A ratings by the credit rating agencies, and sold to investors. In many cases, the securities were repackaged again into collateralized debt obligations (CDOs)—often composed of the riskier portions of these securities—which would then be sold to other investors. Most of these securities would also receive the coveted triple-A ratings that investors believed attested to their quality and safety. Some investors would buy an invention from the 1990s called a credit default swap (CDS) to protect against the securities’ defaulting. For every buyer of a credit default swap, there was a seller: as these investors made opposing bets, the layers of entanglement in the securities market increased.”

In the 2008 crisis, there was also the obscene greed and callous disregard for the well being of the country by Wall Street investment banks actually shorting the toxic drek they had knowingly created and sold off to pension funds and other investors. Goldman Sachs created one of these toxic debt structures called ABACUS, allowing John Paulson’s hedge fund to select debt instruments likely to fail to stuff into ABACUS so the hedge fund could short it, while Goldman Sachs sold it to its own customers as a good investment. See our report: ABACUS, London Whale: Frenchmen Take the Fall for Wall Street’s Crimes.

The other two witnesses scheduled for today’s hearing are Michael Barr, Vice Chairman for Supervision at the Federal Reserve; and Nellie Liang, Undersecretary for Domestic Finance at the U.S. Treasury. The same three witnesses will appear before the House Financial Services Committee tomorrow at 10:00 a.m. to further examine the collapse of these banks.