By Pam Martens and Russ Martens: March 13, 2023 ~

If you want to genuinely understand why Silicon Valley Bank (SVB) failed and why Jerome Powell’s Fed led the effort yesterday to make sure $150 billion of the bank’s uninsured depositors’ money would be treated as FDIC insured and available today, you need to take a look at how the bank defined itself right up until it blew up on Friday. (That history is still available at the Internet Archives’ Wayback Machine at this link. Give the page time to load.)

If you want to genuinely understand why Silicon Valley Bank (SVB) failed and why Jerome Powell’s Fed led the effort yesterday to make sure $150 billion of the bank’s uninsured depositors’ money would be treated as FDIC insured and available today, you need to take a look at how the bank defined itself right up until it blew up on Friday. (That history is still available at the Internet Archives’ Wayback Machine at this link. Give the page time to load.)

This was a financial institution deployed to facilitate the goals of powerful venture capital and private equity operators, by financing tech and pharmaceutical startups until they could raise millions or billions of dollars in a Wall Street Initial Public Offering (IPO). The bank was also involved in managing the wealth of those startup millionaires or billionaires once they struck it big in an IPO.

Many of the former startup companies also continued to keep their operating money at the bank – in many cases in the millions of dollars, ignoring the fact that just $250,000 of that was insured by the Federal Deposit Insurance Corporation (FDIC). Last Friday, dozens of publicly-traded companies made filings with the Securities and Exchange Commission indicating that they had large sums of uninsured deposits now frozen at Silicon Valley Bank. Several indicated that the amounts represented 23 to 26 percent of the company’s cash and/or cash equivalents.

Roku, Inc., the publicly-traded manufacturer of digital media players for video streaming, reported the following to the SEC: “The Company has total cash and cash equivalents of approximately $1.9 billion as of March 10, 2023. Approximately $487 million is held at SVB, which represents approximately 26% of the Company’s cash and cash equivalents balance as of March 10, 2023.”

Publicly-traded Oncorus, Inc., a biopharmaceutical company focused on developing RNA-based medicine for cancer patients, reported the following to the SEC: “The Company informs its investors that it has deposit accounts with SVB with an aggregate balance of approximately $10 million, which is approximately 23% of the Company’s total current cash, cash equivalents and short-term investments. In addition, the Company has a standby letter of credit in place with SVB of approximately $3.4 million securing obligations under its lease agreement with IQHQ-4 Corporate Drive, LLC.”

In big, bold type on its website, Silicon Valley Bank bragged that “44% of U.S. venture-backed technology and healthcare IPOs YTD [year-to-date] bank with SVB.”

To put it bluntly, this was a Wall Street IPO machine that enriched the investment banks on Wall Street by keeping the IPO pipeline moving; padded the bank accounts of the venture capital and private equity middlemen; and minted startup millionaires for ideas that often flamed out after the companies went public. These are the functions and risks taken by investment banks. Silicon Valley Bank – with this business model — should never have been allowed to hold a federally-insured banking charter and be backstopped by the U.S. taxpayer, who was on the hook for its incompetent bank management.

We say incompetent based on this fact alone (although there were clearly lots of other problem areas): $150 billion of its $175 billion in deposits were uninsured. The bank was clearly playing a dangerous gambit with its depositors’ money.

Adding further insult to U.S. taxpayers, the Federal Home Loan Bank of San Francisco was quietly bailing out SVB throughout much of last year. Federal Home Loan Banks are also not supposed to be in the business of bailing out venture capitalists or private equity titans. Their job is to provide loans to banks to promote mortgages to individuals and loans to promote affordable housing and community development.

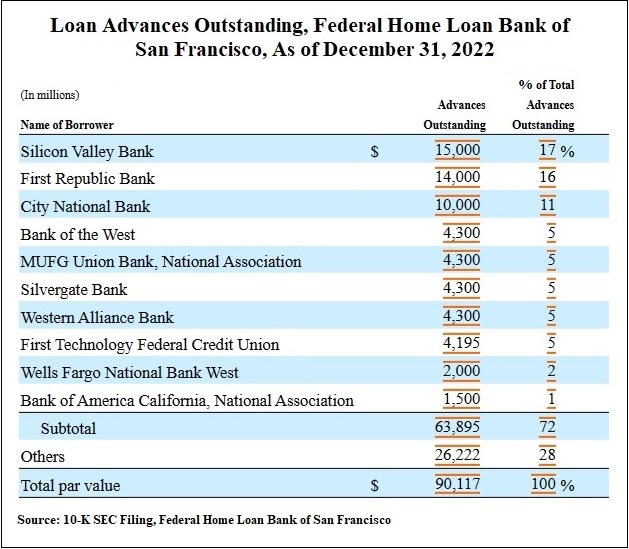

According to SEC filings by the Federal Home Loan Bank of San Francisco, its loan advances to SVB went from zero at the end of 2021 to a whopping $15 billion on December 31, 2022. The SEC filing provides a graph showing that SVB was its largest borrower at year end, with outstanding advances representing 17 percent of all loans made by the FHLB of San Francisco.

Notably, another bank which had $14 billion of loans outstanding from the FHLB of San Francisco – First Republic Bank – saw its stock price plummet by 14.8 percent on Friday. In premarket trading this morning, its stock was down another 70 percent, despite the announcement of a new bailout facility last evening by the Fed.

Western Alliance Bancorp, also on the FHLB of San Francisco’s list of its top 10 borrowers, saw its stock close with a loss of 20.88 percent on Friday. It had lost another 29 percent in premarket trading this morning.

Another member of the top 10 borrowers at FHLB of San Francisco, Silvergate Bank, announced last Wednesday that it was closing shop and liquidating. Silvergate’s problem stemmed from the hot money it held in deposits from crypto companies heading for the exits as investigations began into its role in potentially laundering money for Sam Bankman-Fried’s collapsed house of frauds.

Another crypto-related bank, Signature Bank, was shuttered by New York State regulators on Sunday, with the FDIC being named the receiver. All of its depositors, including its uninsured depositors, will also be made whole, according to a statement from the FDIC yesterday. Signature Bank’s filings with federal regulators indicate that more than $79 billion of its $88 billion in deposits were uninsured at the end of the fourth quarter of 2022.

Signature Bank was also quietly tapping into ongoing bailouts from a Federal Home Loan Bank. In this case FHLB of New York. Its borrowings from FHLB of New York exploded in the fourth quarter of last year, rising to $11.3 billion. According to an SEC filing, as of September 30, 2022, it had total borrowing capacity of $23.4 billion from FHLB New York.

We’re starting to see a pattern here. If you want to know which banks are going belly up next, simply look at which ones took the largest loan advances from a Federal Home Loan Bank last year. That appears to mean that they were seeing an exodus of depositor money and needed to plug their liquidity holes.

The new emergency lending program set up by the Federal Reserve was announced last evening, as follows:

“The additional funding will be made available through the creation of a new Bank Term Funding Program (BTFP), offering loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. These assets will be valued at par. The BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress.”

The translation of the above is as follows: to prevent banks from further panicking the markets by taking massive losses on their underwater Treasury securities by selling them in order to meet depositor withdrawals, we’re going to accept these Treasury securities as collateral for one-year loans and pretend that their market value is par (the full face amount at maturity).

It’s not clear if this new emergency bailout program from the Fed complies with the statutory language of Dodd-Frank, which prohibits the Fed from setting up an emergency bailout program to bail out a specific financial institution; requires that it accept good collateral; and requires that any new Fed emergency facilities be broad-based across the financial industry.

Federally-insured banks that did themselves in with crypto deposits or functioned as an IPO pipeline to Wall Street, do not appear to us to represent a broad base of the federally-insured, commercial banking industry in the U.S. The Fed’s bailout program, once again, appears to be rewarding hubris and enshrining moral hazard in the U.S. banking system.

Equally troubling, both Silvergate Bank and Silicon Valley Bank were supervised by the Federal Reserve Bank of San Francisco. Why the San Francisco Fed’s bank examiners didn’t blow the whistle on the dangerous manner in which these banks were operating deserves its own investigation. For years now, Wall Street On Parade has warned that the crony Fed should be stripped of its supervision of banks.