By Pam Martens and Russ Martens: February 3, 2023 ~

Charlie Munger is the 99-year old billionaire who graduated magna cum laude from Harvard Law and has been the close business partner of legendary investor, Warren Buffett, at Berkshire Hathaway for more than four decades.

For years now, both Munger and Buffett have been outspoken about the dangerous scam called cryptocurrencies. Yesterday, the Wall Street Journal gave Munger space for a 393-word OpEd in which he urges the U.S. to ban crypto as China has done (and a lot of other countries). Unfortunately, those 393 words are competing with years of a nonstop barrage of hyped promises from right-wing Republicans in Congress who are happy to take big political donations from the crypto cabal; big public relations and marketing firms padding their bottom lines with what effectively amounts to money from defrauded crypto customers; K-Street lobbyists also on the dole to crypto firms; celebrities whoring on television for crypto; and, worst of all, Big Law firms attempting to legitimize myriad crypto frauds as “innovation” in order to compete for billable hours.

In one paragraph of the OpEd, Munger writes this:

“Such wretched excess has gone on because there is a gap in regulation. A cryptocurrency is not a currency, not a commodity, and not a security. Instead, it’s a gambling contract with a nearly 100% edge for the house, entered into in a country where gambling contracts are traditionally regulated only by states that compete in laxity. Obviously, the U.S. should now enact a new federal law that prevents this from happening.”

Gambling describes just what the customer is doing. That is, as Microsoft founder Bill Gates has said, cryptocurrencies are “100 percent based on some sort of Greater Fool theory,” where the gambler is betting that a Greater Fool will be willing to take the worthless crypto off his hands for more than he paid for it.

We have seen these kinds of Greater Fool financial frauds throughout history. At the peak of the Tulip Bubble in Holland in 1637, a single tulip bulb sold for many times the annual wage of a skilled laborer. FOMO, or Fear of Missing Out, as it’s called today, was at the heart of the Tulip Bubble. The South Sea bubble in the 1700s was built around the British South Sea Company which seduced investors with the vision of great wealth from trade with South America. When the company’s share price eventually collapsed, it seriously impacted the British economy. Subsequent investigations revealed bribes and trading manipulations to pump up the price in order to suck the public into buying shares.

While gambling describes what the customer is doing with crypto, it fails to capture this complex and deeply-layered fraud.

For reasons that the world’s smartest scientists cannot even explain, the ongoing frauds against crypto customers begin with crypto “mining.” This is how Senator Elizabeth Warren described this “mining” at a Senate hearing in June of 2021:

“Finally, there are the environmental costs of crypto. Many cryptocurrencies are created through ‘proof-of-work’ mining. It involves using computers to solve useless mathematical puzzles in exchange for newly minted cryptocurrency tokens. Such mining has devastating consequences for the climate. Some crypto mining is set up near coal plants, spewing out filth in return for a chance to harvest a few crypto coins. Total energy consumption is staggering, driving up demand for energy. If, for example, Bitcoin — just one of the cryptocurrencies — were a country, it would already be the 33rd largest energy user in the world — using more energy yearly than all of the Netherlands.

“And all those promised benefits – the currency that would be available at no cost to millions of unbanked families and that would provide a haven from the tricks and traps of big banks – well, those benefits haven’t materialized.”

If you have ever paid a bill using “pay by phone,” you understand why crypto is the horse and buggy compared to existing technology. There is no “mining” or crypto token created out of thin air needed to digitally pay a bill by phone. You simply call the “pay by phone” number, and within minutes, if not seconds, the invoice amount is deducted from your checking account.

Economist Nouriel Roubini also addressed the horse and buggy aspect of cryptocurrencies in an interview with Bloomberg TV in 2019, stating:

“Crypto currencies are not even currencies. They’re a joke…It is not a means of payment, nobody, not even this blockchain conference, accepts Bitcoin for paying for conference fees cause you can do only five transactions per second with Bitcoin. With the Visa system you can do 25,000 transactions per second…Crypto’s nonsense. It’s a failure. Nobody’s using it for any transactions. It’s trading one sh*tcoin for another sh*tcoin. That’s the entire trading or currency in the space where’s there’s price manipulation, spoofing, wash trading, pump and dumping, frontrunning. It’s just a big criminal scam and nothing else.”

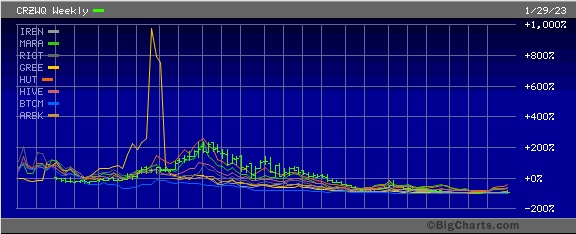

What else is going on with these multi-layers of fraud involving crypto? Well, serious securities manipulation appears to be going on, which is undermining the integrity of U.S. markets in the eyes of the world. Just look at the chart below showing how 9 crypto mining stocks have performed over the past two years after going public in U.S. markets and being offered to a gullible public.

And what about the biggest publicly-traded crypto exchange in the U.S.? Coinbase went public on Nasdaq via a direct listing on April 14, 2021. On its first day of trading it closed at a share price of $328.28, giving it a market capitalization of $85.8 billion. At the close of trading yesterday, its market cap was $18.49 billion, a decline of 78 percent. But not all shareholders have shared an equal amount of pain.

In a traditional IPO, early investors and company executives are not allowed to sell their shares for several months due to a so-called lockup period. There’s no such prohibition in the kind of direct listing that Coinbase did. According to an SEC filing, Coinbase’s Chairman and CEO, Brian Armstrong, sold 750,000 shares on April 14, 2021 at an average share price of $389.10, raising approximately $291,825,000 for himself.

And as we have been reporting extensively at Wall Street On Parade, Big Law firms are taking the position that as long as the music is playing, they’re gonna dance to the crypto tune. The collapsed crypto exchange, FTX, and its indicted former CEO, Sam Bankman-Fried, employed 10 major law firms – none of which appears to have noticed that $8 billion of customers’ funds had been misappropriated by Bankman-Fried’s hedge fund, Alameda Research.

Munger is correct that crypto needs to be banned in the U.S. But until we pull back the complex layers of this fraud, and understand the full picture of those who benefitted, we have not delivered justice to the millions of victims.