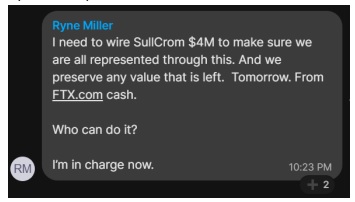

Screenshot of November 8, 2022 Message Sent by Former Sullivan & Cromwell Partner, Ryne Miller, to FTX Employees, Three Days Before FTX Filed Bankruptcy (Source: Sam Bankman-Fried Draft Testimony to House Financial Services Committee)

By Pam Martens and Russ Martens: January 31, 2023 ~

Andrew (Andy) Dietderich, Law Partner at Sullivan & Cromwell Who Is Involved in the FTX Bankruptcy Case

The 144-year old law firm, Sullivan & Cromwell, which previously prided itself on being the go-to law firm for Wall Street, decided a few years back to get deep in the swamp with all things crypto. That dicey decision is now playing out in negative headlines that are dragging down the reputation of the 900-attorney law firm.

Adding to questions swirling around its past legal representation of now indicted crypto kingpin, Sam Bankman-Fried, as well as his bankrupt crypto exchange, FTX, and his hedge fund, Alameda Research, is the fact that a growing number of Sullivan & Cromwell’s other crypto clients are also in various stages of distress. Notwithstanding that reality, the presiding judge in the FTX bankruptcy proceedings, John Dorsey, signed an order on January 20 naming Sullivan & Cromwell the lead counsel in the FTX bankruptcy case.

But long before Judge Dorsey’s order was signed, Sullivan & Cromwell was billing large bucks to FTX, acknowledging in a bankruptcy court filing that over the prior 16 months it had collected legal fees and expenses of $8,564,487.50 from FTX and its affiliates, plus a $12 million retainer for FTX bankruptcy work.

According to Bloomberg Law, Sullivan & Cromwell “has more than 150 people working on the FTX case, including 30 partners…” A court filing from Sullivan & Cromwell shows that its partners can charge as much as $2,165 per hour. The final tab in the bankruptcy case is expected to land in the “hundreds of millions of dollars” according to the Bloomberg Law article.

Sullivan & Cromwell snagged this very lucrative bankruptcy work, according to a screen shot (see above) shared by Sam Bankman-Fried in the testimony he was prepared to present to the House Financial Services Committee on December 13, because it had a friendly former partner at FTX. (Bankman-Fried was arrested by federal prosecutors from the Justice Department and thus prevented from delivering his testimony in person, but Forbes obtained a copy of the document.)

The inside man was Ryne Miller, who left Sullivan & Cromwell and went directly to FTX.US as General Counsel in August of 2021. Despite Miller’s eight years at Sullivan & Cromwell and more than three years working as legal counsel at a federal regulator, Miller somehow managed not to notice the following at FTX: there was no functioning Board of Directors; there was no accounting department; there was no functioning compliance department making sure that customer funds were not co-mingled with Sam Bankman-Fried’s personal piggy bank, his hedge fund, Alameda Research. This lack of corporate controls was described by the new FTX CEO, John Ray, at the December 13 hearing of the House Financial Services Committee.

Despite these failures by Ryne Miller, John Ray reported in a declaration filed on January 17 with the FTX bankruptcy court that Miller is “still employed” by FTX.US, which is also part of the bankruptcy proceedings.

As a direct result of this lack of corporate controls, Ray told the House panel that over $8 billion of customers funds are missing at FTX.

At a bankruptcy court hearing on January 20, a former FTX in-house attorney, Daniel Friedberg, was prepared to testify as follows to the court, according to a sworn declaration he filed:

“Mr. Miller informed me that it was very important for him personally to channel a lot of business to S&C as he wanted to return there as a partner after his stint at the Debtors. This bothered me very much and I told him that his job was to only hire the best outside counsel for the job, and that his allegiance was now to the Debtors and not S&C…”

And this:

“I told Mr. Miller that S&C was not the proper law firm to select [for the bankruptcy proceedings] because of the claims and conflicts, as well as the exorbitant costs of the firm. Mr. Miller told me that there was over $200 million cash in LedgerX and that he was going to send these funds to S&C, and that bankruptcy legal costs were therefore not a problem…”

Friedberg appeared via Zoom on the day of the January 20 hearing. A lawyer, Marshal Hoda, who was representing two FTX customers who were challenging Sullivan & Cromwell being named lead counsel, asked Judge Dorsey to question Friedberg. Dorsey denied the request and then signed the order making Sullivan & Cromwell lead counsel.

While Sullivan & Cromwell enjoys the potential for billing tens of millions of dollars in this bankruptcy case, this is a sampling of how its other crypto clients are performing. (The law firm filed a listing of its current and former crypto clients with the court so that potential conflicts could be explored by a correctly suspicious U.S. Trustee, who represents the U.S. Department of Justice in bankruptcy cases.)

BlockFi: BlockFi, a crypto exchange, is Sullivan & Cromwell’s current client. It filed bankruptcy last November. It revealed that FTX and Sam Bankman-Fried’s hedge fund, Alameda Research, owe it over $1 billion.

Coinbase: This publicly-traded crypto exchange is Sullivan & Cromwell’s current client. It finished last year with a market value loss of 86 percent. Coinbase announced last June it was slashing 18 percent of its workforce. It announced a further 20 percent headcount reduction this month.

Robinhood: This is a publicly-traded stock trading platform and Sullivan & Cromwell’s current client. Sullivan & Cromwell concedes in a bankruptcy court filing that it advised Bankman-Fried personally on a stock transaction involving his purchase of more than half a billion dollars of Robinhood stock. The monies to fund that transaction came from loans from his hedge fund, Alameda Research, which prosecutors say was looting the funds from FTX customer accounts. The Justice Department has seized those Robinhood shares.

CNN reported yesterday that the Justice Department is alleging in its criminal case against Bankman-Fried that “he attempted to obscure his criminal misuse of FTX customer property,” by purchasing the Robinhood shares “through a foreign special purchase vehicle with no public connection to FTX or Alameda.” The lawyer and law firm that performed this work for Bankman-Fried has yet to be explored in Judge Dorsey’s court.

Gemini is a current client of Sullivan & Cromwell. It has $900 million of customer funds frozen at another bankrupt crypto firm, Genesis. On January 12, the Securities and Exchange Commission charged both firms with selling unregistered securities.

Kraken is another crypto exchange that is a current client of Sullivan & Cromwell. It settled charges in November with the U.S. Treasury Department for evading sanctions on Iran; then announced later in the month that it was laying off 30 percent of its workers.

Sequoia Capital is a current client of Sullivan & Cromwell. It was also a large venture capital investor in FTX. It has now written down to zero its entire investment of $214 million in FTX.

Silvergate Bank’s parent (publicly-traded Silvergate Capital) is listed as a former client of Sullivan & Cromwell. Just exactly when that relationship ended is not indicated. Silvergate Bank has managed to pull off a replay of the panic bank runs in the early days of the Great Depression. On January 5, Silvergate reported that its “total deposits from digital asset customers declined to $3.8 billion” as of December 31, 2022 (down from the previously reported $11.9 billion on September 30, 2022.) That’s a shocking 68 percent drop in deposits in one quarter – at a (wait for it) federally-insured bank backstopped by the U.S. taxpayer that also decided to get deep in the crypto swamp. Silvergate’s publicly-traded stock lost 88 percent of its market value last year.

FTX was one of the crypto firms holding deposits at Silvergate. On December 6, U.S. Senators Elizabeth Warren (D-MA), Roger Marshall (R-KS), and John Kennedy (R-LA) wrote to Silvergate demanding answers regarding the funds it had transferred from FTX customer accounts to Bankman-Fried’s hedge fund, Alameda Research. The Senators inquired as follows:

“Your bank’s involvement in the transfer of FTX customer funds to Alameda reveals what appears to be an egregious failure of your bank’s responsibility to monitor for and report suspicious financial activity carried out by its clients. The public is owed a full accounting of the financial activities that may have led to the loss of billions in customer assets, and any role that Silvergate may have played in these losses.”

Despite all of this, Judge John Dorsey stated in open court on January 20 that he couldn’t see any evidence that Sullivan & Cromwell had a conflict that would prevent it from serving as lead counsel in the FTX bankruptcy. (Other than that, how was the play Mrs. Lincoln?)