By Pam Martens and Russ Martens: May 13, 2022 ~

On January 2, 2008, the first trading day of the year that would become the biggest Wall Street crash since the Great Depression, Citigroup’s shares closed at $28.92. Yesterday, Citigroup’s shares closed at $4.66 (adjusted for the 1-for-10 reverse stock split the company did on May 9, 2011). That means that shareholders who have hung on to the stock for the past 14 years are still down 84 percent.

In terms of assets, Citigroup is the third largest bank holding company in the U.S. with $2.29 trillion in assets as of December 31, 2021. (JPMorgan Chase and Bank of America rank first and second with $3.7 trillion and $3.2 trillion in assets, respectively, as of the same date according to the Office of the Comptroller of the Currency.)

Despite the fact that Citigroup blew itself up in 2008 with off-balance-sheet subprime debt and derivatives, as of December 31, 2021 its bank regulators have allowed it to hold $43.4 trillion in derivatives (notional, meaning face amount). Regulators have apparently dismissed the fact that Citigroup had to be resuscitated with the largest bank bailout in global banking history from December 2007 to at least June of 2010, according to a government audit.

Sheila Bair, the former head of the Federal Deposit Insurance Corporation (FDIC), the federal agency that insures the deposits at U.S. commercial banks, wrote about these derivatives in her 2012 book, Bull by the Horns: “For reasons that still today remain a mystery to me, they were allowed by their regulators – the Fed and the OCC – to keep the investments off balance sheet….”

By early 2009, Citigroup’s stock price was trading at 99 cents. The bank’s shakiness and its counterparty relationships with other major global banks played a key role in bringing down Wall Street.

As insane as it may seem to rationale Americans, federal regulators have allowed these massive amounts of derivatives and counterparty relationships to exist to this very day. And some of those relationships are with foreign global banks, many of which are also trading at close to record lows. The Swiss bank, Credit Suisse, closed yesterday at $6.24; the U.K. bank, Barclays, closed at $7.24; and the big German lender, Deutsche Bank, closed at $9.44. (See above chart.)

The derivatives nightmare that is concentrated at the megabanks in the U.S. is called out every quarter in the Office of the Comptroller of the Currency’s Report on Bank Trading and Derivative Activities. Table 14 of this report (see page 19) shows that the 25 largest bank holding companies in the U.S. are sitting on $234 trillion notional (face amount) in derivatives, but just five bank holding companies are responsible for $200.18 trillion of that exposure or 86 percent of the total. Those mega bank holding companies are: JPMorgan Chase, Citigroup, Goldman Sachs, Morgan Stanley, and Bank of America.

There are two realities that coexist in Congress about the state of the U.S. banking system. The alternative reality was expressed yesterday by Senator Pat Toomey, a Republican from Pennsylvania. Yesterday, Jerome Powell was finally confirmed by the full Senate for a second four-year term as Fed Chair and Toomey released a statement which said in part:

“Chairman Powell has a record of acting thoughtfully and constructively, especially in difficult circumstances. From implementing a number of modest, sensible banking reforms that reduced regulatory burdens, to acting swiftly and appropriately to stabilize the financial markets and the economy during the COVID-19 pandemic, Chairman Powell’s leadership has helped spur economic growth while preserving the best capitalized banking system in American history.”

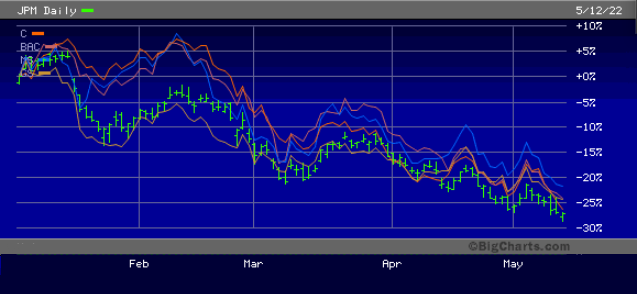

Let that sink in for a moment. Toomey, the Ranking Member of the Senate Banking Committee which oversees both the Fed and the megabanks on Wall Street, is telling the American people that there currently exists in the U.S. “the best capitalized banking system in American history” – despite the concrete data to the contrary published quarterly by the Office of the Comptroller of the Currency – not to mention the price action of these megabanks in the open market. See year-to-date share price chart below of JPMorgan Chase (JPM), Citigroup (C), Bank of America (BAC), Morgan Stanley (MS) and Goldman Sachs (GS).

For how the campaign money behind Toomey may have tainted his opinion of the soundness of the megabanks on Wall Street, see our report here.

Toomey’s assessment of Powell stands in sharp contrast with what Senator Elizabeth Warren had to say about Powell at a Senate Banking Committee hearing on September 28 of last year. Warren told Powell to his face at the hearing:

“So far you’ve been lucky. The 2008 crash shows what happens when the luck runs out. The seeds of the 2008 crash were planted years in advance by major regulators like the Federal Reserve that refused to rein in big banks…Your record gives me grave concern. Over and over, you have acted to make our banking system less safe.”

Warren added that Powell’s record of deregulation gave her “grave concern,” and made him a “dangerous man” to head the Fed.