By Pam Martens and Russ Martens: December 17, 2020 ~

There was a jaw-dropping exchange between Politico reporter Victoria Guida and Fed Chair Jerome Powell at his press conference yesterday following the two-day meeting of the Fed’s Federal Open Market Committee (FOMC). Powell first acknowledged in his opening statement that “the current economic downturn is the most severe of our lifetimes.” But he then proceeds to tell Guida that the Fed has given no thought at all to what kind of emergency lending it might engage in under the incoming Biden administration. Treasury Secretary Steve Mnuchin has kneecapped the Fed’s existing emergency loan facilities by demanding that the Fed return the Treasury’s unused money that is backstopping these facilities as loss-absorbing capital.

The Fed has for years attempted to reassure markets that there will be no surprises from the Fed; that it will be providing lots of forward guidance to Wall Street to assuage any nervous jitters about its actions. And yet this is what Powell tells Guida about the Fed’s future plans for emergency lending facilities:

“We’re very focused on getting through year end. We’ve been very focused on the issues that are right in front of us. And honestly, we’re not planning on anything or having any discussions about what we might do down the road.”

If that were true, which it clearly isn’t, it would be incompetency of the highest order in the midst of what Powell himself describes as the worst economic downturn of our lifetimes.

Guida also dropped the bombshell on Powell (and the full press conference) that she is aware that there is absolutely nothing in the Federal Reserve Act’s Section 13(3) that requires the Fed to get the Treasury to provide loss-absorbing capital from the taxpayer in order for the Fed to create its emergency lending facilities. Guida states:

“Chair Powell, you’ve said that you accept Treasury Secretary Mnuchin’s interpretation of the statute of the CARES Act on what should happen with those programs. So, first of all, I’m curious whether under a new Treasury Secretary, you will accept whatever legal interpretation they put forward for those programs. And then, also, given that there isn’t a statutory requirement for you to have financial backing from Treasury for 13(3) facilities, do you have any plans for any future facilities that don’t require Treasury backing?”

Powell responds:

“Certainly, we would have the ability to do facilities under 13(3) in some cases with no backing, but we can’t do any 13(3) facilities without the approval of the Treasury Secretary. Right. But we did some facilities. I think one of our facilities this time didn’t have any Treasury backing. And I think some in the round of during the global financial crisis also didn’t have any.”

The Fed has seven emergency loan programs today that are using Treasury money as backstops. It has two that are not: the Primary Dealer Credit Facility and the Paycheck Protection Program Liquidity Facility.

Powell has been on the Board of the Federal Reserve since May 25, 2012. He’s been its chair since February 5, 2018. And he has just voiced the opinion that the U.S. Treasury backstopped most of the 13(3) emergency lending facilities during the 2007 to 2010 financial crisis while only “some” of those facilities didn’t have that Treasury backstop.

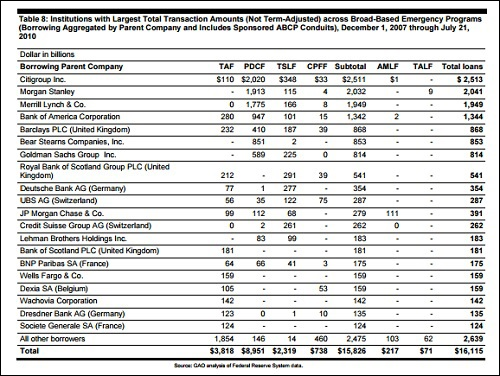

The fact is that according to the government’s in-depth audit of those facilities that was released by the Government Accountability Office (GAO) on July 21, 2011, of the Fed’s six 13(3) emergency loan facilities that were operational during the last financial crisis, just one had any funding support from the Treasury. Those six facilities were the Term Auction Facility (TAF); the Term Securities Lending Facility (TSLF); the Primary Dealer Credit Facility (PDCF); the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF); the Commercial Paper Funding Facility (CPFF); and the Term Asset-Backed Securities Loan Facility (TALF).

According to the GAO audit, the Fed dispersed a total of $16.1 trillion in cumulative loans through these facilities (see graph below) and all it ever got from the Treasury was a $20 billion backstop for TALF, which was eventually reduced to $4.3 billion in July 2010.

The Treasury was involved in providing backstops along with the Fed for the bailouts of the giant insurer, AIG, and the giant bank/casino, Citigroup. However, those were not broadbased 13(3) emergency lending facilities.

What the Fed did back then, which it knows it can still do at the drop of a dime today, is to demand an adequate amount of securities as collateral from the Wall Street firms that request its emergency loans. There is zero need or rational reason to make the U.S. taxpayer backstop potential losses on Wall Street – particularly when today’s Wall Street funding problems began months before COVID-19 reared its head in the United States.

So what would explain the CARES Act putting Mnuchin in charge of providing up to $454 billion in taxpayers’ money to backstop losses for the Fed’s current emergency lending facilities? Mnuchin provided that answer during his December 2 testimony before a House Financial Services Committee hearing. He told Congresswoman Katie Porter that he “wrote the law with Congress.”

Exactly what gives the Treasury Secretary, who is part of the Executive branch of government, the legal right to flip seats and start functioning as part of the legislative branch and writing laws with Congress? But more importantly, when that same Treasury Secretary uses that law he helped write to create a $454 billion slush fund to direct as he sees fit under his usurped law writing ability, Americans need to sit up and take notice.

Editor’s Note: According to the Fed’s H.4.1 balance sheet statement released on December 10, the same $114 billion of Treasury money that has been sitting in the Fed’s emergency facilities for months is still sitting there. Mnuchin demanded the money back in a letter dated November 19.