By Pam Martens and Russ Martens: October 13, 2020 ~

It has been the contention of Wall Street On Parade for more than a decade that today’s so-called “universal banks,” also variously known as megabanks or Global Systemically Important Banks (G-SIBs), are a banking model from hell that was thoroughly discredited in the tens of thousands of transcripts and documents released by the U.S. Senate following its multi-year investigation of that structure in the early 1930s.

It has been the contention of Wall Street On Parade for more than a decade that today’s so-called “universal banks,” also variously known as megabanks or Global Systemically Important Banks (G-SIBs), are a banking model from hell that was thoroughly discredited in the tens of thousands of transcripts and documents released by the U.S. Senate following its multi-year investigation of that structure in the early 1930s.

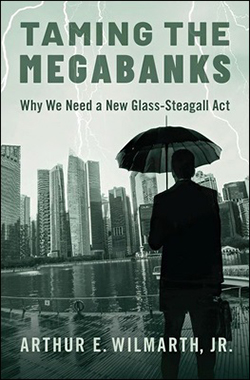

Now the seminal book proving that theory has just been published. Written by Arthur E. Wilmarth, Jr. and titled Taming the Megabanks: Why We Need a New Glass-Steagall Act, the book brilliantly takes the reader through a riveting guided tour covering the past century and the resurrection of this same disastrous U.S. banking model in 1999.

Oxford University Press is the publisher of Wilmarth’s book. We can envision it becoming one of the most important works of this century in providing the impetus for Congress to finally restore the Glass-Steagall Act – the 1933 to 1999 law that mandated the separation of stock trading and stock underwriting firms from federally-insured, deposit-taking banks. That legislation protected the U.S. financial system for 66 years. It took just nine years after its repeal for the universal banks on Wall Street to blow up the financial system in a replay of 1929, taking the U.S. economy along for the gut-wrenching ride.

Wilmarth’s writing is so insightful and profound in its analysis of the similarities between the banks of the late 1920s and today that it feels like the ghost of Ferdinand Pecora might have been whispering in Wilmarth’s ear. Pecora was a former prosecutor from New York who was chosen to preside over much of the early 1930s Senate Banking hearings and investigations of the corrupt Wall Street structure that led to the 1929 crash and Great Depression.

Three banking names that played significant roles in the crash of 1929 and the ensuing Great Depression were National City Bank, JP Morgan, and Chase National Bank. National City Bank was the precursor to today’s Citigroup, the bank that would have collapsed in 2008 except for the largest taxpayer and Federal Reserve bailout in global banking history. JPMorgan and Chase combined in 2000 to create today’s JPMorgan Chase.

It’s pretty uncanny that Wilmarth’s book is being released just as JPMorgan Chase has admitted to its fourth and fifth criminal felony counts in the past six years and the Office of the Comptroller of the Currency (OCC) has just slapped a $400 million fine against Citigroup and threatened to remove its entire Board of Directors: All while the Trump administration attempts to further deregulate Wall Street.

The earlier years of the OCC, the federal regulator of national banks, are brought to life in Wilmarth’s book along with the feisty character of John Skelton Williams, who was appointed to head the OCC by President Woodrow Wilson in 1914. Wilmarth quotes as follows from one of Williams’ scathing critiques on the nature of Wall Street in that era:

“New York has become the commercial capital of the country, the great citadel of the money power, the reservoir of money supply. It is the walled city from which the barons have levied tribute on a territory and population vaster than any Lord or King of the Middle Ages dreamed of, yet sometimes using methods as ruthless and savage as those of the fiercest of the robber nobles….

“No sudden sweep by a feudal magnate on his peaceful neighbors was a more cruel or shameless plundering than some of the transactions which have been brought to light by which the shareholders of railways and other great enterprises…were despoiled. Their property and money were taken from them by the might of masses of money working stealthily.”

Reading this incredibly timely book provides many cases of déjà vu. Wilmarth writes about how Williams wrote to the Federal Reserve to criticize Chase National Bank “for providing $40 million of loans to insiders and their related interests, including $10 million of loans extended to its president, Albert Wiggin, and his family.”

Just yesterday we reported on how JPMorgan Chase was extending millions of dollars to its Board Members and their businesses while simultaneously branding them “independent” Directors.

Wilmarth also writes that Williams criticized the Federal Reserve Bank of New York in a newspaper article for making “loans to the five largest New York City banks” that “exceeded the total amount of discount window loans that five regional Federal Reserve Banks had extended to all of the banks in their regions.” Compare that to our article of November 20, 2019: These Are the Banks that Own the New York Fed and Its Money Button.

Wilmarth notes that Williams “also criticized the New York Fed for allowing its ‘big favored banks’ to use discount window loans to finance ‘call money’ loans that supported ‘stock gambling.’ ” Compare that to the $9 trillion that the New York Fed infused into the trading houses owned by Wall Street banks from September 17, 2019 through March of this year.

Wilmarth also delves into the “trading pools” that played a significant role in creating the stock market bubble of 1929. He writes:

“Prominent speculators—including Walter Chrysler, Arthur Cutten, William Crapo Durant, the Fisher brothers, and John J. Raskob—organized hundreds of trading pools in 1928 and 1929 to boost the prices of targeted stocks. Trading pools conducted purchasing and selling campaigns to increase the trading volumes and market prices of featured stocks, especially ‘glamour stocks’ such as Radio Corporation of America. Pool operators expected that larger trading volumes would boost the prices of targeted stocks and encourage public investors to buy those stocks. Pool operators could then reap handsome profits by selling their shares back into the market. National City Bank, Chase National Bank, and other large banks financed and participated in many of those trading pools.”

Today, those trading pools are called Dark Pools. They are being operated inside the mega Wall Street banks that hold trillions of dollars in federally-insured deposits. Today, these Dark Pools are even allowed by the Securities and Exchange Commission to trade the shares of their own bank stock. (See Wall Street Banks Are Trading in Their Own Company’s Stock: How Is This Legal?)

Wilmarth also demonstrates the similarity between today’s megabank concentration of money and power and the findings of the Pujo Committee that was convened in 1912, named after Congressman Arsene Pujo, a Democrat from Louisiana. Wilmarth writes this:

“The Pujo Committee’s report determined that a group of six financial institutions— J. P. Morgan & Co., First National Bank of New York, National City Bank, Kuhn, Loeb & Co., and two Boston investment banks (Lee, Higginson and Kidder, Peabody)— were ‘the most active agents in forwarding and bringing about the concentration of control of money and credit’ in the U.S.”

Wilmarth explains that the “Pujo Committee recommended that national banks should be prohibited from underwriting and trading in securities (except for government bonds), from owning bank stocks, and from affiliating with companies engaged in securities activities. The committee also recommended that private investment banks should be barred from accepting deposits.”

But just as the Congress of 2010 failed to restore the Glass-Steagall Act, opting instead to pass the easily-gamed Dodd-Frank financial reform legislation, the Congresses that followed the Pujo Committee Report of 1913 also failed to pass legislation to rein in the abuses of Wall Street’s banks. Those failures led to the devastating collapse from 1929 to 1933 when the stock market lost 89 percent of its value, thousands of banks collapsed, and the Great Depression destroyed the jobs and livelihoods of millions of Americans.

If you want to avoid that same outcome today, buy a copy of this book, read it, then send it to one of the Senators from your state with a note appealing to him or her to restore the Glass-Steagall Act.