By Pam Martens and Russ Martens: March 14, 2020 ~

U.S. Treasury Secretary Steve Mnuchin Gives Interview to CNBC Outside of White House on Friday, March 13, 2020

On February 12, 2020, the Dow Jones Industrial Average closed at 29,551.42. Yesterday, March 13, the Dow closed at 23,185.62 -– a loss of 6,365.80 points in one month’s time, or 21.54 percent. In 2008, the greatest financial calamity since the Great Depression, the Dow had lost 2,339.60 points or 21.4 percent one month after the frightening events of September 15, 2008 when Lehman Brothers filed bankruptcy, Merrill Lynch had to be taken over by Bank of America, and one day before the U.S. government seized the giant insurer, AIG, because it couldn’t pay the tens of billions of dollars in derivative bets it had made with the mega banks on Wall Street.

On this past Friday morning, in what appeared to be an effort to restore confidence on Wall Street, U.S. Treasury Secretary Steve Mnuchin gave an interview on CNBC. Mnuchin said “there’s lots of liquidity” and “this isn’t like the financial crisis.” But savvy folks on Wall Street, and readers of Wall Street On Parade, clearly understand that there is not lots of liquidity and this is exactly like the financial crisis of 2008 in terms of mega Wall Street banks losing massive amounts of their common equity capital and being on a liquidity feeding tube inserted by the Federal Reserve.

Since September 17, 2019 – six months ago, the Federal Reserve has loaned billions of dollars to Wall Street every single business day that the stock market has been open. This is the first time this has been necessary since the financial crisis of 2008. That fact, in and of itself, makes this very much on a par with the financial crisis of 2008.

Since the Fed began its repo loan operations on September 17, the tally of the Fed’s cumulative loans to Wall Street’s trading firms comes to more than $9 trillion (using the Fed’s own Excel spreadsheet of the data; you have to manually remove the Reverse Repo dollar amounts.)

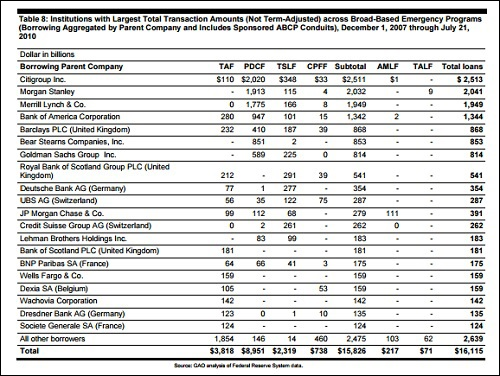

According to the Fed audit conducted by the Government Accountability Office (GAO), from December 12, 2007 to July 21, 2010, a period spanning more than 31 months during the worst financial crisis since the Great Depression, the Fed’s cumulative loans to Wall Street tallied up to $16.1 trillion. (See chart below from the GAO audit.)

And here we are today, when everyone from Fed Chairman Jerome Powell to bank analyst Mike Mayo is telling the public that the banks have plenty of capital and yet the Fed has pumped out 56 percent in six months of the amount it funneled to the Wall Street banks over 31 months during the 2008 financial crisis. At this rate, it is going to top the money it threw at the 2008 crisis in no time at all.

That’s no exaggeration. Just this past Thursday the Fed said it would make $1.5 trillion available to Wall Street over just the next two days. The banks didn’t take all of that money but the Fed clearly thought there was a big enough crisis to offer it.

The Fed’s balance sheet is back to $4.3 trillion, just $200 billion short of the $4.5 trillion peak it set following the financial crisis.

While the Fed was providing that $16.1 trillion to Wall Street during the financial crisis at super cheap interest rates, traders and executives of the mega banks were being rewarded with multi-million bonuses. Contrast that to the announcement that JPMorgan Chase’s Board recently rewarded Jamie Dimon, its Chairman and CEO, with a $30 million pay package. That largess comes despite the fact that the bank is under its fourth criminal probe by the Department of Justice, all while Dimon has sat at the helm. Two of the prior criminal investigations resulted in the bank pleading guilty to three separate felony counts. One of the criminal probes, into turning its precious metals desk into a criminal racketeering enterprise, is ongoing.

Since the Fed turned on its latest money spigot to Wall Street, it has refused to provide the public with the dollar amounts going to any specific banks. This has denied the public the ability to know which financial institutions are in trouble. The Fed, exactly as it did in 2008, has drawn a dark curtain around troubled banks and the public’s right to know, while aiding and abetting a financial coverup of just how bad things are on Wall Street.

In his CNBC interview, Mnuchin also urged the Wall Street banks to tap the Discount Window, stating “there is no stigma about going to the Discount Window.” We have been looking at the Fed’s weekly H.4.1 reports and no bank is borrowing even $1 billion using the Discount Window, whose details of borrowings are made public two years after the fact. Why would the banks borrow at the Discount Window, where the details will eventually be made public, when the Fed is willing to offer them trillions in secret repo loans. It has been the conventional wisdom for the past 100 years that there is stigma attached to a major bank borrowing from the Discount Window, since it suggests that they have run out of their own liquidity – meaning they didn’t properly prepare for a rainy day and their federal regulators were also napping.

Mnuchin also stated that the Trump administration would be going to Congress “for authorities that they took away that we think we need to deal with this…” Mnuchin is referring to the Dodd-Frank financial reform legislation of 2010 which eliminated the power of the Fed to secretly funnel trillions of dollars to domestic and foreign global banks while hiding the names and details from Congress and the public.

According to Section 1101 of Dodd-Frank, both the House Financial Services Committee and the Senate Banking Committee are to be briefed on any emergency loans made by the Fed, including the names of the banks doing the borrowing. The section reads:

“The [Federal Reserve] Board shall provide to the Committee on Banking, Housing, and Urban Affairs of the Senate and the Committee on Financial Services of the House of Representatives, (i) not later than 7 days after the Board authorizes any loan or other financial assistance under this paragraph, a report that includes (I) the justification for the exercise of authority to provide such assistance; (II) the identity of the recipients of such assistance; (III) the date and amount of the assistance, and form in which the assistance was provided; and (IV) the material terms of the assistance, including — (aa) duration; (bb) collateral pledged and the value thereof; (cc) all interest, fees, and other revenue or items of value to be received in exchange for the assistance; (dd) any requirements imposed on the recipient with respect to employee compensation, distribution of dividends, or any other corporate decision in exchange for the assistance; and (ee) the expected costs to the taxpayers of such assistance…”

We know that as of February 6 the Fed had not briefed the Senate Banking Committee on its repo loan operations because on that date Senators Sherrod Brown, Elizabeth Warren, Jack Reed and Tina Smith, Democratic members of the Committee, sent a letter to Jerome Powell, Chairman of the Federal Reserve, listing six specific questions they wanted answers to in preparation for his hearing testimony on February 12. At that point in time, the Fed’s repo loans amounted to a cumulative total of $6.6 trillion, more than a third of the Fed loans made during the last financial crisis. The six questions were the following:

“1) Has the Fed determined the cause for the protracted, increased demand for reserves that necessitates continued intervention through repo activities? If so, what is/are the cause or causes?

“2) Has the Fed analyzed the impact of the availability of this facility on primary dealers’ balance sheets and market activity? If so, what has changed in money markets since September 2019? Are other portfolios affected by these adjustments and reallocations?

“3) Could a bank use access to this facility to game capital or liquidity standards, and what steps are supervisors taking to ensure that is not the case?

“4) Have profits at banks that have access to this facility outpaced profits at similarly situated financial institutions that do not have access or have not participated in the facility? If so, does that suggest anything about the efficiency of overnight repo operations as a transmission mechanism for monetary policy?

“5) The facility has reduced the cost of access to cash in the money markets – to what degree has the cost of borrowing been reduced to consumers, specifically those with outstanding loans? In your estimation, do banks or consumers primarily benefit from the operation of this facility?

“6) Since September 2019, has the Board discussed the possibility of weakening or otherwise altering liquidity, capital, or other regulatory and supervisory standards in order to address this issue? Does the Board continue to consider any such changes? Has the Board or FRBNY considered the possibility that market actors refused to lend into the market, sacrificing short-term profits in order to raise questions about prudential regulation? Would it be feasible for the small network of primary dealers to do so?”

These global banks have been charged with rigging the global interest-rate benchmark, Libor; with rigging the foreign-exchange markets; and their general counsels meet secretly once a year in brazen violation of the spirit of the anti-trust laws. Hopefully, question 6 is a rhetorical question from Democrats on the Senate Banking Committee.