By Pam Martens and Russ Martens: February 28, 2025 ~

On June 29, 2010 when the electric vehicle company, Tesla, launched its Initial Public Offering (IPO) on the Nasdaq Stock Market, its underwriters were trading powerhouses on Wall Street: Goldman, Sachs & Co., Morgan Stanley, JPMorgan, and Deutsche Bank Securities. Over the next dozen years, Tesla would utilize these investment banks and others to raise billions more in secondary stock offerings of Tesla shares.

On June 29, 2010 when the electric vehicle company, Tesla, launched its Initial Public Offering (IPO) on the Nasdaq Stock Market, its underwriters were trading powerhouses on Wall Street: Goldman, Sachs & Co., Morgan Stanley, JPMorgan, and Deutsche Bank Securities. Over the next dozen years, Tesla would utilize these investment banks and others to raise billions more in secondary stock offerings of Tesla shares.

It was a very happy marriage. The Wall Street megabanks made big fees on the underwritings and Musk was able to cash out tens of billions of dollars for himself in Tesla stock sales.

That happy, mutually beneficial relationship turned sour when Musk borrowed $13 billion from a consortium of the megabanks to help fund his purchase of the social medium platform, Twitter, in 2022. (Musk has since renamed Twitter as “X.”)

The banks got stuck with these loans after Musk torpedoed the reputation of Twitter, lost major advertisers, and tanked its value. On February 14, the Financial Times reported that the bank lenders have now been able to sell all but $1 billion of that debt tied to Musk’s purchase of Twitter – ostensibly because of Musk’s First Buddy status with the President of the United States.

Musk may be the richest man in the world on paper, but monetizing that paper into hard cash is another matter. The 10K (Annual Report) filed by Tesla on January 30 of this year with the Securities and Exchange Commission (SEC) carried this loud, shrill alarm bell:

“If Elon Musk were forced to sell shares of our common stock, either that he has pledged to secure certain personal loan obligations, or in satisfaction of other obligations, such sales could cause our stock price to decline.

“Certain banking institutions have made extensions of credit to Elon Musk, our Chief Executive Officer, a portion of which was used to purchase shares of common stock in certain of our public offerings and private placements at the same prices offered to third-party participants in such offerings and placements. We are not a party to these loans, which are partially secured by pledges of a portion of the Tesla common stock currently owned by Mr. Musk. If the price of our common stock were to decline substantially, Mr. Musk may be forced by one or more of the banking institutions to sell shares of Tesla common stock to satisfy his loan obligations if he could not do so through other means. Any such sales could cause the price of our common stock to decline further. Further, Mr. Musk from time to time may commit to investing in significant business or other ventures, and as a result, be required to sell shares of our common stock in satisfaction of such commitments.”

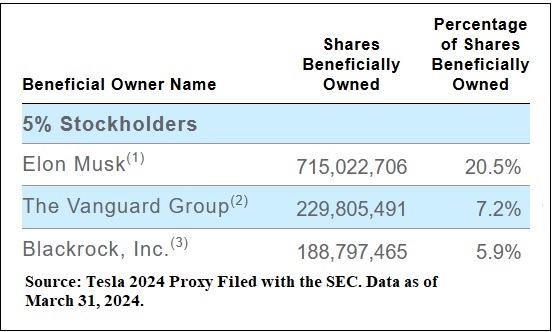

The non-bold type immediately above raises highly problematic questions. According to the 2024 Proxy filed with the SEC, as of March 31, 2024, Musk owned 20.5 percent of the shares outstanding in Tesla. (See page 151 of the proxy.) According to the proxy, that includes common stock and “all shares of common stock subject to options or other convertible securities held by that person or entity that are currently exercisable or exercisable within 60 days of March 31, 2024.”

No other single entity, including mutual funds or institutions, comes close to Musk’s ownership in Tesla. As of yesterday’s closing price on Nasdaq, Musk’s 715,022,076 shares that he owned as of March 31 of last year, have a current market value of $201.6 billion, representing the largest portion of Musk’s wealth.

Most ultra wealthy people try to diversify away from heavily concentrated stock positions. But for some unexplained reason, Musk wanted to concentrate his wealth deeper into a single stock position.

Now we learn from Tesla’s 10K SEC filing that Musk was borrowing money from banks (which potentially took part in one or more Tesla stock offerings) so he could buy more Tesla shares in the secondary stock offerings – notwithstanding that this could be interpreted as an insider trying to push up the stock price.

While the banks may now be off the hook for the bulk of the loans they made to Musk to enable his purchase of Twitter, Tesla’s SEC filing suggests that the banks’ personal loans to Musk – for his purchases of Tesla stock in secondary offerings – are still outstanding and are collateralized with (wait for it) Tesla stock, which is on a sharp downward track.

Bloomberg News reported this morning on the dramatic slump in Tesla’s share price, writing this:

“Shares of the Elon Musk-led electric-vehicle company are down about 40% from their late 2024 high, a reversal that accelerated in recent days after data showed Tesla’s European car sales nearly halved in January. This week’s roughly 17% decline in the share price suggests the slowdown in Tesla’s mainstay auto business is starting to unnerve traders. That’s bad news for a stock whose fortunes have been driven by investor enthusiasm as much as fundamentals.”

Donald Trump and Elon Musk share a common belief in a transactional model, devoid of compassion, that defines their personal and business lives. It can be summed up as “you scratch my back and I’ll scratch yours; defy me and you become my target for retribution.”

Trump verbalized this model on February 18 when he explained why the Associated Press, after more than a century of being part of the White House Press Pool, and receiving 59 Pulitzer Prizes, has now been banned by Trump. Trump stated:

“[The Associated Press] has been very, very wrong on the election on Trump and the treatment of Trump and other things having to do with Trump and Republicans and conservatives. And they’re doing us no favors. And I guess I’m doing them no favors. That’s the way life works.”

Trump, disturbingly, frequently refers to himself in the third person. Equally disturbing, Trump appears to be unaware that it would be corrupt for a news outlet in a democracy to be doing “favors” for an individual it has been assigned to cover objectively in its news reports.

The Associated Press has now filed a federal lawsuit “to vindicate its rights to the editorial independence guaranteed by the United States Constitution and to prevent the Executive Branch from coercing journalists to report the news using only government-approved language.” AP had earned Trump’s wrath by refusing to change its style-guide to reflect Trump’s demand to call the Gulf of Mexico the Gulf of America. That nonsensical demand was seen as sending a message to the press that it should see all things, big and small, as Trump wanted them to be seen.

The back scratching between Trump and Musk is crystal clear. Musk gave more than a quarter of a billion dollars to bolster Trump’s presidential campaign, making Musk the largest enabler of getting a 34-count convicted felon installed in the Oval Office. Trump is now scratching Musk’s back by giving him and his minions of coders and software engineers unprecedented access to tap into classified data stored in the U.S. government’s computers – notwithstanding the dangerous threats to national security this presents.

One of Musk’s top priorities has been to kill the Consumer Financial Protection Bureau (CFPB), the federal agency that investigates predatory financial firms that swindle seniors, students, military families, and others. To date, the CFPB has returned more than $21 billion to victims of financial abuse over its 15 years of existence.

On February 7, Musk Tweeted: “CFPB RIP,” with a graphic of a tombstone.

A 404 Error message now appears on the front page of the CFPB website and its social media pages have been deleted at X (Twitter), and Facebook. The entire video playlist on the CFPB’s YouTube channel has been deleted. That channel previously had hundreds of videos educating the most vulnerable Americans on how to avoid being scammed by financial predators.

Multiple federal lawsuits have been filed against this unprecedented and outrageous attack on a federal agency that fights against scam artists. Notable among them was a lawsuit brought in U.S. District Court for the District of Columbia by the National Treasury Employees Union (NTEU). The lawsuit charges that these actions against the CFPB violate the separation of powers principles embedded in the U.S. Constitution that assign specific powers to the legislative branch (Congress) and specific powers to the Executive Branch (the President).

The CFPB was created under the Dodd-Frank financial reform legislation of 2010, duly passed by both houses of Congress, and signed into law by President Obama. The legislation sought to address the megabanks on Wall Street collapsing the housing market and U.S. economy in 2008 through egregious acts of corruption and tricked up accounting.

On February 14, the federal judge assigned to the CFPB case, Judge Amy Berman Jackson, issued the following order that included this directive, among others:

“…it is hereby ORDERED that until the resolution of plaintiffs’ motion for temporary restraining order [Dkt. # 10], which, with the parties’ consent, will be deemed to be a motion for preliminary injunction, the following orders shall remain in place:

“It is ORDERED that Defendants, including their officers, agents, servants, employees, and attorneys, (hereafter collectively, ‘Defendants’) shall not delete, destroy, remove, or impair any data or other CFPB records covered by the Federal Records Act (hereinafter ‘agency data’) except in accordance with the procedures described in 33 U.S.C. § 44. This means that defendants shall not delete or remove agency data from any database or information system controlled by, or stored on behalf of, the Consumer Financial Protection Bureau (CFPB), and the term ‘agency data’ includes any data or CFPB records stored on the CFPB’s premises, on physical media, on a cloud server, or otherwise.”

Notwithstanding that order, the video playlist on the CFPB YouTube channel has not been restored as of this morning.

Musk’s involvement in the ransacking and attempted shutdown of the CFPB may stem from mixed motives.

The CFPB was in the process of suing some of Musk’s major stock underwriters, including JPMorgan Chase, Bank of America, and Wells Fargo, for “failing to protect consumers from widespread fraud” on the payment network, Zelle.

On February 12, Jamie Dimon, the Chairman and CEO of JPMorgan Chase, held a profanity-laced Town Hall with his workers, where he called the Trump-fired Director of the CFPB, Rohit Chopra, a “son-of-a-bitch.”

Wall Street has had its guns out for the CFPB since its inception because it maintains a complaint database, with detailed complaint narratives direct from consumers, which can be searched via a keyword by other regulators and journalists to spot patterns of fraud by a specific financial institution.

This morning, that database shows that complaints with narratives against Goldman Sachs have not occurred since December 23, 2024. The graphic below appears above that stale data.

This past week, Senator Elizabeth Warren, the Ranking Member of the Senate Banking Committee and the other Democrats on that Committee, released a new analysis showing that since the Trump-Musk attack on the CFPB, the agency is processing 80 percent fewer complaints. Democrats on the Senate Banking Committee also provided a list of 38 CFPB enforcement cases against big corporations that have now seen their investigations frozen. One of the investigations that is now in limbo is the Zelle case against Wall Street megabanks JPMorgan Chase, Bank of America, and Wells Fargo – all of which have been a Tesla underwriter at one time or another.

According to Senator Elizabeth Warren, Elon Musk may have another direct reason to want to kill the CFPB. At a forum she convened this past week on the attacks on the CFPB, she revealed that Musk plans to create a payment system called “X Money” on the former Twitter social media platform he now owns. That would put that product directly in the cross-hairs of the CFPB.

Senator Warren said this at the forum:

“Elon Musk wants to offer a new ‘X Money’ feature on his social media platform. But some other apps are already out there—and Musk would have to compete against them. By seizing control of the agency, Musk can now root through all the CFPB’s confidential data that DOGE has accessed on these potential competitors.

“As Musk launches his new app, he faces oversight from the CFPB. His plan seems to be to eliminate the watchdog, which would leave him free to scam and steal however he wants.

“And that is why I invited Musk to this hearing today. Congress and the public deserve answers about why he is trying to kill the CFPB—and answers about what he would gain personally if he is able to shut the agency down.

“No surprise: Musk is a no-show. He’s too afraid to show up in person and defend his actions. He hides behind a gusher of silly tweets. But Elon, in case you’re watching from your bunker, or your Oval Office, it’s not too late. We’re going to be here for another hour and a half. We saved a seat for you and we all have plenty of questions.”

Musk never appeared at the forum.