By Pam Martens and Russ Martens: September 23, 2024 ~

President Bill Clinton Laughs It Up as He Signs the Repeal of the Glass-Steagall Act, November 12, 1999

Taxpayer-backstopped federal deposit insurance at commercial banks in the U.S. was never meant to be a get-rich scheme for the wild and voracious appetites of traders on Wall Street. But a quarterly report produced by the federal regulator of national banks – those operating across state lines – shows that vast amounts of trading on Wall Street is now taking place inside the federally-insured commercial banks that are owned by the trading powerhouses on Wall Street: JPMorgan Chase, Goldman Sachs, Citigroup and Bank of America. (Wall Street trading houses have been allowed to own federally-insured banks since the repeal of the Glass-Steagall Act in 1999 under the Wall Street friendly Bill Clinton administration.)

For decades, the Office of the Comptroller of the Currency (OCC) has published its “Quarterly Report on Bank Trading and Derivatives Activities.” The reports have shown that the Wall Street megabanks are increasingly moving their trading casinos to operate out of the federally-insured bank they own – which is holding mom and pop deposits for unsuspecting American families.

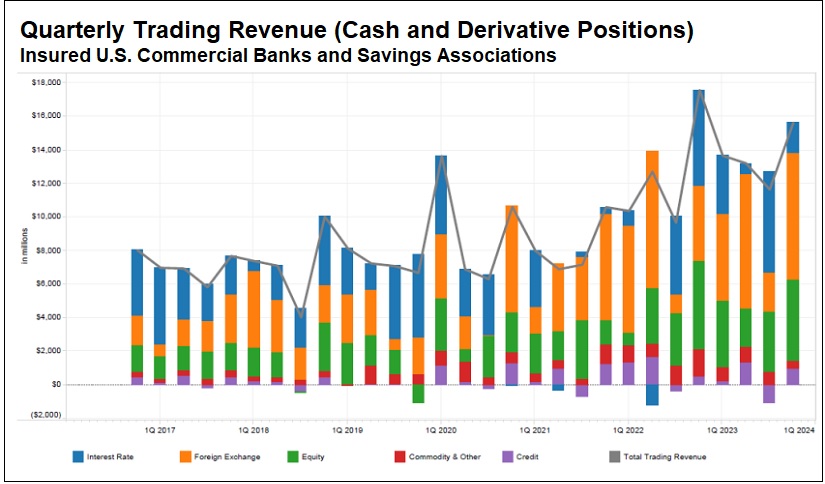

According to the most recent report from the OCC, for the quarter ending March 31, 2024, federally-insured banks in the U.S. reported $4.8 billion in revenues from trading stock (equity). That $4.8 billion represented 37 percent of all stock trading at the bank holding company level, which came in at $13.059 billion for the quarter.

Even more eyepopping, federally-insured banks reported revenues of $7.551 billion from foreign exchange trading, which represented 87 percent of all foreign exchange trading at the bank holding company level, which registered a total of $8.638 billion for the first quarter.

Why should a federally-insured bank be engaged in trading activities? How is it even legally allowed to do that? According to the Wall Street self-regulator, FINRA, only broker-dealers are allowed to have licensed traders and only licensed supervisors are allowed to oversee this trading. (For background, see our report: Jamie Dimon’s Top Women and Their Missing Licenses.)

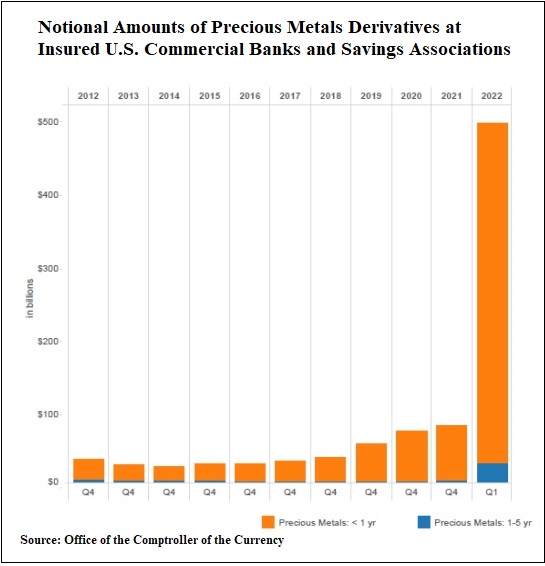

Or how about the bizarre jump in trading in precious metals inside federally-insured banks, as we reported in 2022:

“In just one quarter, precious metals derivatives had soared from $79.28 billion to $491.87 billion. That’s a 520 percent increase in a span of three months….” (See JPMorgan Chase and Citibank Hold 90 Percent of All Gold and Other Precious Metals Derivatives Held by All U.S. Banks.)

And that trend in precious metals has continued. According to the most recent OCC report, in the first quarter of 2024, federally-insured banks held $438.60 billion in precious metals contracts. That figure is at least 12 times greater than the amount the same banks held in precious metal contracts in any quarter from 2007 through 2018.

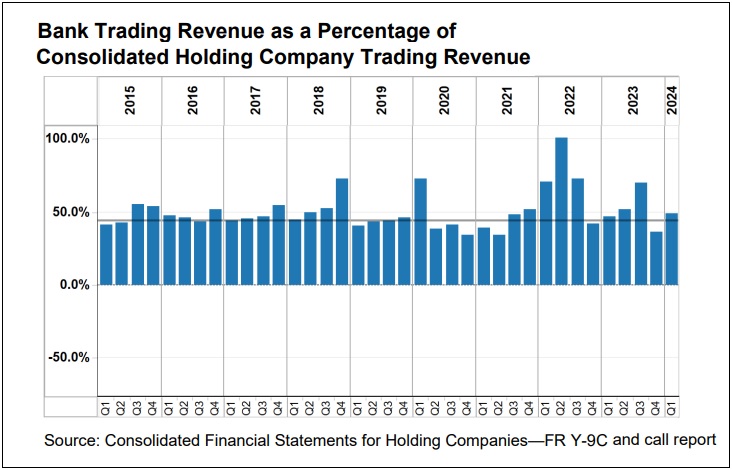

The OCC report for the first quarter of this year shows that federally-insured banks generated 48.9 percent of trading revenues at the bank holding company level. Federally-insured banks have generated half or more of all trading revenues at the holding company level in 9 of the past 11 quarters, through the first quarter of this year. (See top chart above from the current OCC report, page 3.)

Do the millions of Americans that are depositing their paychecks at the 5,143 branches of Chase Bank that are spread coast to coast have any idea that the OCC reported that this federally-insured banking unit of JPMorgan Chase was sitting on $54 trillion in notional derivative contracts as of March 31, 2024? Do you think these customers know that this same bank used deposits from its federally-insured bank to gamble in derivatives in London 12 years ago and lose $6.2 billion of depositors’ money; get investigated by the FBI as a result; become the target of a Senate Permanent Subcommittee on Investigations’ scathing 300-page report; – all while keeping the same Chairman and CEO, Jamie Dimon, at the helm of the bank for the past 17 years. Do you think the customers of this trading juggernaut are aware that it has admitted to five felony charges brought by the U.S. Department of Justice since 2014, which include money laundering, rigging markets, and being part of a trading cartel?

Of course these bank customers don’t know. Ask yourself when was the last time you turned on your evening TV news and heard one word about trading corruption on Wall Street?