By Pam Martens and Russ Martens: July 17, 2024 ~

Jamie Dimon Sits in Front of Trading Monitor in his Office (Source: 60 Minutes Interview, November 10, 2019)

We can’t remember a time when the Chairman and CEO of the largest, most complex and scandal-ridden bank in the United States, Jamie Dimon of JPMorgan Chase, was too busy to squeeze in an appearance at the company’s heavily-scrutinized quarterly earnings call with analysts. That happened last Friday.

When something happens for the first time at a bank that has racked up five felony counts, has been doled out non-prosecution and deferred-prosecution agreements by the U.S. Department of Justice in a steady drumbeat since 2014, and spent most of last year in the headlines for a decade of sluicing tens of thousands of dollars per month in hard cash to the international sex trafficker of children, Jeffrey Epstein, it pays to sit up and pay attention.

Reuters’ reporter John Foley also found it “unusual” that Dimon had missed the earnings call last Friday, writing that “neither throat cancer nor an aortic dissection” had stopped Dimon from being present at earnings calls in the past.

The official excuse for the absence was that Dimon was travelling. Forgive us for the suspicion that Dimon might have wanted to avoid uncomfortable questions about the quality of the bank’s earnings this past quarter and what the bank had done with those earnings.

The only bank official on the call with analysts was JPMorgan Chase’s CFO Jeremy Barnum, who got the sticky issue out of the way right up front. That issue was that $7.9 billion of net income came from a net gain on the sale of Visa stock, which the bank had held as an investment. Without that gain, profits would have been down compared to the same quarter a year ago.

Barnum also fessed up to the fact that the bank had used $4.9 billion of its net income to buy back JPMorgan Chase’s own stock – something that Dimon has turned into an art form at the bank. From January 1, 2014 through June 30, 2024, Dimon has plowed the astronomical sum of $124.5 billion into buying back the bank’s own stock.

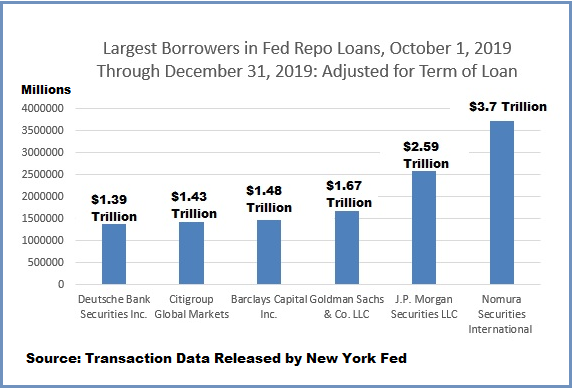

There are three critical facts you need to understand about using bank profits to buy back the company’s own stock. First, when earnings are retained as opposed to being used for buybacks, they increase the capital of the bank, making megabanks far less susceptible to needing bailouts. Dimon has been bullying his federal bank regulators this year and holding high-powered meetings in Washington in an effort to get his regulators to back off their demands for JPMorgan Chase (and other megabanks) to increase their capital. While Dimon likes to brag about his bank’s “fortress balance sheet,” bank regulators know all too well that something blew up in the fourth quarter of 2019, necessitating JPMorgan Chase needing $2.59 trillion in emergency repo loans from the Fed on a term-adjusted basis, in just that one quarter. (See chart below.)

The second thing you need to understand is that stock buybacks are prudently done when the stock is considered undervalued, and thus represents a good investment. JPMorgan Chase’s stock has been trading at its highest level in history in the past quarter.

And, finally, federally-insured/taxpayer backstopped banks like JPMorgan Chase are supposed to be making loans to sound businesses and consumers in order to grow the U.S. economy and create good jobs – not blowing their profits on propping up their share price to make the CEO look good to his Board of Directors so he can get fat bonuses.

In July of 2017, Thomas Hoenig, then Vice Chair of the Federal Deposit Insurance Corporation (FDIC), sent a letter to the U.S. Senate Banking Committee. He made the following points:

“[If] the 10 largest U.S. Bank Holding Companies [BHCs] were to retain a greater share of their earnings earmarked for dividends and share buybacks in 2017 they would be able to increase loans by more than $1 trillion, which is greater than 5 percent of annual U.S. GDP.

“Four of the 10 BHCs will distribute more than 100 percent of their current year’s earnings, which alone could support approximately $537 billion in new loans to Main Street.

“If share buybacks of $83 billion, representing 72 percent of total payouts for these 10 BHCs in 2017, were instead retained, they could, under current capital rules, increase small business loans by three quarters of a trillion dollars or mortgage loans by almost one and a half trillion dollars.”

Another troubling aspect of Dimon missing his earnings call last Friday is that he did something else quite noteworthy this year for the first time. He sold a very large chunk of his stock in the bank. In February, Dimon sold $150 million of JPMorgan Chase stock and another $32.8 million in April, bringing his total sales this year to $182.8 million.