By Pam Martens and Russ Martens: July 30, 2024 ~

Then President Donald Trump Tells Fox News that Americans Would End Up Poor Without His Brain in the White House (2018 Screen Shot)

Last Saturday, Republican presidential candidate Donald Trump delivered a speech at the 2024 Bitcoin Conference in Nashville, Tennessee. Throughout the speech, Trump pushed the idea that the United States “cannot let China dominate” in the race to innovate with cryptocurrencies like Bitcoin.

At 46 minutes and 10 seconds (46:10) on this CSPAN video of the Trump speech, you can hear Trump say this to the audience:

“America will become the world’s undisputed bitcoin mining powerhouse. You’ll be a bitcoin mining powerhouse. You will not have to move your family to China. We will not be moving to China. As we implement these reforms, Bitcoin and crypto will grow our economy, cement American financial dominance and strengthen our entire country, long into the future….”

Trump, as well as his speechwriter, are apparently unaware that in September of 2021, ten Chinese agencies, including the PBOC, the central bank of China, banned crypto mining and crypto transactions in that country, following a May 2021 ban on financial institutions engaging in crypto transactions.

Trump being unaware that China figured out ahead of the U.S. that crypto posed a national security and financial stability threat to the country added to the speciousness of his remarks. At one point, Trump compared the crypto venture capitalists at the conference to “modern-day Edisons and Wright brothers and Carnegies and Henry Fords,” ignoring the mounting evidence from thousands of scientists that both crypto and blockchain are a sham in terms of a useful technology and pose a grave threat to heating the planet from their mining operations.

In January 2022, Senator Elizabeth Warren and other Democrats in Congress investigated the inherent dangers between crypto, energy usage and the heating of the planet. A press statement summarized their concerns as follows:

“Bitcoin is the largest cryptocurrency by market cap, and the United States’ share of Bitcoin mining increased from 4% in August 2019 to 35% in July 2021. This share of mining is growing even more rapidly after China’s crackdown on crypto-mining, which left 500,000 mining operations looking for new locations. This could push North America to represent over 40% of the total global computing power dedicated to mining Bitcoin. As more cryptomining operations proliferate in the United States, the extraordinary energy use raises alarms about massive carbon emissions and the impacts of this energy consumption on consumer energy prices. A recent study estimated that cryptomining in upstate New York raised annual electric bills by about $165 million for small businesses and $79 million for consumers.”

According to a report published by the United Nations University and Earth’s Future journal, “during the 2020–2021 period, the global Bitcoin mining network consumed 173.42 Terawatt hours of electricity. This means that if Bitcoin were a country, its energy consumption would have ranked 27th in the world, ahead of a country like Pakistan, with a population of over 230 million people. The resulting carbon footprint was equivalent to that of burning 84 billion pounds of coal or operating 190 natural gas-fired power plants. To offset this footprint, 3.9 billion trees should be planted, covering an area almost equal to the area of the Netherlands, Switzerland, or Denmark or 7% of the Amazon rainforest.”

The report also found this:

“The UN scientists report that Bitcoin mining heavily relies on fossil energy sources, with coal accounting for 45% of Bitcoin’s energy supply mix, followed by natural gas (21%). Hydropower, a renewable energy source with significant water and environmental impacts, is the most important renewable source of energy of the Bitcoin mining network, satisfying 16% of its electricity demand. Nuclear energy has a considerable share of 9% in Bitcoin’s energy supply mix, whereas renewables such as solar and wind only provide 2% and 5% of the total electricity used by Bitcoin.”

Bitcoin mining involves massive banks of computers being used to solve complex math problems which have no practical use to society. The incentive to build these crypto “mines” and solve the math problems is simply to get rewarded with the payment of Bitcoins. Any rational person would have to seriously question if the fossil fuels industry is behind this insane business model.

In July 2019, NYU Professor and economist Nouriel Roubini summed up his findings on crypto like this:

“Crypto currencies are not even currencies. They’re a joke…The price of Bitcoin has fallen in a week by how much – 30 percent. It goes up 20 percent one day, collapses the next. It is not a means of payment, nobody, not even this blockchain conference, accepts Bitcoin for paying for conference fees cause you can do only five transactions per second with Bitcoin. With the Visa system you can do 25,000 transactions per second…Crypto’s nonsense. It’s a failure. Nobody’s using it for any transactions. It’s trading one sh*tcoin for another sh*tcoin. That’s the entire trading or currency in the space where’s there’s price manipulation, spoofing, wash trading, pump and dumping, frontrunning. It’s just a big criminal scam and nothing else.”

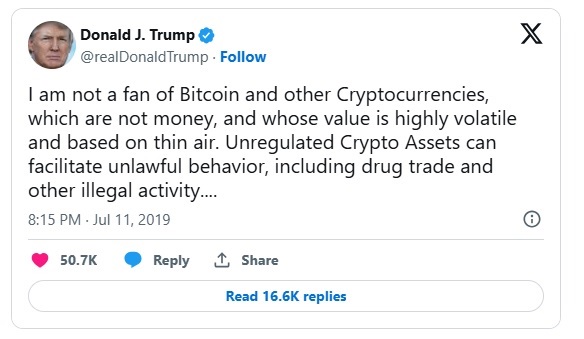

Trump wasn’t always a fan of crypto or Bitcoin. In 2019, he posted the Tweet below, calling crypto “based on thin air.”

That previous assessment was in line with 1600 scientists and technology experts who sent a letter on June 1, 2022 to the leadership of key U.S. Senate and House Committees. In the letter, they wrote this:

“We strongly disagree with the narrative—peddled by those with a financial stake in the crypto-asset industry—that these technologies represent a positive financial innovation and are in any way suited to solving the financial problems facing ordinary Americans…

“As software engineers and technologists with deep expertise in our fields, we dispute the claims made in recent years about the novelty and potential of blockchain technology. Blockchain technology cannot, and will not, have transaction reversal or data privacy mechanisms because they are antithetical to its base design. Financial technologies that serve the public must always have mechanisms for fraud mitigation and allow a human-in-the-loop to reverse transactions; blockchain permits neither.”

The letter links to an article from Bruce Schneier, a Security Technologist who teaches at the Harvard Kennedy School. The article appeared at Wired on February 6, 2019 under the headline: “There’s No Good Reason to Trust Blockchain Technology.” The article makes the following salient points:

“What blockchain does is shift some of the trust in people and institutions to trust in technology. You need to trust the cryptography, the protocols, the software, the computers and the network. And you need to trust them absolutely, because they’re often single points of failure.

“When that trust turns out to be misplaced, there is no recourse. If your bitcoin exchange gets hacked, you lose all of your money. If your bitcoin wallet gets hacked, you lose all of your money. If you forget your login credentials, you lose all of your money. If there’s a bug in the code of your smart contract, you lose all of your money. If someone successfully hacks the blockchain security, you lose all of your money. In many ways, trusting technology is harder than trusting people. Would you rather trust a human legal system or the details of some computer code you don’t have the expertise to audit?”

Sam Bankman-Fried subsequently built on the above analysis by proving that trusting either the people involved in crypto or its technology can be extremely hazardous to your wealth.