By Pam Martens and Russ Martens: November 13, 2023 ~

Tomorrow, the Senate Banking Committee will hold a hearing to question federal banking regulators on what they are doing to restore public trust and financial stability to the U.S. banking system after the second, third and fourth largest bank failures in U.S. history occurred this Spring and caught regulators napping. One of the regulators scheduled to testify is Michael Hsu, the Acting Comptroller of the Office of the Comptroller of the Currency (OCC).

Hsu undermined public trust in the U.S. banking system in May when he allowed JPMorgan Chase, the largest and riskiest bank in the United States, to become even larger and riskier through its purchase of the failed bank, First Republic Bank.

At a July 12 Senate hearing, Senator Elizabeth Warren had this to say about Hsu’s conduct:

“When First Republic Bank collapsed in April, the bank was ultimately sold to the biggest bank in America, JP Morgan Chase. That sweetheart deal cost the Federal Deposit Insurance Fund $13 billion. Meanwhile, overnight, the country’s biggest bank got $200 billion bigger. And what happened to the regulators? The Acting Comptroller of the Currency, Michael Hsu, rubber stamped the deal in record time. When I asked Mr. Hsu at a hearing in May to explain how this merger was approved, he was unable to provide a clear answer.

“But the overall picture gets worse. Instead of inattentive regulators who don’t use their tools to block increasing consolidation, leaders within the Biden Administration seem to be inviting more mergers. In a May 2023 statement before the House Financial Services Committee, Acting Comptroller Hsu reassured banks that the agency would be ‘open-minded’ while considering merger proposals….”

Senator Warren said this attitude was “courting disaster.”

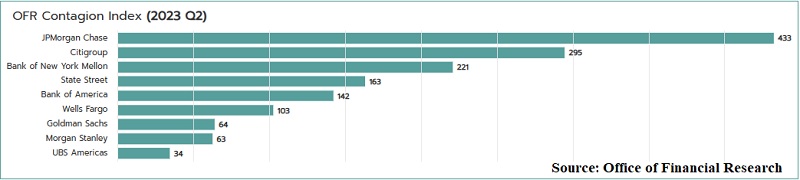

The federal agency that is charged with providing an early warning system for serious cracks in financial stability, the Office of Financial Research, has the chart below currently residing on its website. It shows how banks rank in OFR’s Contagion Index.

OFR’s Contagion Index measures the degree to which a default by a specific bank could create systemic contagion in the U.S. banking system as a result of its interconnectedness and leverage. As of June 30, 2023, JPMorgan Chase represented three times the amount of potential contagion as the second largest bank in the U.S., Bank of America.

Hsu’s idea to deal with the collapse in public trust in the U.S. banking system is to – wait for it – conduct a survey measuring public trust in banks. Is it possible that Hsu doesn’t know that the esteemed Gallup organization has been doing just that for more than 40 years?

The most recent Gallup annual survey that measures the confidence that Americans have in key U.S. institutions was conducted between June 1-22 and released on July 6. Banks continued their downward trend, registering just 26 percent of Americans who have “a great deal” or “fair amount” of confidence in banks. That confidence ranking stood at 27 percent last year and at 33 percent in 2021.

Measured against a longer time horizon, today’s public confidence in U.S. banks looks dramatically more dire. In 1979, the Gallup poll showed 60 percent of Americans had confidence in the banks. In the years prior to the Wall Street financial crisis of 2008, which gutted the U.S. economy and also caught regulators napping, roughly half of Americans had confidence in the banks.

Another reason that trust in U.S. banks is setting four-decade lows is that the mega banks on Wall Street continue to function as serial fraudsters with no corrective pushback from their regulators – who frequently make a beeline to get a fat paycheck at the banks after leaving the U.S. government.

In an October 10 letter to the OCC, the nonprofit financial watchdog, Better Markets, wrote as follows:

“Beyond specific periods of panic, trust in the banking system is consistently being undermined by the steady stream of illegal, predatory, dishonest, and deceitful behavior that blatantly harms the American people, particularly the most vulnerable members of our communities. The frequency and severity of cases against the largest banks in the country for engaging in such conduct against their customers is a trust-killer.”

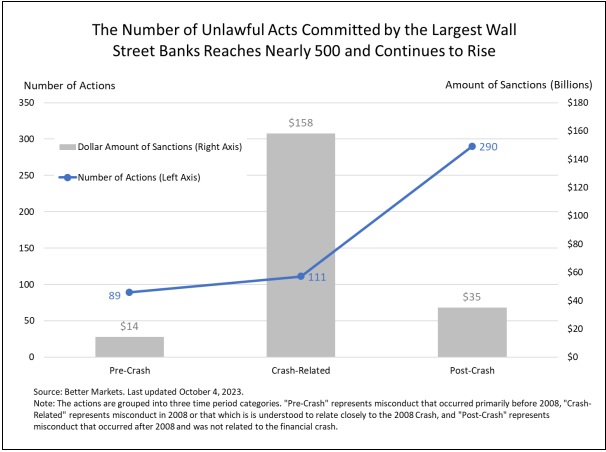

Better Markets included the graph below, showing the number of illegal acts of the six largest banks over the last two decades, along with the $207 billion in fines they have paid.

It summarized the graph’s findings as follows:

“These almost 500 matters and more than $200 billion in fines and settlements are widely reported and visible to the American public. The public not only sees that the banks break the law repeatedly, but that they are never meaningfully or effectively punished. The public also sees puny fines imposed on banks while the bankers just keep pocketing billions of dollars in bonuses while continuing to break the law. Moreover, it’s not just that those banks were all bailed out in 2008 and that not one Wall Street banker went to jail for crashing the global financial system, but it’s equally visible to the public that the banking regulators failed to do their jobs.”

And it’s not just the federal banking regulators that are failing to do their job. The criminal division of the U.S. Department of Justice has been compromised for the past 15 years when it comes to prosecuting Wall Street mega banks and their executives.

In 2013, the PBS program, Frontline, took a hard look at why the criminal division of the Justice Department had not brought one single indictment against any of the executives at the big Wall Street firms that had engaged in peddling fraudulent mortgages in the leadup to the 2008 financial crash. Frontline Producer Martin Smith had this exchange with the then head of the DOJ’s criminal division, Lanny Breuer:

MARTIN SMITH: We spoke to a couple of sources from within the Criminal Division, and they reported that when it came to Wall Street, there were no investigations going on. There were no subpoenas, no document reviews, no wiretaps.

LANNY BREUER: Well, I don’t know who you spoke with because we have looked hard at the very types of matters that you’re talking about.

MARTIN SMITH: These sources said that at the weekly indictment approval meetings that there was no case ever mentioned that was even close to indicting Wall Street for financial crimes.

On March 11, 2016, the National Archives released a large volume of documents related to the work of the Financial Crisis Inquiry Commission (FCIC) and its investigation of the causes of the 2008 financial crash on Wall Street. After reviewing those documents, Senator Elizabeth Warren sent a September 15, 2016 letter to the Inspector General of the Justice Department and to then FBI Director James Comey seeking to find out why the Justice Department had not prosecuted any of the individuals or banks that were referred to it by the FCIC for potential criminal prosecution.

Senator Warren indicated in her letter to James Comey that her staff had “identified 11 separate FCIC referrals of individuals or corporations to DOJ in cases where the FCIC found ‘serious indications of violation[s]’ of federal securities or other laws consistent with this statutory mandate. Nine specific individuals were implicated in these referrals — yet not one of these nine has gone to prison or been prosecuted for a criminal offense.”

After a year of silence on Warren’s letter, Wall Street On Parade filed its own Freedom of Information Act (FOIA) request to the Justice Department in the matter. To be certain that the Justice Department would not decline our FOIA on the basis that we were seeking too broad a search, we narrowed our inquiry to the three former Citigroup executives whom the FCIC had referred to the Justice Department for potential prosecution: former Chairman of the Executive Committee of Citigroup, Robert Rubin – who served as the former U.S. Treasury Secretary under President Bill Clinton; former Citigroup CEO Charles (Chuck) Prince; and former Citigroup CFO Gary Crittenden. The Justice Department responded as follows:

“This is in response to your request for records on Charles Prince, Gary Crittenden, and Robert Rubin. Please be advised that I have decided to neither confirm nor deny the existence of such records pursuant to Exemptions 6 and 7(C) of the FOIA. 5 U.S.C. 552(b)(6), (7)(C). Even to acknowledge the existence of law enforcement records on another individual could reasonably be expected to constitute an unwarranted invasion of personal privacy. This is our standard response to such requests and should not be taken to mean that records do, or do not, exist. Accordingly, I cannot confirm nor deny the existence of records responsive to your request.”

Read the full Justice Department response to Wall Street On Parade’s FOIA request here.

Until corporate and Wall Street billionaire funding of political campaigns is outlawed by Congressional legislation; until Wall Street’s revolving door is slammed shut; until the U.S. President stops nominating (and the Senate stops confirming) partners at Wall Street’s law firms to run the U.S. Department of Justice, this is the corrupt, predatory banking system that every American will be forced to attempt to navigate.

Related Article: