By Pam Martens and Russ Martens: September 21, 2023 ~

On July 27, the Federal Reserve, FDIC and Office of the Comptroller of the Currency released a proposal to require higher capital levels at banks with $100 billion or more in assets – those that demonstrated quite clearly this past spring that they could spread systemic contagion throughout the U.S. banking system. Community banks will not be impacted at all by the new proposals according to the regulators.

On July 27, the Federal Reserve, FDIC and Office of the Comptroller of the Currency released a proposal to require higher capital levels at banks with $100 billion or more in assets – those that demonstrated quite clearly this past spring that they could spread systemic contagion throughout the U.S. banking system. Community banks will not be impacted at all by the new proposals according to the regulators.

The three federal bank regulators provided a very generous public comment period of 120 days on the proposal. (Submit your own comment here.) The large banks had to only begin transitioning to the new rules on July 1, 2025, with full compliance not due for an absurd five years – on July 1, 2028.

On September 12, the banking cartel made their anger known in a 7-page letter that assaulted the proposal from every conceivable angle and demanded that the three federal agencies turn over all “evidence and analyses the agencies relied on” in making the proposal.

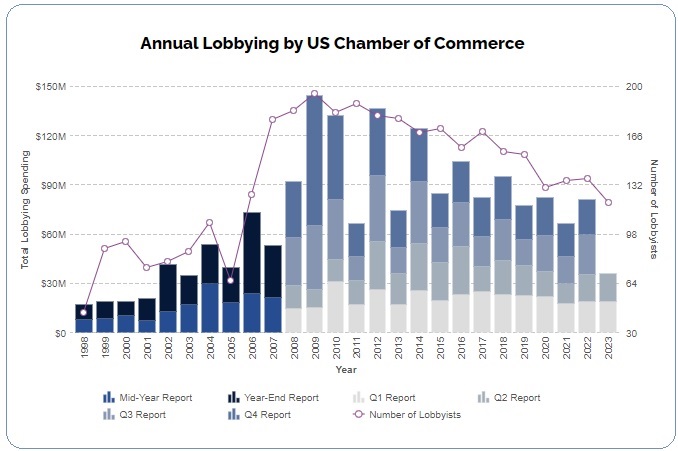

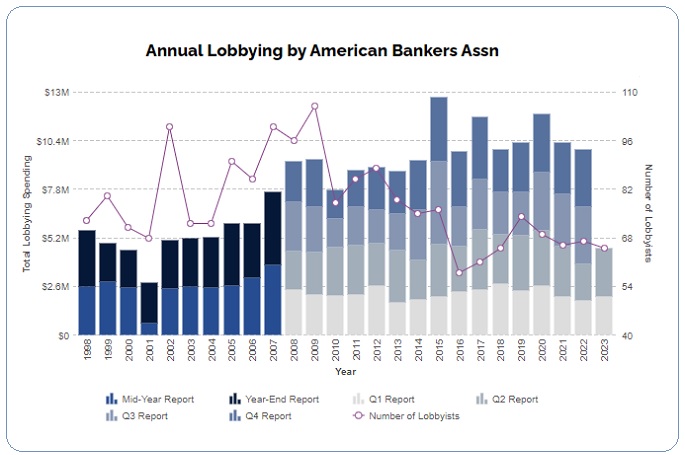

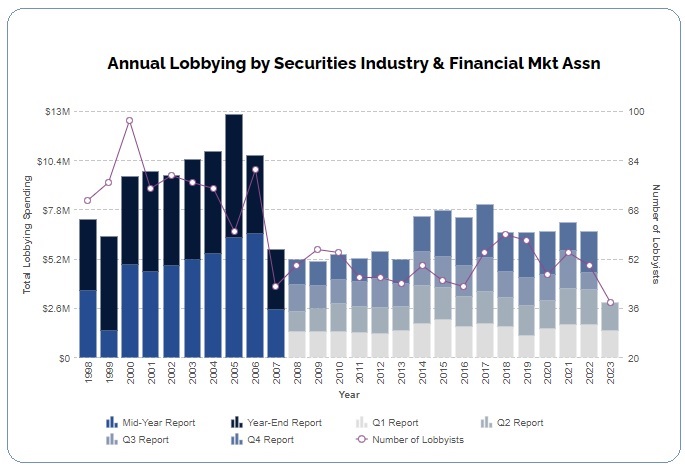

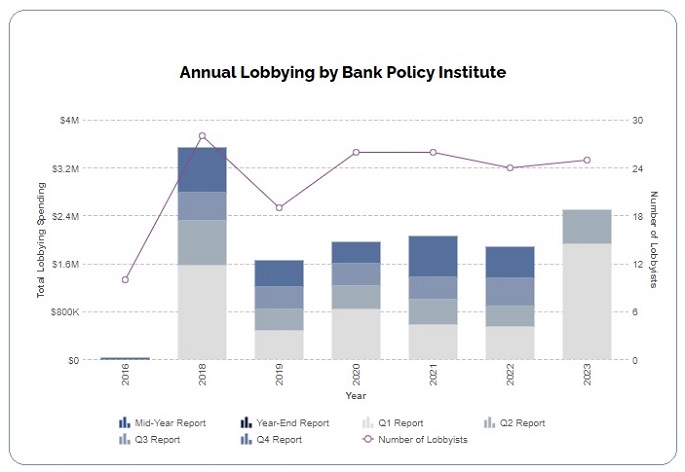

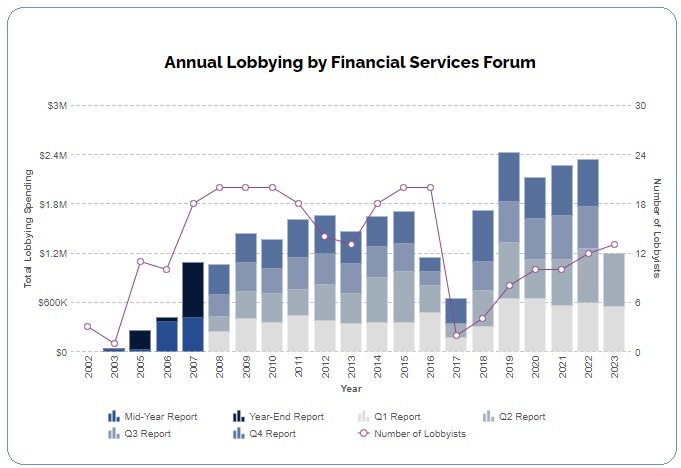

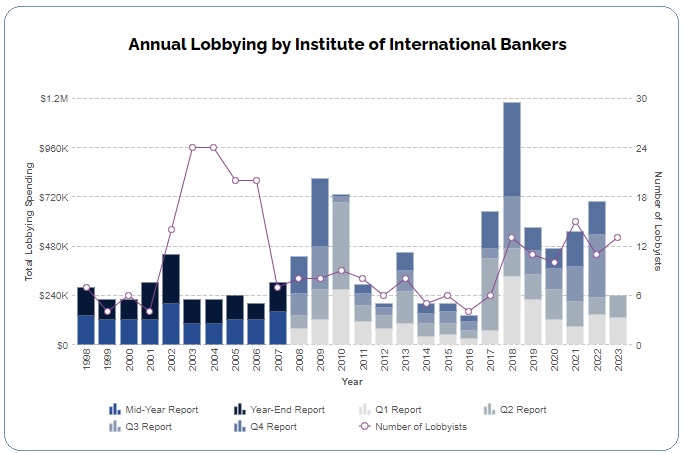

The logos at the top of this article capture the banking cartel that sent the letter. The graphs below from the nonprofit watchdog, OpenSecrets.org, capture the millions of dollars and more than 200 lobbyists that the cartel has available to stop banking reform in its tracks.

The Bank Policy Institute (BPI), whose Board of Directors consists of the CEOs of the biggest banks and is Chaired by Jamie Dimon, CEO of five-count felon JPMorgan Chase, has even launched an ad campaign that grossly distorts the narrative to harming working families. Hopefully, those working families will remember when the reckless and irresponsible banks blew up the U.S. economy in 2008, put millions of Americans out of work, left millions of working families in foreclosure and got a secret $29 trillion bailout behind-the-scenes from the Federal Reserve.

Unfortunately, the graphs below only capture a small part of the corrupt system that poses a daily threat to the safety and soundness of the U.S. banking system. Each of the mega banks on Wall Street also hire their own lobbyists and spend millions lobbying Congress to get their way on any proposed regulations that threaten the status quo.

Last year, JPMorgan Chase spent $2.9 million lobbying Congress and employed 49 lobbyists to do its work. In addition to hiring lobbyists working for outside lobbying firms, 11 lobbyists worked directly for JPMorgan Chase. Of those 11 lobbyists, 8 had revolving door histories.

For example, JPMorgan Chase lobbyist Tim Berry was the former Chief of Staff to two Republican Majority Leaders in the House of Representatives. He worked for Kevin McCarthy from 2011 to 2017 and for Tom Delay from 1995 to 2005.

Jack Bartling, another lobbyist working directly for JPMorgan Chase as Executive Director for International Government Relations, was previously Senior Counsel to the House Financial Services Committee and Deputy Assistant Secretary for International Affairs at the U.S. Department of the Treasury. From 1999 to 2005, Bartling was Legislative Counsel to former Republican Senator Christopher (Kit) Bond of Missouri.

To get an even broader picture of the banking cartel that is undermining the safety and soundness of the U.S. banking system, see our earlier report: Yes, America, a Banking Cartel Exists and Here’s the Proof.