By Pam Martens and Russ Martens: August 23, 2023 ~

The speed at which the largest U.S. banks are shedding deposits is unlike anything seen in the last half century – at least. But then again, the speed at which those same banks gained deposits from the various stimulus programs during the COVID-19 pandemic was also unprecedented.

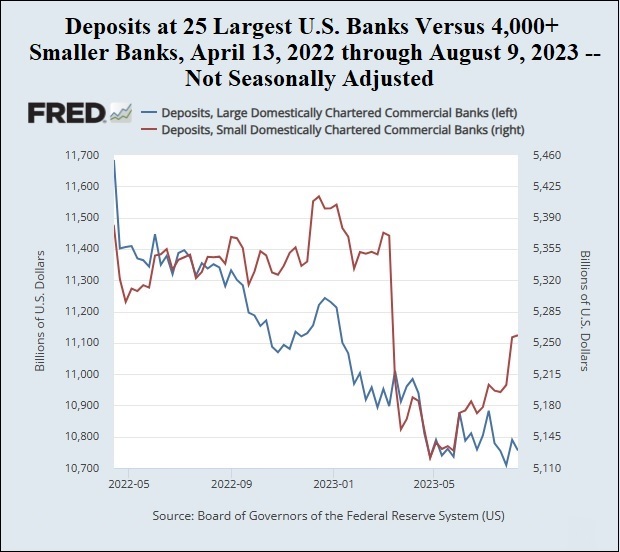

According to Federal Reserve data, for the week ending April 13, 2022, deposits at the 25 largest domestically-chartered commercial banks in the U.S. stood at $11.68 trillion (a new record) before doing a bungee dive in the following week to $11.4 trillion – likely triggered by the horrific scenes on network television of Russia’s invasion of Ukraine along with the severe economic sanctions against Russia announced on April 6, 2022 by the U.S. and other nations. This likely triggered a rush by Russian oligarchs to get their billions of dollars out of U.S. banks.

As the chart above indicates, deposits at the smaller banks also took a steep decline in the spring of 2022 but then stabilized and actually grew until the banking crisis in March of this year. Deposits at the biggest banks, however, continued their decline, consistently setting lower lows – a pattern that continues.

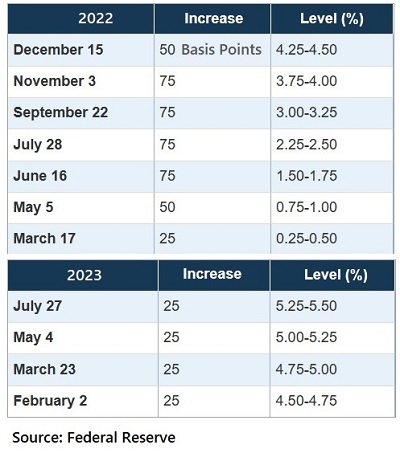

A large part of this deposit story is the chart below. The Fed’s unrelenting increases in interest rates to tame inflation have given depositors multiple alternatives to accepting the minuscule interest rates offered by the largest banks. Smaller banks, federal credit unions, and U.S. Treasury securities are now competing for those deposits with interest rates over 5 percent on some instruments.

On April 21 of this year, Moody’s took the unusual step of downgrading the entire U.S. banking system from “Very Strong –” to “Strong +.” It implicated the Fed’s rate hikes in its decision, writing as follows:

“Moody’s has lowered the macro profile of the US banking system to ‘Strong +’ from ‘Very Strong –.’ The change in funding conditions reflects rising asset liability management challenges at US banks. Specifically, the banking system faces rising funding and profitability pressures related to the significant and rapid tightening in monetary policy, which has led to a reduction in US banking system deposits and higher funding costs. Higher interest rates have also reduced the value of US banks’ fixed rate securities and loans which increases their liquidity and capital risks.”

The April 21 move by Moody’s followed its announcement on March 13 that it was changing the outlook on the U.S. banking system from stable to negative. It wrote at that time:

“We have changed to negative from stable our outlook on the US banking system to reflect the rapid deterioration in the operating environment following deposit runs at Silicon Valley Bank (SVB), Silvergate Bank, and Signature Bank (SNY) and the failures of SVB and SNY.”

Silvergate Bank was placed into voluntary liquidation – a story that has a lot of unanswered questions. See our report: Disgraced Silvergate Bank Hints It May Not Be Able to Cover All of Its Deposits; Fed Slaps It with a Cease and Desist Consent Order.