By Pam Martens and Russ Martens: June 22, 2023 ~

According to unsealed documents released this week by the U.S. Virgin Islands in its federal lawsuit against JPMorgan Chase over claims it facilitated Jeffrey Epstein’s sex trafficking of underage girls for more than a decade, the largest bank in the United States has a lot of explaining to do to the American people – and potentially to the criminal division of the U.S. Justice Department.

After Jeffrey Epstein was arrested by the U.S. Department of Justice on July 6, 2019 on federal sex trafficking charges, JPMorgan Chase – which had been Epstein’s banker from 1998 to 2013 – apparently decided to get a quick look at how much legal liability and reputational damage it might have if its labyrinthine client relationship and intimate and undisclosed business relationship with Epstein came to light.

The “top of the house” at JPMorgan Chase ordered an internal investigation in 2019 which was code named “Project Jeep.” The JE stood for Jeffrey; the EP for Epstein. Jamie Dimon, the Chairman and CEO of JPMorgan Chase, denied knowledge of Project Jeep in his deposition in the lawsuit in late May. An attorney for the Virgin Islands writes in a letter that there is documentation suggesting that Dimon is part of “top of the house.”

Project Jeep included almost two dozen pages of internal emails between Epstein and a host of JPMorgan executives, its private client bankers and licensed brokers, stretching from 2008 when Epstein began serving his first jail term for soliciting a minor for sex, to 2013 when JPMorgan says it severed its client relationship with Epstein. According to news reports, JPMorgan’s business relationships with Epstein continued long past 2013.

The emails are stomach-churning and humiliating for the U.S. banking system. They show a sex trafficker actually directing business strategies for JPMorgan’s investment bank and referring clients from around the world to JPMorgan Chase, including Microsoft co-founder Bill Gates, Peter Mandelson, Andrew Farkas, Boris Nikolic, science advisor to the Gates Foundation, Leon Black, former Chairman of Apollo Global Management, and many others.

According to a letter filed with the court by Linda Singer, an attorney for the Virgin Islands, as of June 7 JPMorgan Chase had failed to produce internal documents referenced in Project Jeep that showed the full scope of Epstein’s client referrals to the bank and related business transactions – ostensibly that generated large fees for the bank.

One thing is for certain, Epstein was getting paid in multiple ways for sending business deals and clients to JPMorgan. The full extent of those payments should, by law, be made public under reporting requirements of the Securities and Exchange Commission.

What we do know thus far is that Epstein was paid $15 million for his role in arranging the sale of Highbridge Capital Management, a hedge fund, to JPMorgan.

In a related lawsuit filed against the bank by a Jane Doe 1 sexually-trafficked victim of Epstein’s, her attorney alleges the following in a January 13, 2023 amended complaint:

“For example, despite that Epstein was not FINRA-certified, Epstein was paid more than $15 million for his role in the Highbridge/JP Morgan deal.

“Moreover, Highbridge, a wholly-owned subsidiary of JP Morgan, trafficked young women and girls on its own private jet from Florida to Epstein in New York as late as 2012.”

The Jane Doe 1 case was certified as a class action by Judge Jed Rakoff on June 12. JPMorgan Chase has agreed to settle that case for $290 million, according to David Boies, one of the attorneys for Jane Doe 1. The large sum of money strongly suggests that the public has yet to hear the full particulars hiding in the shadows of Project Jeep.

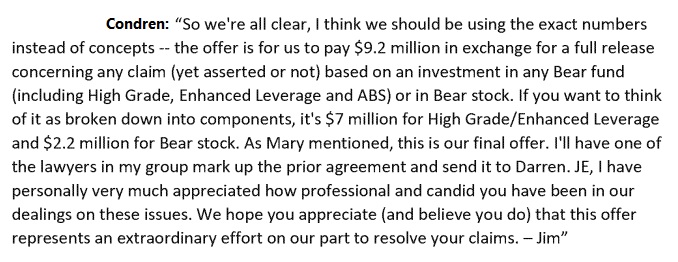

In addition, Project Jeep emails show that the bank agreed to settle Epstein’s claims for his losses in hedge funds run by Bear Stearns, which JPMorgan Chase acquired during the financial crisis in 2008, and losses on Epstein’s holdings in Bear Stearns’ common stock, for a whopping $9.2 million. Bear Stearns’ stock price collapsed when JPMorgan took over the company for a fraction of what its trading price had been on the previous Friday. The July 2011 email from Jim Condren, Associate General Counsel at JPMorgan Chase, to Epstein reads as follows:

There is a question as to whether it is legal for a bank to make good on what amounts to trading losses in a publicly-traded common stock for a client. Licensed brokers are certainly prohibited from doing such a thing unless there was an overt error by the broker in properly executing the stock trade and management handles the reimbursement.

There is also the question as to whether JPMorgan was allowed to provide monetary relief to Epstein on his stock losses without providing the same relief to other shareholders in Bear Stearns. To put it bluntly, this email has opened up a big can of legal worms for JPMorgan and its Board of Directors.

If, indeed, JPMorgan was using its corporate jet to transport Epstein’s sex trafficked victims, that would be a matter for the criminal division of the U.S. Department of Justice.