By Pam Martens and Russ Martens: May 3, 2023 ~

President Joe Biden is putting the national security of the United States at risk by not suspending the short-selling of federally-insured banks. Concerns over the safety and soundness of the U.S. financial system could cause money flight out of the U.S., impacting the strength of the U.S. dollar and a loss of confidence by our foreign allies.

This is also a matter that impacts the financial lives of every American, because every American – rich, poor or middle class – will suffer the consequences in terms of ability to access bank credit and higher fees on that credit as a result of rebuilding the rapidly depleting federal Deposit Insurance Fund that protects bank deposits.

The second, third and fourth largest bank failures in the history of the U.S. have now occurred in the span of seven weeks (First Republic Bank, Silicon Valley Bank and Signature Bank, respectively) with the Federal Deposit Insurance Corporation (FDIC) taking big hits in each case to its Deposit Insurance Fund.

At the time of First Republic Bank’s failure on Monday (with JPMorgan Chase given a very sweet deal by the FDIC to buy its underwater assets and take over the deposits that hadn’t yet fled), it was one of the most heavily shorted bank stocks with one-third of its outstanding shares shorted as of one week before it failed, according to a report from Reuters.

First Republic Bank was not a small bank. At the time of its demise, it had $207.5 billion in assets. According to a statement from the FDIC on Monday, it “estimates that the cost to the Deposit Insurance Fund will be about $13 billion. This is an estimate and the final cost will be determined when the FDIC terminates the receivership.”

The FDIC estimated the cost to the Deposit Insurance Fund in the failure of Silicon Valley Bank to be $20 billion, and the cost to the DIF in the failure of Signature Bank to be $2.5 billion.

All of these FDIC estimates seem very optimistic but even if they are accurate, that’s a combined hit thus far of $35.5 billion to a Deposit Insurance Fund that had just $128.2 billion as of December 31, 2022.

On April 18 – prior to the failure of First Republic Bank – the FDIC released the following statement:

“The Federal Deposit Insurance Act (FDI Act) requires that the FDIC’s Board of Directors adopt a restoration plan when the Fund’s reserves fall below 1.35 percent of all insured deposits held in FDIC-insured financial institutions. Extraordinary deposit growth during the first and second quarters of 2020 caused the Fund’s reserve ratio to decline below this statutory minimum. On September 15, 2020, the FDIC established a plan to restore the Fund’s reserves to at least 1.35 percent by September 30, 2028, while maintaining the assessment rate schedule in place at the time.”

In short, assessments on banks to restore the Deposit Insurance Fund are going to be going up as a result of these bank failures and attendant losses – which mean that banks are going to be passing those increased costs along to their customers. If more banks fail, those costs will rise exponentially, putting aside the more critical issue of loss of confidence in the U.S. banking system.

This is not some abstract theory. The newest target of the short sellers is PacWest Bancorp (ticker PACW). According to S&P Global Market Intelligence, as of March 31, 20.6 percent of PacWest’s shares outstanding were sold short, making it the third largest shorted bank stock at that point. (The bank stock with the largest percentage of shares shorted on March 31 was Silvergate Bank, which became an easy target of short sellers because it had entangled itself with crypto companies, including Sam Bankman-Fried’s house of frauds, FTX and Alameda Research. Silvergate wound itself down voluntarily by the end of the first quarter. The second largest short position in a bank as of March 31 was in First Republic Bank, which failed on Monday.)

PacWest Bancorp is showing similar distress. PacWest’s stock has lost 71 percent year-to-date. On Monday and Tuesday of this week, the stock has gone from a closing price of $10.15 on Friday to $6.55 at the close on Tuesday – a stunning collapse of 35 percent in just two trading sessions.

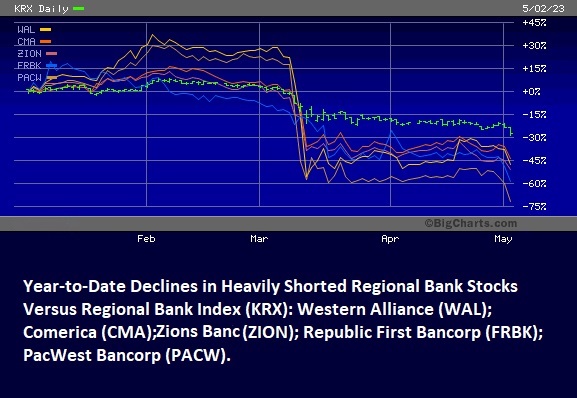

Other banks that are targets of short sellers that have seen outsized year-to-date losses in share price include Western Alliance, Comerica, Zions Bank, Republic First Bancorp (no relation to First Republic Bank other than similarity of its name, which may be why short sellers have piled on). Those stocks are down anywhere from 45 to 60 percent year-to-date versus a decline of 27 percent in the regional bank index (ticker KRX). See chart above.

The longer President Biden waits to sign an executive order suspending short sales in federally-insured banks, the faster the contagion will spread to other banks.

Editor’s Note: We believe that, in general, short sellers perform a critical role in U.S. markets – calling attention to corporate corruption and fraud that has been missed by regulators and the media. But the rapidly deteriorating condition of U.S. banks is a function of the unprecedented span of time that the Fed kept interest rates at the zero interest level, forcing banks to make fixed-rate mortgage loans at 3, 4 and 5 percent interest in order to remain competitive. Those loans and their related mortgage-backed securities are now underwater as a result of the Fed raising rates faster than at any time in the last 40 years. Exceptional times call for exceptional actions. President Biden needs to step up to the plate.