By Pam Martens and Russ Martens: January 4, 2023 ~

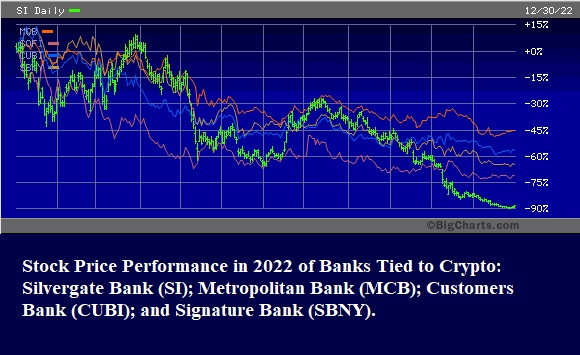

After multiple federally-insured banks involved with crypto have watched their publicly-traded stocks crater in price over the past year (see above chart); after a former Fed insider blew the whistle on what’s been going down as a result of the Fed’s hands off approach to policing crypto banks; after alleged fraudster operation, FTX, quietly bought a large stake in a federally-insured bank in the state of Washington; and after Senators Elizabeth Warren and Tina Smith sent a blistering demand for answers to the Fed, FDIC, and OCC on December 7 – those three federal agencies issued a new warning to banks yesterday on what life in the crypto lane could mean to their future.

The warnings included the following:

“The events of the past year have been marked by significant volatility and the exposure of vulnerabilities in the crypto-asset sector. These events highlight a number of key risks associated with crypto-assets and crypto-asset sector participants that banking organizations should be aware of, including:

“• Risk of fraud and scams among crypto-asset sector participants.

“• Legal uncertainties related to custody practices, redemptions, and ownership rights, some of which are currently the subject of legal processes and proceedings.

“• Inaccurate or misleading representations and disclosures by crypto-asset companies, including misrepresentations regarding federal deposit insurance, and other practices that may be unfair, deceptive, or abusive, contributing to significant harm to retail and institutional investors, customers, and counterparties.

“• Significant volatility in crypto-asset markets, the effects of which include potential impacts on deposit flows associated with crypto-asset companies.

“• Susceptibility of stablecoins to run risk, creating potential deposit outflows for banking organizations that hold stablecoin reserves.

“• Contagion risk within the crypto-asset sector resulting from interconnections among certain crypto-asset participants, including through opaque lending, investing, funding, service, and operational arrangements. These interconnections may also present concentration risks for banking organizations with exposures to the crypto-asset sector.

“• Risk management and governance practices in the crypto-asset sector exhibiting a lack of maturity and robustness.

“• Heightened risks associated with open, public, and/or decentralized networks, or similar systems, including, but not limited to, the lack of governance mechanisms establishing oversight of the system; the absence of contracts or standards to clearly establish roles, responsibilities, and liabilities; and vulnerabilities related to cyber-attacks, outages, lost or trapped assets, and illicit finance.”

The most pointed warning came in these two sentences:

“Based on the agencies’ current understanding and experience to date, the agencies believe that issuing or holding as principal crypto-assets that are issued, stored, or transferred on an open, public, and/or decentralized network, or similar system is highly likely to be inconsistent with safe and sound banking practices. Further, the agencies have significant safety and soundness concerns with business models that are concentrated in crypto-asset-related activities or have concentrated exposures to the crypto-asset sector.”

The wake-up call to the Fed and the two other federal regulators of banks was hastened no doubt from the recent statement from Justice Department prosecutor Damian Williams that the FTX crypto exchange (which had fraudulently lured customers with the promise of federal deposit insurance) was “one of the biggest financial frauds in American history.” According to congressional testimony from John Ray, the newly-appointed CEO of FTX, $8 billion of customers’ money is missing. Both Silvergate Bank and Signature Bank, featured in the chart above, had banking relationships with FTX.

The FDIC had early warning that FTX was running a scam enterprise. On August 18 of last year – three months before FTX went belly up – the federal agency sent FTX US a letter warning it to stop falsely claiming its uninsured products were insured. The FDIC wrote:

“It appears that on July 20, 2022, Mr. Harrison [then President of FTX US] published a tweet on the Twitter account, ‘@Brett_FTX,’ which stated, among other things, ‘direct deposits from employers to FTX US are stored in individually FDIC-insured bank accounts in the users’ names,’ and ‘stocks are held in FDIC-insured and SIPC-insured brokerage accounts.’…

“These statements appear to contain false and misleading representations that uninsured products are insured by the FDIC, as well as false and misleading statements about the extent and manner of protection provided by FDIC deposit insurance and misuse the FDIC’s name. These false and misleading statements represent or imply that FTX US is FDIC-insured, that funds deposited with FTX US are placed, and at all times remain, in accounts at unnamed FDIC-insured banks, that brokerage accounts at FTX US are FDIC-insured, and that FDIC insurance is available for cryptocurrency or stocks. In fact, FTX US is not FDIC-insured, the FDIC does not insure any brokerage accounts, and FDIC insurance does not cover stocks or cryptocurrency. The FDIC only insures deposits held in insured banks and savings associations (insured institutions), and FDIC insurance only protects against losses caused by the failure of insured institutions. Accordingly, these statements are likely to mislead, and potentially harm consumers.”

You can read the full letter from the FDIC to FTX here.