By Pam Martens and Russ Martens: November 11, 2021 ~

Former Dallas Fed President Robert Kaplan made “over $1 million” trades in and out of S&P 500 futures throughout his tenure at the Dallas Fed, which began in September 2015 and ended with his resignation on September 27 of this year over his scandalous trading.

Trading in S&P 500 futures is a market-timing device used by hedge funds and day traders. No individual with market-moving information at the Federal Reserve should ever use such a device.

The U.S. stock market is open from 9:30 a.m. to 4:00 p.m. (ET) Monday through Friday. But S&P 500 futures trade around the clock during weekdays. The E-mini S&P 500 futures contract is the most popular and liquid S&P 500 futures contract. It can be leveraged by as much as 95 percent. The E-mini trades continuously from 6 p.m. Sunday night through 5 p.m. on Friday evening (ET), allowing someone who might wish to trade on inside information a much larger window of opportunity to do so than stock trading.

Kaplan was a sophisticated trader who previously worked at Goldman Sachs for 22 years, rising to the rank of Vice Chairman. His financial disclosure forms suggest that Kaplan maintained a trading relationship with Goldman Sachs, since he lists proprietary products created by “GS,” short for Goldman Sachs. (See Kaplan’s financial disclosure forms from 2015 through 2020 here.)

Wall Street On Parade previously reached out via email to a total of five Goldman Sachs media relations staff inquiring as to whether Kaplan was conducting his S&P 500 trades and/or his individual stock trades of “over $1 million” at their firm. The company declined to answer our questions. The Dallas Fed refused to tell us if Kaplan was using S&P 500 futures to short the market — a bet that the market would go down.

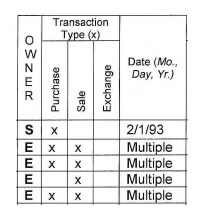

Kaplan was under clear instructions provided on his financial disclosure form to provide the “month, day, year” of each of his purchases of securities and each of his sales. The form even provides an example of how it wants the date to appear: “2/1/93.” From 2015 through 2020, however, Kaplan failed to do that, listing only the word “multiple” where the specific date should have appeared on the form.

Since Kaplan’s trading dates were owed to the public and long overdue, we asked the Communications Team at the Dallas Fed for the dates of each of Kaplan’s trades so that we could compare the dates to when Kaplan was sitting on market-moving information from the Fed. They declined to provide the information. The Wall Street Journal has also reported that they have been denied the dates of Kaplan’s trades.

On January 21, 2021, the Federal Reserve Board of Governors announced that it had given its approval for the reappointment of the Presidents of all 12 Federal Reserve Banks for a new five-year term. That included Dallas Fed President Robert Kaplan. The Fed’s press release said that “the eligible Reserve Bank directors, with significant input from the Board of Governors and key stakeholders, have conducted a rigorous process to inform their reappointment decisions.”

Since any “rigorous process” of vetting these Fed Bank Presidents would have required a review of their trading records, we filed a Freedom of Information Act request (FOIA) with the Federal Reserve on October 12, requesting expedited processing since the public had been improperly denied this information from Kaplan for years.

On October 22, we received the following response from Margaret McCloskey Shanks, the Deputy Secretary of the Federal Reserve Board of Governors who serves in the dual role of Chief FOIA Officer for the Fed:

“I have determined to grant your request for expedited processing in light of the fact that the topic of your request concerns a matter that has recently been the subject of news reporting. Accordingly, your request will be accorded priority treatment and processed as soon as practicable. By granting expedited treatment, your request will be processed ahead of other FOIA requests.”

The mandated turnaround for all FOIA requests to federal agencies is 20 business days. It rationally follows that expedited processing would be less than that. As the calendar was approaching the 20th business day, we asked for an update from the FOIA office. We promptly received a letter indicating that the Fed anticipated being able to provide the information by November 9.

But on November 9, via email, we received a very strange communication, not from Margaret McCloskey Shanks, the Chief FOIA Officer for the Fed, but from the “Information Disclosure Section” of the “Board of Governors of the Federal Reserve System.” The letter informed us that:

“Pursuant to section (a)(6)(B)(i) of the FOIA, we are extending the period for our response until November 24, 2021, in order to consult with two or more components of the Board having a substantial interest in the determination of the request.”

This is a bogus stalling tactic by the Fed. There can be no FOIA exemption to immediately turn over the information because the information is already legally mandated by the financial disclosure form to be turned over to the public.

But more alarming, why are “two or more components of the Board” allowed to stop the free flow of information to the American people. The letter appears to intentionally obscure just who it is that is blocking the release of this information through the use of the word “components.” That could be actual Board members sitting on the Board, such as Fed Chair Jerome Powell, or it could be legal advisors or consultants to the Board.

After the Federal Reserve lost much of its credibility during and after the financial crash of 2008 by fighting the media in court for almost three years in an effort to avoid turning over the shocking details of its $29 trillion bailout of Wall Street, the FOIA office of the Fed should be bending over backwards today in an effort to restore that lost credibility. Instead, the Fed is back to its abusive tactics with the American people and the press when it comes to transparency.

The U.S. Department of Justice has published a “Guide” indicating how federal agencies are to respond to FOIA requests. It reads in part:

“…each agency, upon any request for records which (i) reasonably describes such records and (ii) is made in accordance with published rules stating the time, place, fees (if any), and procedures to be followed, shall make the records promptly available to any person.

“Once an agency properly receives a FOIA request, it has twenty working days in which to make a determination on the request…Agencies are not necessarily required to release the records within the statutory time limit, but access to releasable records should, at a minimum, be granted promptly thereafter.”

The Justice Department’s Guide also provides the “unusual circumstances” that would allow the federal agency to extend the twenty-day time limit. They are listed as follows: “(1) the need to search for and collect records from separate offices; (2) the need to examine a voluminous amount of records required by the request; and (3) the need to consult with another agency or agency component.”

None of these “unusual circumstances” apply in this case. We intentionally narrowed our request so that the Fed couldn’t use the excuse of receiving a request for a “voluminous amount of records.” We did not ask for Kaplan’s trades from 2015 through 2020. We asked just for the year 2020 when he sat as a voting member of the Fed’s FOMC (Federal Open Market Committee) and was privy to the Fed’s unprecedented interventions in the market during the pandemic.

We also did not ask for the dates of Kaplan’s extensive trading in “over $1 million” purchases and sales of individual stocks. We asked only for the dates of his transactions in S&P 500 futures.

Making this stalling by the Fed even more outrageous is the fact that the General Counsel of the Dallas Fed, Sharon Sweeney, still has her job despite the fact that she signed off on each of Kaplan’s financial disclosure reports.

The type of trading done by Kaplan appears to be expressly prohibited by the Code of Conduct of the Dallas Fed. Appendix A on “Disqualifying Interests” of the Code of Conduct reads as follows:

“De minimis exemption for a matter of general applicability. An employee may participate in a particular matter of general applicability, such as rulemaking, where the disqualifying financial interest arises from ownership by the employee, his or her spouse or minor children of securities issued by one or more entities affected by the matter, if:

“(1) the securities are publicly traded, or are municipal securities, the market value of which does not exceed; (a) $25,000 in any one such entity; and (b) $50,000 in all affected entities;

“or (2) the securities are long-term federal government securities, the market value of which does not exceed $50,000.”

There was certainly nothing de minimis about Kaplan’s trading. In addition to his “multiple” trades in and out of S&P 500 futures, he lists on his financial disclosure form for 2020 “multiple” purchases and sales of greater than $1 million per transaction in 11 individual stocks. Three of those were interest-rate sensitive Big Tech stocks (Amazon, Apple and Facebook) that rose between 75 percent to 90 percent from their March 2020 lows, in no small part because of the interest rate cuts and other interventions by the Federal Reserve in 2020.

It’s time for Congress to meaningfully restructure the Federal Reserve, ending its myriad abuses of the public’s right to know and its chronic failures to supervise its own officials as well as the mega banks on Wall Street.