By Pam Martens and Russ Martens: August 10, 2018 ~

Earlier this week, James Freeman, the Assistant Editor of The Wall Street Journal’s editorial page, wrote an opinion piece headlined as “We’ll Never Know How Bad the Federal Reserve Is.” Freeman is also a Fox News contributor so one might be prone to suspect there is that typical right-wing bias to bash the Fed.

Freeman, however, has a legitimate beef. His new book, “Borrowed Time: Two Centuries of Booms, Busts and Bailouts at Citi,” with co-author Vern McKinley was published this week and Freeman laments in the article about how the Fed “hides and then destroys documents.” If you’re a journalist attempting to compile a truthful and accurate account about a financial institution or a financial era and a key institution holding those documents refuses to release them, then the American people have lost the ability to exercise oversight of their government.

At Wall Street On Parade, we know exactly how bad the Federal Reserve is. Before 1999, the Federal Reserve typified the assessment of American democracy – the worst form of government, except for all the others. In 1999, Alan Greenspan, then Chair of the Federal Reserve, got what he and Wall Street had been pushing for years to achieve: the repeal of the Glass-Steagall Act which had protected the U.S. financial system for 66 years by barring banks holding Federally-insured deposits from combining with investment banks engaged in underwriting and trading in securities. In 2010, Wall Street got the balance of its wish list: the Dodd Frank financial reform legislation made the Federal Reserve the primary regulator of the now behemoth Wall Street bank holding companies, despite the fact that it had been asleep at the switch as the worst financial crash since the Great Depression was incubating on Wall Street.

Most people, even those paying close attention to the Fed’s bailouts of Wall Street, think that the big banks were fine until the 2008 crash. But the public will never really know because Wall Street got another secret bailout from the Fed after the terror attacks of September 11, 2001. (Read our previous report here.) There is the forgotten history that Wall Street was already heading for a crash before the planes struck on 9/11. In fact, on the day before 9/11, the Nasdaq stock market had lost 66 percent of its market value over the preceding months and had evaporated $4 trillion in wealth. The economy had contracted for two consecutive quarters and was facing another quarter of negative growth.

We may never really know the full story of the Fed’s pump priming of Wall Street after 9/11 but we do know this: The Fed’s balance sheet grew from $609.9 billion at the end of 2000 to $654.9 billion at the end of 2001 to $730.9 billion at the end of 2002 and $771.5 billion as of December 31, 2003. To some folks, that looks a lot like an earlier version of quantitative easing.

Then there was the Fed’s Kafkaesque behavior during and after the epic financial crash of 2008. In April and May 2008, the intrepid Bloomberg News reporter, Mark Pittman, filed a Freedom of Information Act (FOIA) request with the Fed. Pittman wanted details on why the Fed’s discount window borrowings had skyrocketed from approximately $250 million a week in prior years to over $100 billion in October 2008. (Pittman passed away at age 52 on November 25, 2009.) After being stonewalled and denied the information over the next five months, Bloomberg News filed a lawsuit in Federal Court on November 7, 2008.

Two years later, Bloomberg News had won its case at both the Federal District Court and the Appellate Court and the Fed still had not released the information. It might have been embarrassing for the Fed to ask the U.S. Supreme Court to help it hide behind a dark curtain, so, instead, Wall Street banks did the job for it. The very banks that taxpayers had bailed out (Bank of America, JPMorgan Chase, Citigroup, Wells Fargo) through a consortium called The Clearinghouse Association LLC, filed an appeal with the U.S. Supreme Court.

On March 21, 2011 the Supreme Court turned down hearing the appeal, meaning that the lower court decisions would stand. Ten days later, after stalling for almost three years, the Fed released the discount window borrowing information to the public.

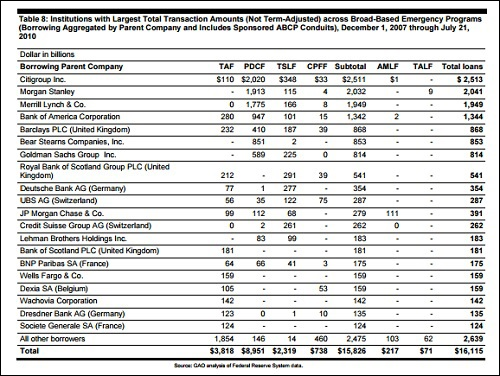

But the discount window loans were a tiny tip of the unfathomable money spigot that the Fed had secretly turned on for Wall Street. Thanks to an amendment inserted into the Dodd-Frank financial reform legislation of 2010 by Senator Bernie Sanders, the Government Accountability Office (GAO) was required to perform an audit of the Fed’s lending programs. That report was released by the GAO in 2011. It showed that $16.1 trillion in cumulative loans had been made to banks from the end of 2007 through mid 2010. Suggesting serious cronyism between the Fed and the biggest Wall Street banks, the report indicated that $7.8 trillion in near-zero interest loans had been sluiced to just four Wall Street behemoths: $2.5 trillion to Citigroup; $2 trillion to Morgan Stanley; $1.9 trillion to Merrill Lynch; and $1.3 trillion to Bank of America. (See chart below from the report.)

The bailout of the Wall Street banks, that had imploded the system through their own misdeeds and regulatory capture, stood in stark contrast to the bailout of homeowners who were caught in the grips of the housing implosion. Last year, the GAO released a study showing that as of October 31, 2016, the Federal government “had disbursed $22.6 billion (60 percent) of the $37.51 billion Troubled Asset Relief Program (TARP) funds” that were earmarked for helping distressed homeowners.

Imagine how wealth inequality in the United States might have improved dramatically if the Fed had made zero-interest rate loans available to distressed homeowners instead of funneling $16.1 trillion to the banks.

Greenspan’s idiotic belief that Wall Street bankers were capable of policing themselves and thus needed little oversight from the Fed was at the root of the crisis. But Ben Bernanke (who took over the Fed Chairmanship on February 1, 2006) believed that the Fed had every right to cover its hubris behind a wall of secrecy.

In 2014 we reported that Fed Chair Bernanke Held 84 Secret Meetings in the Lead Up to the Wall Street Collapse. Even though it was six years after the crash, we could not get the Fed to release the details of those meetings.

But the Federal Reserve Board of Governors (whose members are appointed by the President) often feels like little more than a titular figure head to the real central bank power player – the Federal Reserve Bank of New York. In 2013 we explained how How Power Moved to Wall Street, Via the New York Fed and we rhetorically asked and answered: Is the New York Fed Too Deeply Conflicted to Regulate Wall Street?

Photo of the Trading Floor at the New York Fed (Obtained by Wall Street On Parade from an Educational Video Despite Stonewalling by the New York Fed)

The New York Fed’s operations are also very dark. The New York Fed is the only one of the Fed’s 12 regional banks to have its own trading floor. In 2013 we asked the New York Fed for a photo of its trading floor so that we could share it with our readers. It said it didn’t have a photo. We had to spend days digging through educational videos released by the Federal Reserve to find a photo.

Freeman and McKinley’s book is not the first one this year to question the operations of the Federal Reserve. Nomi Prins, a progressive writer with solid Wall Street career credentials, is receiving wide praise for her book Collusion: How Central Bankers Rigged the World, released on May 1. Prins writes that the largest Wall Street banks that took the big bailout funds from the Fed “were not required to increase their lending to the Main Street economy as a condition of the availability of that money…Wall Street used its easy access to cheap money to increase speculation in derivatives and other complex securities. They used it to buy back their own shares, thus effectively manipulating their own stock – in broad daylight and with explicit approval from the Fed.”

Prins believes that another epic financial crash is inevitable, writing that “Eight years after the crisis began, the Big Six US banks – JPMorgan Chase, Citigroup, Wells Fargo, Bank of America, Goldman Sachs, and Morgan Stanley – collectively held 43 percent more deposits, 84 percent more assets, and triple the amount of cash they held before. The Fed has allowed the biggest banks on Wall Street to essentially double the risk that devastated the system in 2008.”

In summary, writers on both sides of the political spectrum see the Fed as a disfigured central bank which has lost its way. What will it take for Congress to wake up?