By Pam Martens and Russ Martens: October 28, 2015

The Federal Open Market Committee (FOMC) of the Federal Reserve will release its statement today at 2 p.m. (ET). It is widely expected that the Fed will be holding rates steady. The Fed has been signaling for more than a year that the U.S. economy is strong enough for it to raise interest rates gradually. Based on comments from various Fed speakers, many had expected the rate hike to come in September.

Wall Street on Parade has taken a skeptical view of the Fed’s happy talk about the economy – preferring to look at the cold, hard data coming from inside and outside the Fed. It now seems quite plausible that the Fed’s agenda all along has been to talk up the U.S. dollar to prevent capital flight while waving pom-poms to boost confidence and spur consumer spending.

Corporate media seems sycophantically willing to regurgitate the Fed’s optimistic prognostications on the U.S. economy, month after month, quarter after quarter. There have been a few courageous exceptions. On February 10, Steve Ricchiuto, Chief U.S. Economist at Mizuho Securities USA, had this to say on CNBC, the cable business channel:

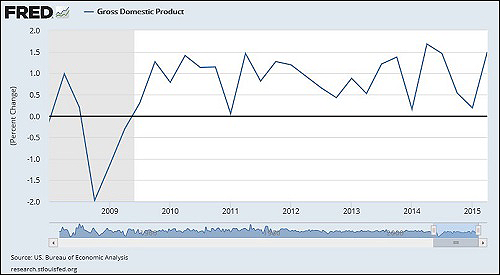

“…there’s also this wrong concept that I keep hearing over and over again in the financial press about this acceleration in economic growth. That isn’t happening. Last month we had a horrible retail sales number. We had a horrible durable goods number. We’re likely to have a very disappointing retail sales number coming forward. This month we’ve had a strong payroll number – we say everything’s great. It’s not great. It’s running where it’s been. It’s been the same thing for the last five years. There’s no improvement in the economy.”

The St. Louis Fed’s GDP chart below shows just how correct Ricchiuto is. Despite unprecedented fiscal stimulus and three doses of quantitative easing since the 2008 financial crash, the U.S. is still unable to sustain meaningful economic momentum.

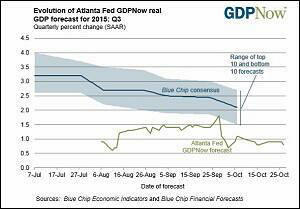

Even inside the Fed there are major doubters. The GDPNow forecast shown above from the Federal Reserve Bank of Atlanta, updated as of yesterday, forecasts an anemic seasonally adjusted annual GDP rate in the third quarter of 0.8 percent versus 0.9 percent on October 20. The Atlanta Fed will update this number later today to reflect this morning’s advance report from the Census Bureau on U.S. international trade in goods.

On February 2, Kevin Lansing and Benjamin Pyle, two researchers in the Economic Research Department of the Federal Reserve Bank of San Francisco, produced a study calling into question the FOMC’s overly optimistic forecasts for U.S. economic growth.

FOMC projections for Gross Domestic Product (GDP) are reported in its Summary of Economic Projections (SEP). According to Lansing and Pyle, the FOMC’s SEP “(1) did not anticipate the Great Recession that started in December 2007, (2) underestimated the severity of the downturn once it began, and (3) consistently over predicted the speed of the recovery that started in June 2009. The SEP growth forecasts have typically started high, but then are revised down over time as the incoming data continue to disappoint.”

Included in the study is a chart showing that the SEP forecast for 2008 never turned negative while the “actual growth rate for 2008 turned out to be –2.8%, the largest annual decline since 1946.”

The FOMC’s SEP forecasts for 2011 through 2013 started at around 4 percent or higher, only to eventually be cut in half, with each ending around 2 percent according to the Lansing and Pyle study.

The Fed’s FOMC statement will be available here at 2:00 p.m. (ET) today.