By Pam Martens: April 13, 2015

For nine years now we have written about Wall Street’s institutionalized system of transferring wealth from decent, hardworking Americans to the denizens of Wall Street and those it selectively chooses to favor in the one percent class. The methods of wealth transfer are as diverse as they are diabolical, thus even well intentioned members of Congress cannot stem the havoc on the financial well being of the average American and the overall economy.

For nine years now we have written about Wall Street’s institutionalized system of transferring wealth from decent, hardworking Americans to the denizens of Wall Street and those it selectively chooses to favor in the one percent class. The methods of wealth transfer are as diverse as they are diabolical, thus even well intentioned members of Congress cannot stem the havoc on the financial well being of the average American and the overall economy.

One facet that all of these wealth transfer systems have in common is that they all masquerade under a benign sounding name. The 401(k) plan is viewed by most Americans as a way to save for retirement. That’s a good thing – right? It is not a good thing when two-thirds of your savings over a working lifetime end up in Wall Street’s pocket, as carefully demonstrated by Frontline and math-checked by us.

The very same Wall Street banks that are asset-stripping 401(k)s are the same banks that asset-stripped the equity in homes across America through illegal foreclosures and mortgage fraud and then were allowed to decide on their own how much to pay their victims.

If you attempt to legally challenge being ripped off by Wall Street, you will end up in a private justice system created by Wall Street lawyers and run by a self-regulatory agency. You will not be allowed to take your claim to one of the nation’s courts where juries are randomly selected from a large pool of fellow citizens. You will have limited discovery and the arbitrators of your claim do not have to follow legal precedent or case law.

Even when serious financial crimes are committed against our cities and counties, causing mass layoffs and economic suffering to millions, no one will go to jail. Prosecutors will allow Wall Street to pay a fraction of the amount stolen and walk away.

After each illegal cartel on Wall Street is exposed, removing any doubt that this is an institutionalized wealth transfer system, new Wall Street cartels crop up faster than you can say “where are the customers yachts.” Today, Wall Street is under investigation for the following cartels: rigging interest rates (Libor); rigging precious metals trading; rigging foreign currency trading; hoarding physical commodities – and that’s likely just the tip of the iceberg.

Add dark pools, high frequency trading, and stock exchange collusion to the 401(k), private justice system and cartel fleecing activity and you have an almost perfect system for criminal financial wealth transfers with impunity.

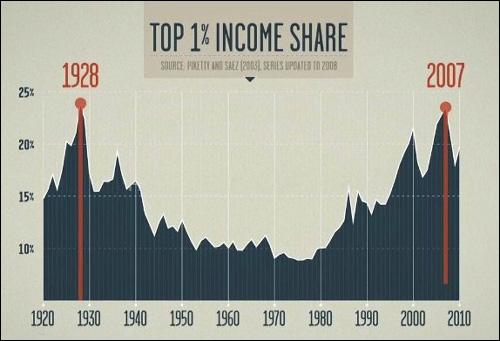

The proof that this institutionalized, unchecked, criminal wealth transfer system is destroying the economy of the United States resides in the fact that only twice in our Nation’s history has Wall Street been this corrupt – in the late 1920s and now. Simultaneous with this institutionalized corruption in both periods has come the greatest income and wealth inequality in the last century (see graph below); and Great Depression and Great Recession.

This level of concentrated wealth prevents our economy from growing. Workers are deprived of an adequate share of the Nation’s wealth and income and are thus unable to buy the goods and services being produced. This results in endless rounds of layoffs and downsizing which lead to ever less disposable income by consumers.

Nothing proves this point better than the fact that we have had three massive doses of Quantitative Easing (QE) since the financial crisis of 2008 and the economy is slowing down again. The Federal Reserve cut its Federal Funds rate to the zero-bound range in 2008 and we’ve been locked there ever since, despite the Fed ballooning its balance sheet to over $4 trillion.

Now the Fed is constantly jawboning about when it will tighten credit by raising interest rates because the economy is doing so well. Look at the past history of the talk of tightening by the Fed since the crisis; in each case the economy slumped and the Fed had to inject another round of QE. This is how long the media has been talking about the Fed’s tightening plans:

March 29, 2011: Bloomberg News

“The U.S. Federal Reserve may need to decide on when to tighten monetary policy before the outlook for the global economy clears up later this year, St. Louis Fed President James Bullard said.”

April 27, 2012: The Atlantic

“Imagine that the economic recovery actually picks up. Unemployment is still far too high, but it’s falling at a rapid clip. And here’s the crucial bit: say inflation creeps over 3 percent — or even hotter. It’s hard to believe the Fed wouldn’t tighten in this scenario given its inflation bias.”

March 15, 2013: Fox News

“The Federal Reserve Board meets next week and investors will be looking for signs that recent positive economic data might be putting pressure on board members to begin tightening fiscal policy.”

October 10, 2014: Value Walk Headline —

“When Will the FOMC Tighten the Fed Funds Rate?”

February 19, 2015: Seeking Alpha

“There is no doubt that the Fed will tighten, it’s just a question of when.”

Until Congress, regulators and prosecutors come to grips with the screaming fact that Wall Street has become an institutionalized wealth transfer system, until an equitable system is devised to return these stolen trillions of dollars of wealth to their rightful owners, our Nation is at peril of another epic economic crisis.