By Pam Martens: January 30, 2014

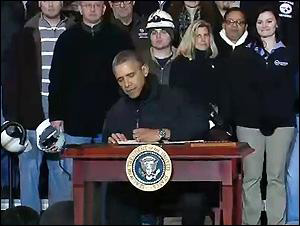

President Obama Signs the Presidential Memorandum Creating the MyRA at U.S. Steel in West Mifflin, Pennsylvania on January 29, 2014

Yesterday, the White House transported a little cherry table with the Presidential seal for a signing event in West Mifflin, Pennsylvania. President Obama was visiting workers at a U.S. Steel Corporation manufacturing plant there and used the occasion to officially sign the order creating the new MyRA, a retirement account with low dollar minimums for participation.

The Presidential Memorandum, surprisingly, was devoid of any salient details of how the MyRA would work and effectively gave the U.S. Treasury Secretary, Jack Lew, carte blanche to tailor the account as long as it complied with the following: “By December 31, 2014, you shall finalize the development of a new retirement savings security that can be made available through employers to their employees. This security shall be focused on reaching new and small-dollar savers and shall have low barriers to entry, including a low minimum opening amount.”

The President’s memorandum adds further that “within 90 days of the date of this memorandum, you shall begin work with employers, stakeholders, and, as appropriate, other Federal agencies to develop a pilot project to make the security developed pursuant to subsection (a) of this section available through payroll deduction to facilitate easy and automatic contributions.”

This is the first we’ve heard to date that the MyRA is just a pilot project and not going to be a full scale rollout. After speaking with the U.S. Treasury, and scouring fact sheets provided by the White House, this is the detailed outline of how the MyRA is currently envisioned.

Firstly, this is not a new retirement account. The President has no authority outside of Congress to start creating retirement accounts for the country. This is the existing Roth IRA account that is being offered a new investment product from the U.S. Treasury which has low dollar minimums in order to reach less affluent workers.

The new product is U.S. Treasury securities which will be backed by the U.S. government against loss and earn a floating rate based on the Thrift Savings Plan’s Government Securities Investment Fund that is offered to Federal workers. While there is no guarantee of what that will earn going forward, over the past decade it has averaged approximately 3.6 percent.

Under Roth IRA rules, the account is eligible to workers earning less than $191,000 for 2014 if you’re married filing jointly; less than $129,000 for 2014 if you’re single or the head of a household. Under Roth IRA rules, not everyone is able to make the full maximum contribution of $5500 (2014) or $6500 (2014) if you’re age 50 or older. The IRS provides an easy table showing how to figure out your own specific contribution limits based on your modified adjusted gross income and tax filing status.

The White House has touted the fact that the employee can always withdraw the money at any time. That’s not completely correct. Because workers get no tax deduction for contributions to a Roth IRA, the money is going in on an after tax basis, unlike a traditional IRA where contributions are tax deductible. That fact allows the worker to withdraw Roth IRA and MyRA contributions without paying additional taxes or a penalty. Withdrawal of the interest earned on the account is only tax-free if you’ve reached age 59 ½ or older and you’ve had the account for at least 5 tax years. There could also be a 10 percent federal penalty tax on the interest under certain conditions. (Participants in any form of retirement account should always speak with a tax advisor before making any withdrawals.)

The President’s fact sheet states that participants will be able to make a first time contribution to their MyRA for as little as $25 and $5 thereafter. Once the account reaches $15,000 it will be mandatory for it to roll over to a private sector company.

As incorrectly reported by some media outlets, the U.S. Treasury will not be administering this plan. The U.S. Treasury acknowledges that it will be hiring an outside money management firm with the capability of keeping track of all of these small contributions and disbursements.

Since small accounts are not attractive to most money management firms, it is likely that the U.S. government will pay significant sums to this outside firm, and/or offer it the inside track of rolling over the accounts to their own investment products when the accounts reach $15,000 in size.

It’s at the $15,000 level that the worker who is unsophisticated in the ways of Wall Street will need to pay very close attention. At that point the worker is likely to get hustled to buy a high commission annuity or a high commission mutual fund that seriously eats into the earnings he has made.

If, at this point, the MyRA participant still wants a risk-free investment, low to no-cost rollover accounts will still hopefully be available at community banks offering FDIC-insured certificates of deposit inside of Roth IRAs.

What the MyRA does not address, of course, is the reason that most workers have so little to contribute toward their own retirement plans: wage stagnation.

From World War II onward to the early 1970s, the income of the middle class was on a consistent upward trajectory. Then, in the late 70s, the progress abruptly stopped. For the next three decades, adjusted for inflation, middle class incomes stagnated.

To make ends meet, women joined the workforce; workers took on longer hours and part-time jobs. Still struggling to keep pace with inflationary costs for food, housing, medical insurance, and college tuition, the middle class took on increasing levels of debt on high-interest credit cards.

Wage stagnation was further aggravated by a loss of good union jobs. Over the intervening years, the number of people represented by unions fell from one-third of all workers to a stunning seven percent. The ability of union workers to negotiate for higher wages, and set a higher benchmark for all wage earners, died with the decimation of unions.

Before the President can effectively address the plight of future retirees, he must deal with wage stagnation, the effective looting of Wall Street-managed retirement plans through exorbitant fees, and the lopsided playing field that pits the financially unsophisticated against an army of financial hustlers.

————-

Presidential Memorandum — Retirement Savings Security

MEMORANDUM FOR THE SECRETARY OF THE TREASURY

SUBJECT: Retirement Savings Security

All Americans deserve the ability to save for retirement. Since taking office, my Administration has committed to strengthening retirement security for all Americans, including by helping workers find ways to save for retirement and to protect those hard earned savings. Unfortunately, too few Americans have enough savings to maintain their standard of living in retirement.

But we know there are proven strategies that can help the average family save. Workplace-based retirement savings that allow workers to automatically take a portion of their pay and put it into a retirement account can increase retirement savings dramatically. Approximately 9 out of 10 workers automatically enrolled in a 401(k) plan continue to make contributions to that account compared to the less than 1 out of 10 eligible workers who voluntarily contribute to Individual Retirement Accounts. The positive effect of automatic contributions is especially pronounced among lower-income households and others with traditionally low savings rates.

Unfortunately, only about half of all American workers have access to employer-sponsored retirement savings accounts. It is clear that we cannot continue on this course.

The Department of the Treasury has worked diligently to develop a new tool that can make long-term savings a reality for more working Americans. A new kind of retirement savings tool could help American families as they start to build for their retirement. In order to make this tool available to working Americans, I hereby direct as follows:

Section 1. Retirement Savings Security. (a) By December 31, 2014, you shall finalize the development of a new retirement savings security that can be made available through employers to their employees. This security shall be focused on reaching new and small-dollar savers and shall have low barriers to entry, including a low minimum opening amount. In developing this security, you shall ensure that it:

(i) protects the principal contributed while earning interest at a rate based on yields on outstanding Treasury securities;2

(ii) offers savers the flexibility to take money out if they have an emergency and keep the same Treasury security if they change jobs; and

(iii) is designed to help savers start on a path to long-term saving and serve as a stepping stone to the broader array of retirement products available in today’s marketplace.

(b) Within 90 days of the date of this memorandum, you shall begin work with employers, stakeholders, and, as appropriate, other Federal agencies to develop a pilot project to make the security developed pursuant to subsection (a) of this section available through payroll deduction to facilitate easy and automatic contributions.

Sec. 2. General Provisions.

(a) Nothing in this memorandum shall be construed to impair or otherwise affect:

(i) the authority granted by law to a department or agency, or the head thereof; or

(ii) the functions of the Director of the Office of Management and Budget relating to budgetary, administrative, or legislative proposals.

(b) This memorandum shall be implemented consistent with applicable law and subject to the availability of appropriations.

(c) This memorandum is not intended to, and does not, create any right or benefit, substantive or procedural, enforceable at law or in equity by any party against the United States, its departments, agencies, or entities, its officers, employees, or agents, or any other person.

(d) You are authorized and directed to publish this memorandum in the Federal Register.

BARACK OBAMA