By Pam Martens: January 21, 2013

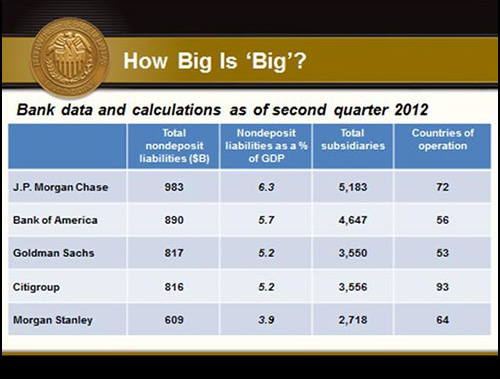

This month, U.S. Senators David Vitter (R-La.) and Sherrod Brown (D-Ohio) sent a letter to the Government Accountability Office (GAO) asking the federal watchdog agency to research and report on the economic subsidy that too-big-to-fail banks receive as a result of actual or perceived taxpayer support. Last week, Richard Fisher, president and CEO of the Federal Reserve Bank of Dallas, delivered a speech on the same topic.

This month, U.S. Senators David Vitter (R-La.) and Sherrod Brown (D-Ohio) sent a letter to the Government Accountability Office (GAO) asking the federal watchdog agency to research and report on the economic subsidy that too-big-to-fail banks receive as a result of actual or perceived taxpayer support. Last week, Richard Fisher, president and CEO of the Federal Reserve Bank of Dallas, delivered a speech on the same topic.

While the points made by these gentlemen are both valid and critically important, they fail to take note of four other dangerous subsidies: (1) the market perception that the Washington and Wall Street revolving door has rendered these firms immune from prosecution – even for repeated, illegal cartel behavior; (2) the ability to spend billions buying back their own stock, effectively propping up their own share price and bad behavior; (3) self-regulation with compromised bodies creating the market perception and reality of a competitive edge; and (4) Congress and the Supreme Court tolerating Wall Street running its own private justice system (mandatory arbitration) where corrupt acts are kept hidden from public view until they blow up into catastrophic events to the economy.

In their letter to the GAO, Vitter and Brown noted:

“Government support also provides insured depository institutions with higher credit ratings that can encourage institutions to shift activities into these subsidiaries. For example, Bank of America moved $15 trillion in derivatives contracts from its broker-dealer, Merrill Lynch, to its insured depository institution affiliate in response to a credit downgrade. The result is that taxpayers would subsidize, and ultimately backstop, potentially risky investments. This move reportedly saved the bank $3.3 billion in additional collateral payments.

“When the Federal Reserve granted a 23A exemption to Goldman Sachs Bank in 2009, Goldman moved its multi-purpose derivatives dealer into its insured bank affiliate. Likewise, Morgan Stanley converted to a bank holding company, and received a 23A exemption for its derivatives business. And JPMorgan Chase Bank, N.A., currently holds 99 percent of the notional derivatives of JPMorgan Chase & Co.

“Morgan Stanley is reportedly considering similar measures in response to a threatened downgrade by Moody’s. Such a downgrade could require Morgan Stanley to post as much as $6.5 billion over the course of a year.”

The Senators quantified the subsidies in dollar terms for the crisis years of 2007 through 2009:

“According to the Congressional Oversight Panel for TARP (COP), the six largest banks received a total of $1.27 trillion in government support.

“Commentators have noted that a loan to an underwater bank is a long-shot investment whose substantial downside easily justifies a 15% to 20% return, comparable to the rates charged on risky sovereign bonds. But the Fed’s emergency lending was not nearly so stringent – for example, the Federal Reserve’s Term Auction Facility maxed out at an interest rate of 4.67 percent. The result is that failing banks can borrow money far more cheaply than the market would bear. Comparing net interest margins for these loans and the loans made by banks, Bloomberg estimates that the six largest banks made $4.8 billion in profit from these loans–equal to 23 percent of their combined net income during those two years.”

In his speech to the Committee for the Republic in Washington D.C. on January 16, 2013, Richard Fisher of the Dallas Fed said: “The next financial crisis could cost more than two years of economic output, borne by millions of U.S. taxpayers. That horrendous cost must be weighed against the supposed benefits of maintaining the TBTF [too-big-to-fail] status quo. To us, the remedy is obvious: end TBTF now. End TBTF by reintroducing market forces instead of complex rules, and in so doing, level the playing field for all banking institutions.”

The plan from the Dallas Fed recommends “that TBTF financial institutions be restructured into multiple business entities. Only the resulting downsized commercial banking operations—and not shadow banking affiliates or the parent company—would benefit from the safety net of federal deposit insurance and access to the Federal Reserve’s discount window.”

While each of these concerns constitute a worthy debate, they will do little to rein in Wall Street without tackling the other anti-competitive perks bestowed on Wall Street. As we have previously reported, U.S. regulators have been investigating the banking cartel’s rigging of Libor since the spring of 2008. The U.S. Justice Department has exposed corruption on the part of foreign banks in rigging Libor interest rates. But, to date, no U.S. bank has been fined or prosecuted by the DOJ, despite affidavits and reams of evidence pointing in that direction.

Over the past 15 years, Wall Street cartels have rigged the Nasdaq market, rigged stock research to pad their own profits while peddling “dogs” to the American people, created offshore vehicles to hide their true financial condition, and turned the dream of home ownership in America into an economic nightmare for millions of families.

The Justice Department and regulators and Courts have enabled and reinforced these actions by rubberstamping monetary fines and meaningless sanctions without putting one major Wall Street CEO or CFO in jail; without prosecuting any major firm.

If we are going to discuss market subsidies, let’s get everything out in the open and on the table. And let’s stop kidding ourselves that anything short of a complete separation of commercial banking from securities underwriting (i.e., the restoration of the Glass-Steagall Act) will rein in Wall Street and avert another crisis. Time is running out.