By Pam Martens: September 28, 2012

U.S. Treasury Secretary Tim Geithner is now three for three in the book world: the quintessential poster boy for regulatory capture who ended up as Citigroup’s bitch. In Ron Suskind’s Confidence Men, Geithner ignores a directive from the President of the United States to wind down Citigroup. In Neil Barofsky’s Bailout, Geithner is the evil genius using the Home Affordable Modification Program (HAMP) to “foam the runways” for the banks, slowing down the foreclosure stream so the banks could stay afloat, with no genuine goal to help struggling families stay in their homes.

U.S. Treasury Secretary Tim Geithner is now three for three in the book world: the quintessential poster boy for regulatory capture who ended up as Citigroup’s bitch. In Ron Suskind’s Confidence Men, Geithner ignores a directive from the President of the United States to wind down Citigroup. In Neil Barofsky’s Bailout, Geithner is the evil genius using the Home Affordable Modification Program (HAMP) to “foam the runways” for the banks, slowing down the foreclosure stream so the banks could stay afloat, with no genuine goal to help struggling families stay in their homes.

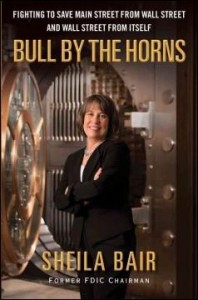

Now Sheila Bair, the ultimate insider as former head of the FDIC during the crisis, has completed the microscopic job on Geithner in Bull by the Horns. The image that emerges is a two-headed monster: a regulator functioning as a Citigroup messenger boy and an insanely mismanaged bank that was somehow able to shield from public scrutiny that it had a measly $125 billion in U.S. insured deposits while turning government on its head and raking in over $2.5 trillion in taxpayer capital, guarantees and loans.

When I came to the part about the $125 billion in insured deposits, I thought my Kindle had malfunctioned. What! It was well publicized that Citigroup had over $2 trillion in assets; how could it have only $125 billion in U.S. insured deposits?

Sheila Bair may not have realized it, but she was filling in the missing piece of a puzzle that has captivated much of Wall Street since 2008: why was every regulator jumping through hoops to save Citigroup, a serial predator that constantly promised to change but never did.

As it turns out, the bulk of Citigroup’s deposits were foreign and much of those deposits were not insured or had low insurance amounts. Had this foreign money decided to run for the exits on fear of a Citigroup collapse, FDIC might have been looking at just a $125 billion problem but the rest of the financial system was looking at $2 trillion on the books, $1 trillion off the books and God knows what kind of counterparty agreements in the closets.

Bair indicates her belief that Citigroup’s two main regulators, John Dugan (a former bank lobbyist) at the Office of the Comptroller of the Currency (OCC) and Tim Geithner, then President of the Federal Reserve Bank of New York, were not being forthright on Citigroup’s real condition. Bair explains Citigroup’s situation in 2008 as follows:

“By November, the supposedly solvent Citi was back on the ropes, in need of another government handout. The market didn’t buy the OCC’s and NY Fed’s strategy of making it look as though Citi was as healthy as the other commercial banks. Citi had not had a profitable quarter since the second quarter of 2007. Its losses were not attributable to uncontrollable ‘market conditions’; they were attributable to weak management, high levels of leverage, and excessive risk taking. It had major losses driven by their exposures to a virtual hit list of high-risk lending; subprime mortgages, ‘Alt-A’ mortgages, ‘designer’ credit cards, leveraged loans, and poorly underwritten commercial real estate. It had loaded up on exotic CDOs and auction-rate securities. It was taking losses on credit default swaps entered into with weak counterparties, and it had relied on unstable volatile funding – a lot of short-term loans and foreign deposits. If you wanted to make a definitive list of all the bad practices that had led to the crisis, all you had to do was look at Citi’s financial strategies…What’s more, virtually no meaningful supervisory measures had been taken against the bank by either the OCC or the NY Fed…Instead, the OCC and the NY Fed stood by as that sick bank continued to pay major dividends and pretended that it was healthy.”

The backdrop for all this, says Bair, was that “Regulation had fallen out of fashion and both government and the private sector had become deluded by the notion that markets and institutions could regulate themselves.” (To truly comprehend how that happened, you’ll have to read the Gary Weiss book, Ayn Rand Nation.)

On Citigroup’s Structured Investment Vehicles (SIVs) that eventually blew up the bank in short order as they were forced to come out of hiding in the Cayman Islands and back onto Citigroup’s balance sheet, Bair had this to say: “For reasons that still today remain a mystery to me, they were allowed by their regulators – the Fed and the OCC – to keep the investments off balance sheet…” Citigroup was not required to hold capital or reserve against those assets to absorb losses.

Wall Street has another secret deregulatory weapon not widely discussed: if you can’t gut the legislation, cut the funding for the regulator. Bair explains that the FDIC went from 12,000 employees in 1995 to 4,500 in 2006.

Then there are the other enablers. Bair reveals how New York City Mayor Michael Bloomberg, a billionaire with an existing business of selling high priced computer terminals to Wall Street, and Charles (Chuck) Schumer, New York Senator who depends on Wall Street largesse to get elected, commissioned a 2007 McKinsey & Company study on U.S. competition in financial markets, arriving at the hilarious conclusion that the U.S. should use the European style principles-based regulation.

Schumer, wise scribe that he is, wrote to Bair in 2007 with this missive: “I do not believe that more capital is always better, particularly where banks create strong systems to internalize their risks.”

One of the most egregious episodes with Geithner, and there are many, was his proposal for the FDIC to provide all out support to Citigroup, guaranteeing all of its debt, including its half trillion in foreign deposits. Bair did not let this happen.

The FDIC had agreed to guarantee Citigroup’s issuance of new debt, providing it was used for lending to help get the economy back on its feet. What the FDIC examiners found instead was that “Citi was using the program to pay dividends to preferred shareholders, to support its securities dealer operations, and, through accounting tricks, to make it look as if funds raised through TLGP [Temporary Liquidity Guarantee Program] debt were actually raising capital for Citi’s insured bank.”

Here’s the quick read and real tragedy. The same man Bair repeatedly calls a hedge fund manager not up to the job of running one of the world’s largest banks, Vikram Pandit, is still at the helm of Citigroup. Tim Geithner got a promotion from New York Fed President to Secretary of the United States Treasury. This is the new world of rapacious capitalism with no accountability.