By Pam Martens: July 17, 2012

The U.S. Department of Justice has a thing about the big corporate law firm, Covington and Burling. The U.S. Attorney General, his assistant, and the assistant to his assistant, all came from that firm. And Citigroup has decided that’s the firm for it as it winds its way through the Libor matter.

On Citigroup’s earnings call yesterday, it effectively told analysts that they should not infer that all banks on the Libor rate setting panel will be tarred with the same brush. That’s true. Some banks were in much better financial shape going into the 2008 crisis and would have had less reason to fudge their costs to borrow. Unfortunately, despite CEO Vikram Pandit’s efforts to wipe analysts long term memory banks clean, Citigroup was not one of the banks that had no motive to fudge its numbers.

The popular retail brokerage, the Charles Schwab Corporation and its affiliates have filed a Libor lawsuit in Federal court in San Francisco naming Citibank, N.A., (the insured bank of parent Citigroup) Citigroup Global Markets Inc., and Citigroup Funding, Inc. along with numerous other banks that were on the Libor panel and sold it financial products indexed to Libor.

In the case of Citigroup, the lawsuit has this to say:

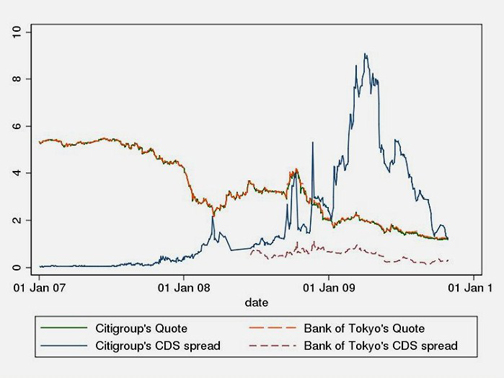

“…the Libor Panel defendants continued to give Libor quotes that in fact deviated from their costs of borrowing as reflected in CDS spreads. Citibank, for example, reported rates virtually identical to those of the Bank of Tokyo-Mitsubishi, another U.S. dollar Libor panel member, even though the banks had vastly different costs of borrowing, as implied by the respective costs of CDS insurance on their debt. Indeed, during much of 2009, Citibank’s panel quote was, anomalously, lower than the premiums on its CDS, which if true would mean anyone lending to Citibank at interbank rates would, after purchasing CDS insurance, incur a 5% loss. That discrepancy contravenes basic rules of economics and finance, thus indicating that Citibank underreported borrowing costs to the BBA [British Bankers Association].”

Would Citigroup actually do something as dastardly as lie? In 2007, Citigroup told investors it had $13 billion in subprime exposures, knowing the figure was in excess of $50 billion, according to the SEC. It got caught and on July 29, 2010 paid a meagerly $75 million to settle charges with the SEC. Its CFO, Gary Crittenden, was fined a puny $100,000 and the head of its Investor Relations Department, Arthur Tildesley, was fined an even punier $80,000.

So what I think Citigroup is really saying is don’t assume every bank will be treated equally by regulators. Citigroup has had a charmed life with regulators, including the ultimate charm of merging Travelers Group, Salomon Brothers, Smith Barney (insurance, investment bank and brokerage) with Citicorp (insured bank) with the blessing of the Federal Reserve at a time when the deal was patently illegal under both the Glass-Steagall Act and the Bank Holding Company Act of 1954.

Citigroup may also be saying, don’t assume every bank knows how to pick its legal counsel. Covington and Burling is the former law firm of the sitting U.S. Attorney General, Eric Holder and the Assistant Attorney General Lanny Breuer who heads the Justice Department’s criminal division. And just yesterday, July 16, the new deputy chief of staff and counselor to Lanny Breuer became Dan Suleiman. Where did Suleiman come from? Covington and Burling, the firm with a long history of representing the major banks on Wall Street.

Citigroup is being represented In re Libor-Based Financial Instruments Antitrust Litigation by Alan Wiseman, senior counsel of Covington and Burling’s Washington, DC office. Covington and Burling also represented Citigroup in the Federal Reserve Board and Office of the Comptroller of the Currency’s consent orders concerning mortgage servicing and foreclosure misdeeds.

Citigroup may not be able to keep out of trouble, but it has consistently shown it knows how to line up its legal team. That’s been very good for the richly rewarded CEOs of the firm, like Sanford Weill and Chuck Prince and Vikram Pandit. For shareholders, not so much. Had it not been for the 1 for 10 reverse stock split, Citigroup’s shares would have closed yesterday at the market alarming price of $2.68.

City of Baltimore Says You Can Chart Citigroup’s Big Libor Lie

The City of Baltimore and other plaintiffs have told a Federal Court in New York that it can chart Citigroup’s big Libor lie. It submitted the following chart to the court, showing the 12-month U.S. Dollar Libor quotes from Citigroup and the Bank of Tokyo, together with the respective bank’s one-year senior Credit Default Swap (CDS) spread. Citigroup had a significantly higher CDS spread than the Bank of Tokyo, yet it was submitting a lower Libor quote.