By Pam Martens: July 20, 2012

Tomorrow will mark the second anniversary of the Dodd-Frank Wall Street Reform and Consumer Protection Act. It is appropriate that the public has learned recently through the Libor scandal that Wall Street is far from reformed and that no consumer in America is protected from the continued pillaging of Wall Street.

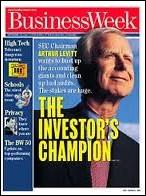

One man who has done his very best to escape his rightful place among the cast of Wall Street enablers who provided the deregulatory foundation for a serial crime spree by Wall Street is Arthur Levitt, the longest serving Chairman of the Securities and Exchange Commission from 1993 to 2001.

Levitt and his mighty crew of public relations handlers have pulled out all stops to rewrite history. Levitt’s current page at the SEC’s web site contains this rollicking piece of fantasy: “Investor protection was Chairman Levitt’s top priority. Throughout his tenure at the Commission, Chairman Levitt worked to educate, empower, and protect America’s investors.”

The reality is that Levitt presided over one Wall Street rip off after another and what he delivered to his pals on Wall Street were fines and slaps on the wrists and the repeal of the investor protection legislation known as the Glass-Stegall Act and part of the Bank Holding Company Act of 1954, which allowed insured deposit banks to merge with brokerage firms, investment banks and insurance companies – the Frankenbanks that are creating today’s reign of terror.

Levitt was Sandy Weill’s former business partner in the brokerage firm, Cogen, Berlind, Weill & Levitt. The brokerage firm acquired more than a dozen companies to become Shearson Loeb Rhoades in the 60s and 70s. Weill, while Levitt was SEC Chairman, crafted the illegal merger of the insured deposit bank, Citibank, with the Travelers Group insurance company, Salomon Brothers investment bank and Smith Barney brokerage firm, a combination that was illegal at the time. The merger created Citigroup, the behemoth that collapsed into the arms of the taxpayer in 2008.

Before joining the SEC, Levitt owned Roll Call, a newspaper covering politics on Capitol Hill. From 1989 to 1993, he served as the Chairman of the New York City Economic Development Corporation. From 1978 to 1989 he was the Chairman of the American Stock Exchange.

My earliest memory of Levitt was a slobbering address he gave to Wall Street’s trade association in 1994, which I read in amazement at the SEC’s web site. Speaking before the Securities Industry Association on December 3, 1994 in Boca Raton, the top cop on the beat policing Wall Street, made the following remarks:

“As I meet you and greet familiar faces, I recollect previous visits to this Boca meeting — memories of Morgan Stanley’s parties, dinners with Congressional staffers, hot dogs in the St. Louis Room, and gala, invitation-only dances for honored guests and members of the old guard…I find myself looking at the industry now from a very new perspective — no longer a member of the immediate family, more like an uncle viewing the family from afar…”

An uncle? The Chairman of the SEC is an “Uncle” to Wall Street? And, indeed, that’s what Uncle Artie became. In Gary Weiss’ book, Wall Street versus America, Weiss calls him “the terminally shame-deprived Levitt…who can spin the most laughable cop-out into an investor victory…”

Levitt watched as his former business partner, Sandy Weill, became the most obscenely overpaid Wall Street executive in history. Dan Ackman, writing for Forbes on April 26, 2001 said: “Sanford ‘Sandy’ Weill tends to be so closely identified with the companies he runs that people consider him an owner. Certainly he is paid like one: $785 million in total compensation over five years – more than any chief executive in America, and by a wide margin. But Weill owns less than one-half of 1% of Citigroup…”

Levitt also presided over the biggest price fixing scandal in history on the Nasdaq stock exchange; the IPO rigging and tech bubble which collapsed the year before he stepped down; Wall Street’s fraudulent research to build that tech bubble; JPMorgan and Citigroup helping Enron cook its books, and on and on. The big Wall Street firms simply paid fines, did not admit or deny the charges, and went on their merry way to ever bigger frauds against the investing public.

Most repugnant of all is that despite the massive deregulation of Wall Street occurring on his watch, as he cheered it on, he had the audacity to come back in 2008 and 2009 at the height of the financial crisis and give testimony to Congress on what it needed to do.

On March 26, 2009, Levitt told the Senate Banking Committee the following:

“The public may demand that you act over some momentary scandal, but you must not give in to bouts of populist activism. Your goal is to serve the public not by reacting to public anger, but by focusing on a system of regulation which treats all market actors the same under the law, without regard to their position or status… Specifically, some have suggested that we should re-impose Glass-Steagall rules regarding the activities and regulation of banks. Those rules kept the nation’s commercial banks away from the kinds of risky activities of investment banks…Perhaps we were too hasty in doing away with it, and should have held onto several key principles that made Glass-Steagall an effective bulwark against systemic risk in America’s banking sector. That does not mean we should pursue ‘turn-back-the-clock’ regulation reforms and re-impose Glass-Steagall.”

The above statement is a window into Levitt’s brain and moral compass. Read it again, carefully. Despite acknowledging that Glass-Steagall was “an effective bulwark against systemic risk in America’s banking sector” we shouldn’t re-impose it.

Despite Levitt’s efforts to whitewash his record at the SEC in his autobiography, Take On the Street: What Wall Street and Corporate America Don’t Want You to Know, the truth has apparently seeped through to the marketplace. The book is selling for $3.50, new, at Amazon.