By Pam Martens and Russ Martens: May 28, 2019 ~

Simon Potter, who runs the Federal Reserve’s open market operations at the Federal Reserve Bank of New York, is stepping down at the end of this week, as is Richard Dzina, head of the New York Fed’s Financial Services Group. Wall Street is buzzing over the fact that the two are long-tenured executives at the New York Fed; are exiting simultaneously, and with only a four-day notice to the public and the markets – suggesting that their departure may not have been voluntary.

The praise lavished on the pair in the press release issued today by John Williams, President of the New York Fed, also suggests that an effort is being made to soften the blow of their surprise departure.

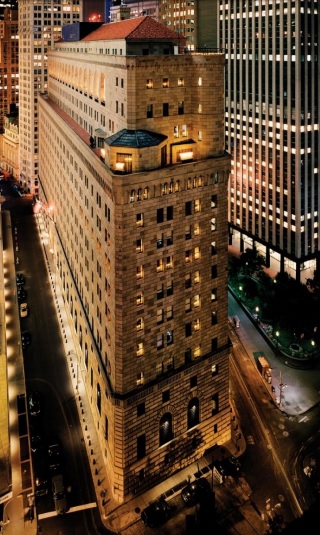

Potter is responsible for carrying out the monetary policy mandate of the Federal Open Market Committee (FOMC) by supervising the execution of transactions for the System Open Market Account (SOMA). This is done via the New York Fed’s Open Market Trading Desk which has speed dials to the mega banks on Wall Street. Potter is the Manager of SOMA as well as Executive Vice President of the New York Fed’s Markets Group.

The minutes of the FOMC’s April 30 to May 1, 2019 meeting carries this assessment by Potter:

“The manager of the SOMA reviewed developments in financial markets over the intermeeting period. In the United States, prices for equities and other risk assets reportedly were buoyed by perceptions of an accommodative stance of monetary policy, incoming economic data pointing to continued solid economic expansion, and some signs of receding downside risks to the global outlook.”

When the Chairman of the Federal Reserve, Jerome Powell, spoke at his press conference on May 1, he seemed to mirror the upbeat assessment by Potter. Powell stated:

“Economic growth and job creation have both been a bit stronger than we anticipated, while inflation has been somewhat weaker. Overall, the economy continues on a healthy path, and the Committee believes that the current stance of policy is appropriate.”

But just this past Friday, May 24, that rosy perception had cold water thrown all over it by the New York Fed’s Nowcast team which uses economic data as it is released to attempt to forecast quarterly Gross Domestic Product (GDP) in real time. The Nowcast moved from a forecast of 2.2 percent GDP growth for the second quarter on May 10 to a stunning drop to 1.41 percent on May 24 based on a spate of weak economic data in the intervening period.

The personnel changes come at a time when a major derivatives counterparty to Wall Street, Deutsche Bank, has seen its stock price hit new lows on almost a daily basis – raising the risk of a credit downgrade by the ratings agencies and collateral demands from the Wall Street banks. The Fed is also struggling with an already bloated balance sheet of almost $4 trillion with little room to engage in further quantitative easing if another Wall Street mess erupts.

It will be interesting to learn what actually happened behind the scenes to provoke today’s unusual announcement.