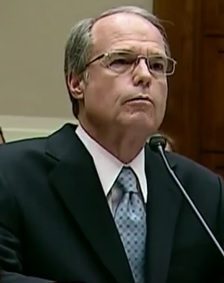

Editor’s Note: Richard Bowen is the former Citigroup Senior Vice President who repeatedly alerted his superiors in writing that potential mortgage fraud was taking place in his division. At one point, Bowen emailed a detailed description of the problem to top senior management, including Robert Rubin, the former U.S. Treasury Secretary and then Chairman of the Executive Committee at Citigroup. Bowen’s reward for elevating serious ethical issues up the chain of command was to be relieved of most of his duties and told not to come to the office. Bowen testified before the Financial Crisis Inquiry Commission in 2010. In 2011, Bowen had the courage to pull back the curtain on Citigroup’s moral code on the CBS program 60 Minutes. Bowen is today a Professor of Accounting at the University of Texas at Dallas and speaks widely on the ethical breakdowns that led to the 2008 Wall Street financial collapse. Professor Bowen’s analysis of Citigroup’s latest foray into changing its ethical culture appears below.

————-

Who’s Trying Now to Save Citigroup’s Soul?

By Richard Bowen: March 27, 2017

The headline in last Saturday’s Wall Street Journal captured my immediate attention. The Banker-Turned-Seminarian Trying to Save Citigroup’s Soul… What??

Supposedly Citigroup is taking a “new” approach to the cultural and other issues they have had for years and have hired Dr. David Miller, a Princeton University professor, theologian and former banker to be their “on call ethicist.” Dr. Miller heads the University’s Faith & Work Initiative and has worked with Citi intermittently over the last three years. He says, “You need banking, just like you need pharmaceuticals.”

His role, to provide “advice and input to senior management.” This includes CEO Michael Corbat who recently raised an idea that came from Dr. Miller. Mr. Corbat said, when faced with an uncertain situation, “ask the four M’s: What would your mother, your mentor, the media and—if you’re inclined—your maker think?” The problem, he adds, isn’t the bad apples. Rather, it is how easy it is for good employees to justify bad decisions when they face gray-zone questions.

And Citi has had more than its share of gray zone areas. Citigroup has had numerous issues and has earned a reputation for ethical problems before and after the financial crisis. Dr. Miller was brought in by Mr. Corbat who was surprised when the company’s employee surveys showed some workers weren’t comfortable escalating concerns about possible wrongdoing.

He was also disturbed by the banking industry’s image problem overall. “If you look today at what the poll numbers say, what the general population says, there is distrust of banks,” Mr. Corbat said in an interview.

The article goes on to say, “Citigroup is embracing Dr. Miller’s idea (influenced by Plato and Aristotle) of three lenses to apply in ethical decision-making, an approach: Is it right, good and fitting? Citigroup executives have added: Is it in our clients’ interest, does it create economic value, and is it systemically responsible?”

The bank is sharing these ideas with employees worldwide, working them into its ethics and training manuals and mission statement and posting it on the wall of its Manhattan headquarters lobby.

But wait! This is not a “new” idea.

I was at Citi, when in 2003 they were fined $1.5 billion for “false and misleading research reports;” and in 2004 when they were hit with $5 billion in fines and settlements associated with Enron and WorldCom. These and other scandals in Japan Private Banking and the European bond market led to the Federal Reserve (in 2005) to publicly announce that they would not approve any major Citigroup mergers and acquisitions, until the company resolved their issues.

As a result of all this and more, Citi vowed that these issues would not happen again. And in March 2005, then CEO Chuck Prince announced his strategy to transform the financial giant and to provide a new direction for the future, called the “Five Point Ethics Plan” to: improve training, enhance focus on talent and development, balance performance appraisals and compensation, improve communications, and strengthen controls. A comprehensive ethics policy was implemented requiring annual training by all employees. Employees could be fired if they did not follow the new ethics plan.

And Mr. Prince announced, with great fanfare, the hiring of Lewis B. Kaden, a former professor and director of Columbia University’s Center for Law and Economic Studies and moderator of PBS’s popular Ethics in America TV series, which earned a Peabody Award. Mr. Kaden was named Vice Chairman and was over ethics and other areas. In the trenches we called him the Ethics Czar.

Well despite desperation, a new ethics policy, training and fear, the Five Point Ethics Plan didn’t work. By now you know by heart of their subsequent mortgage fraud and what led to my and Sherry Hunt’s blowing the whistle on Citi. And following that there were the LIBOR and FOREX trading scandals.

To this day, Citi still has ethics issues as witness one of the latest, their being investigated for hiring practices that could violate foreign bribery laws.

We can “talk” culture all day long, mandate it, instill fear re firing, but if leadership is not an example and role model for ethical behavior… well it’s not going to happen! If a company wants to promote and assure ethical standards are followed then transparency, trust and developing an ethical culture based on guiding principles are critical.

In a previous post I quoted Ms.Yves Smith, commenting on an article “Can Philosophy Stop Bankers From Stealing?” by Lynn Parramore, a senior research analyst at the Institute for New Economic Thinking. Ms. Parramore states, “Pernicious cultural norms inside American banks and regulatory agencies have crowded out fundamental moral principles…”

Ms. Parramore quotes Ed Kane, Professor of Finance at Brown College, “Ed Kane believes it’s vital to discuss moral questions, in plain English, without abstractions. Following his own advice, he is blunt in characterizing some of the behavior in the banking industry in recent years: “Theft is a forced taking of other people’s resources,” he says. ‘That’s what’s going on here.” Kane urges a deep inquiry into our culture to understand why bankers so commonly get away with crimes in the United States.”

Evidence shows Citi did not change its culture. It did not follow its own ethics plan. It may presently have a 60 page ethics policy, however, that has proved to not be enough. Posting it does not change behavior.

Who knows, perhaps this time around it may work. Dr. Miller believes banks can change. “To make the assumption that an organization cannot be more ethical than it was is to give up before you start… It is not naive. It is a realistic and necessary goal.”

Am I skeptical? Heck yes. Let’s see if Citigroup has the moral fortitude to indeed finally make good culture changes happen. For the sake of our country, I wish Dr. Miller much success.