By Pam Martens and Russ Martens: August 25, 2015

America’s largest bank, JPMorgan Chase, has lost 10.87 percent of its market capitalization in the past three trading sessions. That’s $27.18 billion in three days, raising serious questions about the Federal Reserve’s theory that beefed up equity capital would buffer the mega banks in a market downturn.

America’s largest bank, JPMorgan Chase, has lost 10.87 percent of its market capitalization in the past three trading sessions. That’s $27.18 billion in three days, raising serious questions about the Federal Reserve’s theory that beefed up equity capital would buffer the mega banks in a market downturn.

While the Dow Jones Industrial Average lost 3.57 percent yesterday, JPMorgan lost 5.27 percent, despite its rich dividend yield of 2.92 percent.

The indefatigable Eric Hunsader, owner of the market data firm Nanex, was Tweeting the abominations occurring in the stock market yesterday as the opening bell set off a bungee dive to a loss of 1,089 points in the Dow Jones Industrial Average (DJIA). The Dow ended the day down 588 points to close at 15,871.35, a three day loss of 1,477 points.

One of Hunsader’s Tweets remarked on the bizarre price action in the stock of JPMorgan Chase, a member of the 30 stocks in the DJIA. The chart posted by Hunsader showed that JPMorgan’s stock was flash crashing by $5 a pop, only to regain the loss seconds later. The price action shown on the chart above occurred between 9:33 and 9:34 a.m., within moments of the market open.

So who was this miracle worker helping to boost JPMorgan’s sagging share price? According to the SEC’s amended Rule 10b-18, JPMorgan Chase could have had its own agent buying back its stock after just one “independent” trade had occurred at the opening. The SEC’s amended rule notes:

“…because the opening transaction continues to set the tone for that day’s trading session, the safe harbor will continue to preclude an issuer from being the opening (regular way) purchase reported in the consolidated system.”

But after the first opening trade, the SEC explains:

“We are adopting the proposed amendment to apply a uniform price condition that limits all issuers to purchasing their securities at a price that does not exceed the highest independent bid or the last independent transaction price, whichever is higher, quoted or reported in the consolidated system…”

In addition to not being allowed to be the first buyer at the open, corporations with highly liquid float are barred from conducting buybacks during the last ten minutes of trading before the market closes. Issuers of illiquid stocks are barred for the last 30 minutes under the SEC’s Rule 10b-18.

Another Wall Street mega bank, Citigroup, recipient of the largest taxpayer bailout in history during the 2008 crash, has also been pummeled in the past three trading sessions. Citigroup closed last Wednesday at $57 per share. In the intervening three trading days, its stock has lost an eyebrow-raising 11.68 percent or a total of $20.05 billion in market capitalization.

We have few delusions that the market panic will galvanize our Congress to take meaningful steps to deal with the fragile nature of our financial system, tethered to Wall Street gambling casinos in drag as insured, deposit-taking banks. But it should if Congress genuinely cared about the future of America.

On November 24, 2008, we wrote the following about how Citigroup was unraveling before our very eyes in the midst of the last panic:

“Citigroup’s five-day death spiral last week was surreal. I know 20-something newlyweds who have better financial backup plans than this global banking giant. On Monday came the Town Hall meeting with employees to announce the sacking of 52,000 workers. (Aren’t Town Hall meetings supposed to instill confidence?) On Tuesday came the announcement of Citigroup losing 53 per cent of an internal hedge fund’s money in a month and bringing $17 billion of assets that had been hiding out in the Cayman Islands back onto its balance sheet. Wednesday brought the cheery news that a law firm was alleging that Citigroup peddled something called the MAT Five Fund as ‘safe’ and ‘secure’ only to watch it lose 80 per cent of its value. On Thursday, Saudi Prince Walid bin Talal, from that visionary country that won’t let women drive cars, stepped forward to reassure us that Citigroup is ‘undervalued’ and he was buying more shares. Not having any Princes of our own, we tend to associate them with fairytales. The next day the stock dropped another 20 percent with 1.02 billion shares changing hands. It closed at $3.77.

“Altogether, the stock lost 60 per cent last week and 87 percent this year. The company’s market value has now fallen from more than $250 billion in 2006 to $20.5 billion on Friday, November 21, 2008. That’s $4.5 billion less than Citigroup owes taxpayers from the U.S. Treasury’s bailout program.”

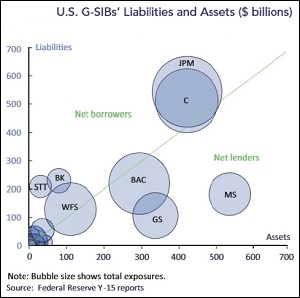

Graph from Office of Financial Research Report on Systemic Risks in U.S. Banking System (Symbols JPM and C denote JPMorgan and Citigroup, respectively.)

In February, the Treasury’s Office of Financial Research released a study finding that JPMorgan Chase and Citigroup scored the highest among U.S. banks for systemic importance, meaning the “threat to global financial stability that a large bank would pose if it were to fail.” The study noted:

“…the default of a bank with a higher connectivity index would have a greater impact on the rest of the banking system because its shortfall would spill over onto other financial institutions, creating a cascade that could lead to further defaults. High leverage, measured as the ratio of total assets to Tier 1 capital, tends to be associated with high financial connectivity and many of the largest institutions are high on both dimensions…The larger the bank, the greater the potential spillover if it defaults; the higher its leverage, the more prone it is to default under stress; and the greater its connectivity index, the greater is the share of the default that cascades onto the banking system. The product of these three factors provides an overall measure of the contagion risk that the bank poses for the financial system.”

Don’t count on the U.S. Congress, or the Federal Reserve, or any other bank regulator to take any meaningful action to deal with the systemic dangers in our financial system before the next crash. When it comes to Wall Street, you’re on your own.