By Pam Martens and Russ Martens: September 23, 2014

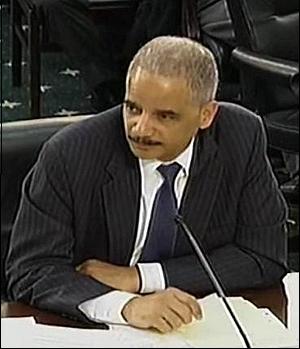

U.S. Attorney General Eric Holder Testifying on High Frequency Trading Before the House Appropriations Committee on April 4, 2014

In addition to hundreds of Federal bank examiners permanently stationed at Wall Street’s biggest banks by the Federal Reserve and Office of the Comptroller of the Currency in an effort to eradicate a serial crime spree, an unknown number of Justice Department moles are now roaming about the mahogany corridors of power, chatting up potential criminals around the water cooler and hoping to make it out alive before being detected.

Avoiding detection as a mole becomes so much more challenging when the highest law enforcement officer in the land, U.S. Attorney General Eric Holder, comes to New York to address Wall Street’s lawyers and tells them, flat out, that he’s got moles stationed inside his Wall Street targets. (There were likely 100,000 text messages flying about Wall Street before Holder got to the next paragraph of his speech.)

The revelation by Holder came on September 17, not in off the cuff remarks, but in a carefully prepared speech delivered at NYU School of Law in Manhattan. Discussing an insider trading case, Holder stated:

“It was only because the government had a cooperating witness inside the company – a witness who had agreed to wear a wire – that the department was able to record a verbal account of these actions, to illuminate other obstruction, and to uncover illegal conduct that otherwise might never have come to light.

“Similarly, in our full-court press to investigate and prosecute the ongoing LIBOR matter – which is being led by the Criminal and Antitrust Divisions, and involved a wide-ranging scheme to rig one of the world’s benchmark interest rates – witnesses from inside some of the world’s leading financial firms have played important roles. They have strengthened our ability to follow leads; to obtain guilty pleas from subsidiaries of major banks like UBS and RBS; and to pursue individual charges against nine former traders and managers at these institutions. Our ongoing investigation into the manipulation of foreign exchange rates has relied on similar investigative techniques involving undercover cooperators, as well.” [Italics added.]

We learn two things in that last sentence. Moles are now called “undercover cooperators” by the U.S. Justice Department and the U.S. Attorney General wants Wall Street to know they’re there.

One can just imagine the paranoia that has spread exponentially on Wall Street since September 17. Every question asked by a colleague is assumed to be a trap. Every wrinkle in those crisp, $400 Gekko shirts is assumed to be a wire. A pair of new eyeglasses might be equipped with a Justice Department mic.

So why would Eric Holder want to throw cold water on all that wonderful synergism on Wall Street — “The Cartel” and “The Bandits’ Club” in the world of foreign currency trading come to mind.

Based on the rest of Holder’s speech, one has the feeling that since multi-billion dollar fines have not worked; deferred prosecutions have not worked; the 849-page Dodd-Frank Wall Street Reform and Consumer Protection Act didn’t work; and perp walks of the lower ranks haven’t worked, the new crime deterrent strategy on Wall Street appears to be to spread the word of an army of moles hiding out in bathroom stalls, boardrooms, and perched on bar stools to record loose tongues.

Holder is nothing if not straight-forward. He came right out and acknowledged that those jaded ways of Wall Street that collapsed the financial system six years ago are back. “…we are already witnessing a troubling return to some of the very same profit-driven risk-taking that contributed to the 2008 collapse,” said Holder.

Holder went to great lengths to explain how hard it is to prosecute Wall Street’s top dogs, saying it “is true for any number of reasons – from possible advice-of-counsel defenses; to the adequacy or inadequacy of written disclosures; to the difficulty to establish materiality and intent. And in some instances, it is simply not possible to establish knowledge of a particular scheme on the part of a high-ranking executive who is far removed from a firm’s day-to-day operations.”

The new thinking at the Justice Department, according to Holder, involves incentivizing individuals. Holder told the audience of lawyers: “…no financial fraud case is prosecutable unless we have sufficient evidence of intent – we should seek to better equip investigators to obtain this often-elusive evidence. This means, among other things, thinking creatively about ways to incentivize witness cooperation and encourage whistleblowers at financial firms to come forward.”

One way to do that, according to Holder, is to increase the bounty for whistleblowers on Wall Street to the one-third of recovered amounts that can be paid to whistleblowers under the False Claims Act, which is limited to fraud against government-funded programs. Holder said he would “implore” Congress to take that action.

Holder explained further:

“…the Justice Department has come to rely on a statute known as the Financial Institutions Reform, Recovery, and Enforcement Act – or FIRREA – a little-used law passed after the savings and loan crisis of the 1980s. Over the last few years, the Residential Mortgage-Backed Securities Working Group – a part of the President’s Financial Fraud Enforcement Task Force – has been aggressive in using this law to develop the types of cases that have resulted in major settlements with JPMorgan, Citigroup and Bank of America, among many others…

“Like the False Claims Act, FIRREA includes a whistleblower provision. But unlike the FCA, the amount an individual can receive in exchange for coming forward is capped at just $1.6 million – a paltry sum in an industry in which, last year, the collective bonus pool rose above $26 billion, and median executive pay was $15 million and rising.

“In this unique environment, what would – by any normal standard – be considered a windfall of $1.6 million is unlikely to induce an employee to risk his or her lucrative career in the financial sector.”

So the new plan at Justice to rein in an unrepentant Wall Street appears to be spreading moles about like rat traps in an infested basement while dangling the incentive cheese that they may be able to retire sooner and better off than their bosses.

Of course, there is also the less taxpayer-costly plan of simply breaking up these global behemoths so that they can’t ever again crash the economy by restoring the one law that actually worked for 66 years – the Glass-Steagall Act.