By Pam Martens: August 1, 2013

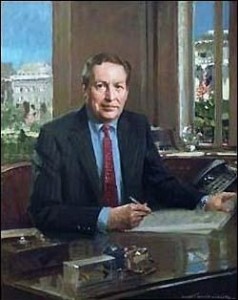

President Obama met in a closed door session with the House Democratic Caucus yesterday and was told that Lawrence (Larry) Summers is a decidedly bad choice for Federal Reserve Chairman. That assessment triggered a strident response from the President. He defended Summers and praised him for his hard work during the 2008 financial crisis.

The President’s praise of Summers has been met with a new volley of press today that is keeping it fresh in the minds of the voting public that were it not for Summers’ brashness and bullying of opponents to deregulate Wall Street, repeal the Glass-Steagall Act, and keep trillions of dollars of derivatives off regulated exchanges during the Clinton administration – there might not have been a 2008 financial crisis. Summers served as both Deputy Secretary at the Treasury and Secretary during Clinton’s Presidency.

It’s tough to convince the public that a man’s a saint for helping out during a crisis he created. That’s like complimenting an arsonist for holding a fire extinguisher on a raging inferno he started.

In an unusual twist, according to The Hill web site, during the closed door meeting the President singled out the Huffington Post as being particularly unkind to Summers in its coverage. The President may well have been thinking of Robert Scheer’s column in the Huffington Post this Tuesday, titled “Gag Me With Lawrence Summers.” It’s not every day you read a headline like that.

Scheer wrote the following about Summers: “As Clinton’s Treasury secretary, he pushed for radical deregulation allowing investment bankers to take wild risks with the federally insured deposits of ordinary folks, a disastrous move compounded when he successfully urged Congress to pass legislation banning the effective regulation of the tens of trillions in derivatives that often proved to be toxic.”

Well that’s all true. Should Robert Scheer be socialized to silence by the President just because he’s telling an inconvenient truth about the man the President would like to nominate for the highest monetary post in the world.

Exactly 15 years ago to the day that Scheer published his “Gag Me” headline, Larry Summers sat before the U.S. Senate Agriculture Committee and uttered these words: “To date there has been no clear evidence of a need for additional regulation of the institutional OTC derivatives market, and we would submit that proponents of such regulation must bear the burden of demonstrating that need.” It was derivatives that blew up Wall Street in 2008 – coming within a hairsbreadth of plunging the country into the second Great Depression.

On November 12, 1999, after he, his boss Robert Rubin, U.S. Treasury Secretary at the time, and Alan Greenspan, then Chairman of the Federal Reserve, had succeeded in repealing the depression era investor protection legislation known as the Glass-Steagall Act, Summers had this to say at the signing ceremony for the deregulatory Gramm-Leach-Bliley Act:

“Let me welcome you all here today for the signing of this historic legislation. With this bill, the American financial system takes a major step forward towards the 21st century, one that will benefit American consumers, business, and the national economy for many years to come…I believe we have all found the right framework for America’s future financial system.”

What Summers, Rubin and Greenspan had found was the right framework for their own personal enrichment and an economic nightmare for their fellow citizens. Rubin left his Treasury Secretary post and went directly to serve on the board of Citigroup – the prime beneficiary of the repeal of the Glass-Steagall Act. Rubin received $120 million in compensation from Citigroup over the next 8 years for his non-management job. At the height of the crisis, Greenspan became a consultant to Paulson & Company, the hedge fund that teamed up with Goldman Sachs to use insider knowledge of a rigged bond portfolio to fleece investors in the infamous ABACUS deal.

After stepping down from Treasury, Summers earned at least $5 million from another hedge fund, D.E. Shaw, and millions more in speaking engagements to Wall Street firms like Citigroup, Goldman Sachs and Lehman Brothers. Lehman Brothers collapsed in the 2008 crisis; Goldman Sachs and Citigroup received taxpayer bailouts.

According to Bloomberg News, Summers is currently on the payroll of Citigroup. The company would not disclose his compensation.

Obama told the Democrats he met with yesterday that it would not be until the fall that he announced his selection to chair the Fed. Janet Yellen, currently Vice Chair of the Fed, is also under serious consideration according to leaks from the White House.

Obama’s Press Secretary, Jay Carney, described the President’s discussion of Summers this way:

“I would simply say that, as would be the case if I were asked about a senior member of the President’s economic team, as Larry Summers was during the worst economic crisis of our lifetimes, who stood shoulder to shoulder with the President and other members of that team in working out responses to that crisis, the President would defend that individual, as I would. And Larry Summers’s service here was extremely helpful to the President, as he made decisions and put forth the policies that helped reverse the tragic economic decline that this country faced in the beginning of 2009. And he is certainly very grateful for Larry’s service with him.”