By Pam Martens: January 24, 2013

Two stunning assertions came out of the Martin Smith investigative report on Tuesday evening on the PBS program, Frontline. Titled The Untouchables, producer, writer and correspondent Martin Smith interviews Lanny Breuer, the head of the criminal division of the U.S. Department of Justice, who tells Smith he didn’t prosecute any senior executive of the major Wall Street firms because he couldn’t find a criminal case where he could “prove beyond a reasonable doubt every element of a crime.”

As the public has watched big money settlements and deferred prosecutions at the largest banks, the public has assumed that every available device of the U.S. Department of Justice — the top law enforcement agency in America – was being deployed to root out and prosecute those who collapsed Wall Street in 2008, costing the U.S. taxpayer trillions in bailouts, the economy trillions in lost jobs and home values, and investors trillions more in stock and bond losses.

But according to two Frontline sources at the Justice Department who worked for Breuer in the criminal division, “when it came to Wall Street, there were no investigations going on. There were no subpoenas, no document reviews, no wiretaps.”

The obvious question is: if the Justice Department wasn’t using any of the basic law enforcement techniques, how did Breuer know he couldn’t make a criminal case. According to the program’s sources inside the Justice Department, at the weekly indictment approval meetings, “there was no case ever mentioned that was even close to indicting Wall Street for financial crimes.”

The Sarbanes-Oxley Act was enacted on July 30, 2002, giving prosecutors the ability to send CEOs and CFOs to prison for falsifying their company’s financial reports. Under the law, executives can face 10 years in prison and a fine of up to $1 million. If their conduct can be shown to be willful, the prosecution can obtain up to 20 years in prison and a $5 million fine.

Let’s take a look at a case screaming out for criminal prosecution which was settled as a civil suit by the SEC on July 29, 2010 while Breuer was head of the criminal division of the Justice Department. (The SEC has only civil powers; it is up to the Justice Department to bring a criminal case.)

The following is what the SEC alleged in its settlement with Citigroup and two of its executives:

“In late September and early October 2007, Crittenden, the chief financial officer (‘CFO’) of Citigroup Inc. (‘Citigroup’) and Tildesley, the head of Citigroup’s Investor Relations (‘IR’) department, both helped draft and then approved, and Crittenden subsequently made, misstatements about the exposure to sub-prime mortgages of Citigroup’s investment bank. Citigroup then included a transcript of the misstatements in a Form 8-K that it filed with the Commission on October 1, 2007. The misstatements were made at a time of heightened investor and analyst interest in public company exposure to sub-prime mortgages and related to disclosures that the Citigroup investment bank had reduced its sub-prime exposure from $24 billion at the end of 2006 to slightly less than $13 billion. In fact, however, in addition to the approximately $13 billion in disclosed sub-prime exposure, the investment bank’s sub-prime exposure included more than $39 billion of “super senior” tranches of sub-prime collateralized debt obligations and related instruments called ‘liquidity puts’ and thus exceeded $50 billion. Citigroup did not acknowledge that the investment bank’s sub-prime exposure exceeded $50 billion until November 4, 2007, when the company announced that the investment bank then had approximately $55 billion of sub-prime exposure.”

This would seem to be a slum dunk case for criminal prosecution under Sarbanes-Oxley. Instead, Crittenden paid $100,000 to settle the allegations; Tildesley paid $80,000 and Citigroup paid $75 million. No criminal charges were ever brought.

In 2011, the Inspector General of the SEC investigated claims by an unnamed whistleblower from inside the SEC that the settlement had been procured through misconduct on the part of the head of enforcement at the SEC, Robert Khuzami. The whistleblower alleged that Khuzami had a “secret conversation” with his “good friend” and former colleague, a prominent defense counsel representing Citigroup. According to the whistleblower, as a result of that secret conversation, fraud charges were dropped. The Inspector General’s investigation did not find evidence of the whistleblower’s claim that there was “serious problems with special access and preferential treatment” at the SEC.

From the Frontline program and this Inspector General report, it is clear that dedicated and conscientious staff at both the Justice Department and the SEC who want to see Wall Street prosecuted for its misdeeds believe their bosses are the problem.

On September 13, 2012, Breuer delivered a speech to the New York City Bar Association which shed light on what is really going on at the U.S. Justice Department. It appears that the Justice Department no longer needs subpoenas and wiretaps against Wall Street because it just waits for Wall Street to turn itself in.

In the speech, Breuer cites a case against Morgan Stanley:

“In April of this year, for example, a former managing director of Morgan Stanley, Garth Peterson, pleaded guilty to conspiring to evade the bank’s internal Foreign Corrupt Practices Act controls. He was sentenced to prison last month. Because Morgan Stanley voluntarily disclosed Peterson’s misconduct, fully cooperated with our investigation, and showed us that it maintained a rigorous compliance program, including extensive training of bank employees on the FCPA and other anti-corruption measures, we declined to bring any enforcement action against the institution in connection with Peterson’s conduct. That is smart, and responsible, enforcement.”

Then there was the monetary settlement with Barclays in June of last year for rigging the Libor interest rate benchmark:

“In June, as has been widely reported, the Criminal Division’s Fraud Section resolved allegations of criminal wrongdoing with Barclays Bank over the bank’s role in its manipulation of the London Interbank Offered Rate, or LIBOR…The bank voluntarily disclosed its misconduct, informed us of facts we did not know, and continues to cooperate in our ongoing criminal investigation. We agreed not to prosecute Barclays in light of this extensive cooperation.”

But most alarming, Wall Street’s defense counsel get to make pitches to the Justice Department citing the economic impact on their client of an indictment. Breuer makes the astonishing confession in his speech to the bar association that he actually considers “the effect of an indictment on innocent employees and shareholders….” Shareholders? Isn’t that exactly what Americans are outraged about with the 2008 to 2010 bailout – that “they got bailed out; we got sold out.” In many cases, the CEOs rank among the largest individual shareholders in their company.

Unlike the whistleblower at the SEC’s complaint that the head of enforcement held a “secret conversation” with a Wall Street defense lawyer, at the Justice Department it’s all done in a big conference room where the DOJ’s head of criminal prosecution admits to finding the arguments “compelling.”

From Breuer speech at the New York City Bar Association:

“We are frequently on the receiving end of presentations from defense counsel, CEOs, and economists who argue that the collateral consequences of an indictment would be devastating for their client. In my conference room, over the years, I have heard sober predictions that a company or bank might fail if we indict, that innocent employees could lose their jobs, that entire industries may be affected, and even that global markets will feel the effects. Sometimes – though, let me stress, not always – these presentations are compelling. In reaching every charging decision, we must take into account the effect of an indictment on innocent employees and shareholders, just as we must take into account the nature of the crimes committed and the pervasiveness of the misconduct. I personally feel that it’s my duty to consider whether individual employees with no responsibility for, or knowledge of, misconduct committed by others in the same company are going to lose their livelihood if we indict the corporation. In large multi-national companies, the jobs of tens of thousands of employees can be at stake. And, in some cases, the health of an industry or the markets are a real factor. Those are the kinds of considerations in white collar crime cases that literally keep me up at night, and which must play a role in responsible enforcement.”

I, for one, do not believe this is responsible enforcement; this is bullshit enforcement. Executives at the largest firms on Wall Street lavished obscene pay on themselves, creating a new ruling elite in America. Their fraudulent acts in hiding the true condition of their firms so they could continue that obscene pay ushered in the greatest economic collapse since the Great Depression, resulting in giant waves of homelessness, joblessness and human despair. Worrying about the shareholders of these corrupt companies is a sickening spectacle for the top law enforcement agency in the land. Executives on Wall Street can be indicted without indicting the corporation and causing massive job losses.

Yesterday, the Washington Post reported that Breuer is planning to step down. That’s not enough. The Justice Department must be cleansed of its ties to the Covington & Burling law firm and the revolving doors in Washington must grind to a halt.

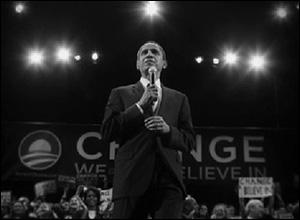

This is the President’s last chance to convince the American people he is serious about change we can believe in.

Related articles:

The Untouchables: PBS Asks Why U.S. Justice Department Isn’t Prosecuting Wall Street