By Pam Martens and Russ Martens: January 13, 2020 ~

Traders at the New York Fed Have Speed Dials to Wall Street’s Biggest Firms (Photo Source: Federal Reserve Educational Video)

Last Friday, the usually reliable and fact-intensive financial website, Wolf Street, threw a hissy fit over how the Wall Street Journal (and by extension, Wall Street On Parade) is reporting the tallies for the repo loans that the New York Fed has been pumping out every business day since September 17, 2019 to the trading houses on Wall Street.

The inflammatory headline blared: “The Wall Street Journal (and Other Media) Should Stop Lying About Repos.” The author of the piece, Wolf Richter, explained his criticism as follows:

“Here is the ‘in’ of a repurchase agreement [repo loan]: The Fed buys securities (mostly Treasury securities and some agency mortgage-backed securities) in exchange for cash. This adds liquidity to the market.

“Here is the ‘out’ of a repurchase agreement: Every repo matures on a set date when the counterparties are obligated to buy the securities back from the Fed at a set price. At this point, the repo unwinds, and it drains liquidity from the market.”

The key flaw in Richter’s analysis is that last sentence: “At this point, the repo unwinds, and it drains liquidity from the market.”

Neither the public nor Congress have any proof that these repo loans are being unwound. One or more of the 24 trading houses on Wall Street (primary dealers), that are authorized by the New York Fed to borrow from its money spigot at super cheap interest rates, could simply be rolling over the same loans or using term money to pay off one loan while taking out another loan.

There is a mountain of evidence to suggest that this is exactly what is going on. The first piece of evidence is that this is exactly what went on the last time the New York Fed turned on its $29 trillion money spigot to Wall Street from December 2007 to July 21, 2010. When the Government Accountability Office (GAO) was forced under legislation to look at the alphabet soup of lending programs the New York Fed had set up to disguise the astronomical sums it was spewing out to Wall Street’s trading houses (including their trading desks in London) it found that $16.1 trillion cumulatively had been pumped out – also at super cheap interest rates. It provided data for the peak amounts outstanding and also a cumulative total.

Why is a cumulative total essential and relevant? Because one institution, Citigroup, was insolvent for much of the time the Fed was flooding it with cheap loans. (Under law, the Fed is not allowed to make loans to an insolvent institution.) And when an insolvent institution is getting loans at interest rates below one percent when the market doesn’t want to loan it money at even double-digit interest rates, it’s highly relevant to know the cumulative tally of just how much Citigroup got from its sugar daddy, the New York Fed. According to the GAO, that tally came to $2.5 trillion for just some of these Fed loan programs. (See page 131 of the GAO study here.)

Today, highly questionable Wall Street trading houses are borrowing at 1.55 percent interest from the New York Fed while the free market attempted to set that rate at 10 percent on September 17 – the day the Fed bolted into action with supercheap loans.

The academic scholars that compiled the Fed’s loans during the financial crisis for the Levy Economics Institute also provided cumulative tallies. Their tally, which included additional Fed bailout programs, came to $29 trillion.

The names of these Wall Street trading houses, the dollar amounts they had borrowed and the period over which they had borrowed, remained a dark secret at the Fed for years until a media lawsuit and legislation forced it to come clean with the American people.

There is substantive evidence to suggest that the New York Fed, once again, has crafted a labyrinthine structure to hide exactly what is going on and how much any one Wall Street trading house is receiving. Just consider this labyrinthine statement the New York Fed made on December 12, 2019:

“The [Open Market] Desk will continue to offer two-week term repo operations twice per week [with $35 billion offered in each], four of which span year end. In addition, the Desk will also offer another longer-maturity term repo operation that spans year end. The amount offered in this operation will be at least $50 billion.

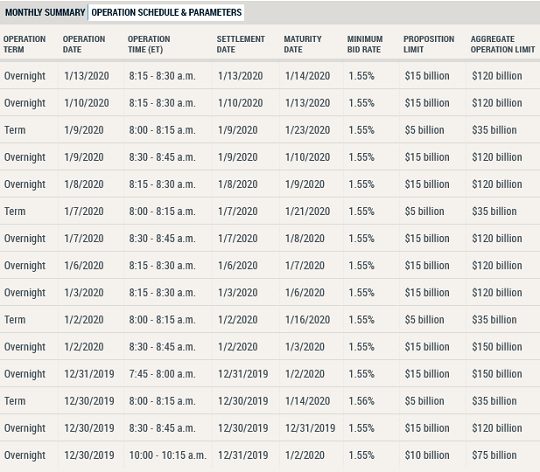

“Overnight repo operations will continue to be held each day [with $120 billion offered in each]. On December 31, 2019 and January 2, 2020, the overnight repo offering will increase to at least $150 billion. In addition, on December 30, 2019, the Desk will offer a $75 billion repo that settles on December 31, 2019 and matures on January 2, 2020.”

How would anyone know if some trading houses are simply borrowing from one of these loan programs to pay off another Fed loan. We simply don’t know because the Fed doesn’t want us to know just as it didn’t want us to know during the financial crisis.

Also, instead of stating in simple language the total amount that any one trading firm can borrow on a single day or have outstanding at any one time, the New York Fed reverts to its typical obfuscation. For its overnight loans which are currently being offered at $120 billion per business day, it states that:

“Securities eligible as collateral for both overnight and term operations include Treasury, agency debt, and agency mortgage-backed securities. Primary Dealers will be permitted to submit up to two propositions per security type…”

Since the predominant amount of loans, according to the New York Fed, have been made against Treasury securities and agency mortgage-backed securities, that would mean that a Primary Dealer could submit a total of four propositions (two per security type) for each offered Fed loan. Now look at the New York Fed chart below. The overnight loan offerings of up to $120 billion indicate a “Proposition Limit” of $15 billion. We don’t know if that means $15 billion in total for all propositions or if it means that one trading house could ask for a total of $60 billion – four propositions at $15 billion each. The same ambiguity is true for the $5 billion “Proposition Limit” for term loans.

Partial List of Overnight and Term Repo Loans Provided to Wall Street’s Trading Houses (Source — New York Fed)

To help our readers understand just how crafty and incestuous the New York Fed has behaved when it comes to bailing out its miscreant banks, please see the related articles below.

As for lying about the Fed’s repo loans, we hope Wolf Street will focus its attention where it rightfully belongs – on the New York Fed and its jaded history as a regulator and a bailout kingpin.

Related Articles:

These Are the Banks that Own the New York Fed and Its Money Button

Dangerous Liaisons: New York Fed and JPMorgan’s Incestuous Relationship

Is the New York Fed Too Deeply Conflicted to Regulate Wall Street?

U.S. Senate Tries Public Shaming of New York Fed President Dudley